Ad Hadromi Partners is one of the prominent law firms in Indonesia. How Much Does It Cost To Get An Accountant To Do Your Tax Return.

Cyber Attacks Threaten Tax Preparers And Auditors During Coronavirus Crisis Accounting Today

Cyber Attacks Threaten Tax Preparers And Auditors During Coronavirus Crisis Accounting Today

Ad Hadromi Partners is one of the prominent law firms in Indonesia.

How much does a cpa charge to do taxes. A good CPA may cost you more upfront but will pay off in the long run because he or she is thorough. HD your CPA Exam. Given that in recent years tax returns have averaged out at over 2000 it may well be that the fee is worth it.

According to the National Society of Accountants 20182019 Income and Fees Survey the average tax preparation fee for a tax professional to prepare a Form 1040 and state return with no itemized deductions is 188. If youre wondering what the average costs for filing common forms are heres the breakdown. I usually charge 1500 per tax return assuming that the client is organized and does their own bookkeeping.

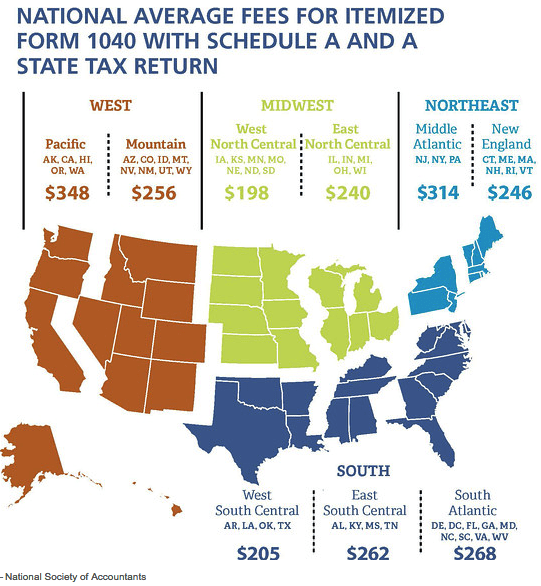

A Form 1040 with a Schedule A and a state tax return will run you an average of about 273. Ad Study the CPA Program with the level of support you need to succeed. Ad CPA HD Notes 100s Of Practice MCQ CPA Exam Prep Courses.

The answer to both questions is the same. The average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return with no itemized deductions is 176 while the average fee for an itemized Form. According to the CPA Practice Advisor the average cost for a full tax return is 273 including both state and federal filing fees.

Bear in mind that is the simplest possible business return. On the other hand I had a client whose return took over a week to prepare when I worked in a large firm which cost the client around 100000. CPAs will also charge clients an hourly rate to prepare tax returns.

Ad Study the CPA Program with the level of support you need to succeed. For example my uncle has a simple tax return and pays 250 in preparation fees. Theres a broad hourly range as to what theyll charge but you should expect to pay between 100 250 per hour.

Most Americans prefer to use such income tax services to assist in preparing their taxes. How much might it cost to have a professional prepare your tax returns. The National Society of Accountants reported an average CPA tax preparation fee of 481 for a Form 1040 with state return Schedule A and Schedule C.

Continue reading How Much Does It Cost To Have A CPA Do Your. Study the CPA Program with the level of support you need to succeed. Tax Preparation Rates More than 60 of tax statements are made via a tax preparer or even a commercial income tax planning software.

The average cost for a Tax Preparer is 190. According to the National Society of Accountants the average cost to hire a CPA in the United States ranges from 457 for an itemized Form 1040 with Schedule C and a state tax return to 176 for a Form 1040 with a state tax return. HD your CPA Exam.

Study the CPA Program with the level of support you need to succeed. Some C corporations and multi-member. I would suggest finding a CPA who has his or her own practice and has experience in multi-family real estate.

