If you play by the rules you wont pay taxes when you take the money out. Rules to Know Understand Individual Retirement Accounts IRAs can be a great way to save for retirement because of the tax benefits they can provide.

What Are The Taxes On My Ira Withdrawal Legacy Planning Law Group

What Are The Taxes On My Ira Withdrawal Legacy Planning Law Group

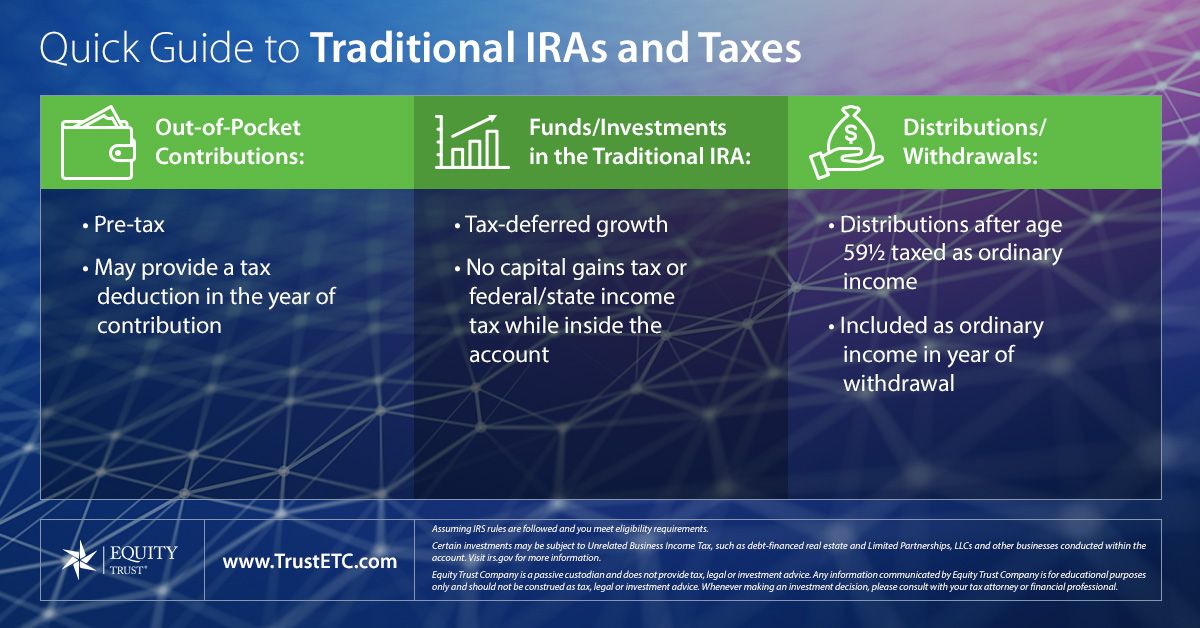

That means that tax is paid when the holder of an IRA account or the beneficiary takes distributionsin the case of.

Taxes on ira accounts. But again this only applies to very valuable estates because of the 117 million exemption. Ad Térítse vissza ír adóját. This increases to 7000 if youre 50 or older.