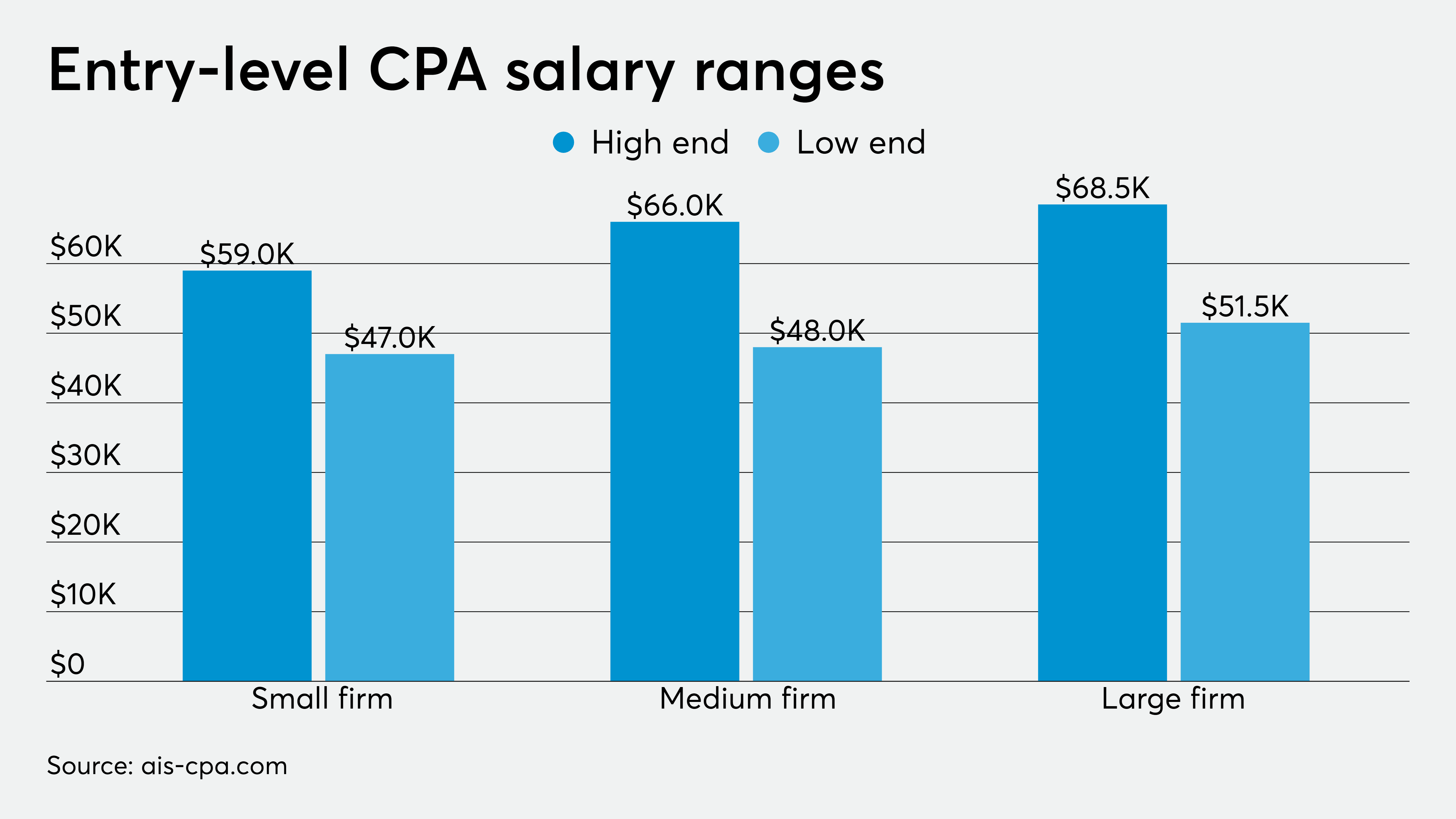

Smaller firms with lower gross earnings each year may charge an average CPA hourly rate between 30 and 50 per hour depending on the tasks for which you hired them. The debate over income tax reform and alterations in the tax code is still on the minds of clients as local accounting professionals report that almost 64 of their earnings comes from the planning and submitting of income tax conformity planning and problem resolution. Ad CPA HD Notes 100s Of Practice MCQ CPA Exam Prep Courses.

However when looking for this kind of services you have to very carefully assess the services prices. To hire a Tax Preparer to prepare your taxes you are likely to spend between 150 and 200 total. CPA Tax Preparation Fees One of the biggest tasks for which consumers and businesses.

If not then this rate is obviously greater. How much you pay will depend on how complex your tax return is. 273 for a Form 1040 with a Schedule A and state return 176 for a Form 1040 non-itemized and state return 184 for a Form 1040 Schedule C business.

How Much Does It Cost To Get Your Taxes Done Ramseysolutions Com

How Much Does It Cost To Get Your Taxes Done Ramseysolutions Com

How Much Does A Cpa Cost In Dallas Texas In Year 2021

How Much Does A Cpa Cost In Dallas Texas In Year 2021

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

How To Find The Best C P A Or Tax Accountant Near You The New York Times

How To Find The Best C P A Or Tax Accountant Near You The New York Times

Average Tax Preparation Fees Hit 273 For 1040 And One State Cpa Practice Advisor

Average Tax Preparation Fees Hit 273 For 1040 And One State Cpa Practice Advisor

How Much Do Accountants And Cpas Really Earn Accounting Today

How Much Do Accountants And Cpas Really Earn Accounting Today

How Much Does It Cost To Hire A Cpa Taxhub

How Much Does It Cost To Hire A Cpa Taxhub

How Much Should Accounting Cost A Small Business Costs Averages

How Much Should Accounting Cost A Small Business Costs Averages

Hiring A Cpa How Much Does It Cost To Have A Cpa Do Your Taxes Trending Us

Hiring A Cpa How Much Does It Cost To Have A Cpa Do Your Taxes Trending Us

How Much Do Accountants Charge For Tax Preparation Tax Preparation Tax Tax Forms

How Much Do Accountants Charge For Tax Preparation Tax Preparation Tax Tax Forms

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif) How Much Is Too Much To Pay For Tax Returns

How Much Is Too Much To Pay For Tax Returns

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

How Much Will It Cost To Have A Tax Professional Prepare Your Tax Return This Year Aving To Invest

How Much Will It Cost To Have A Tax Professional Prepare Your Tax Return This Year Aving To Invest

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.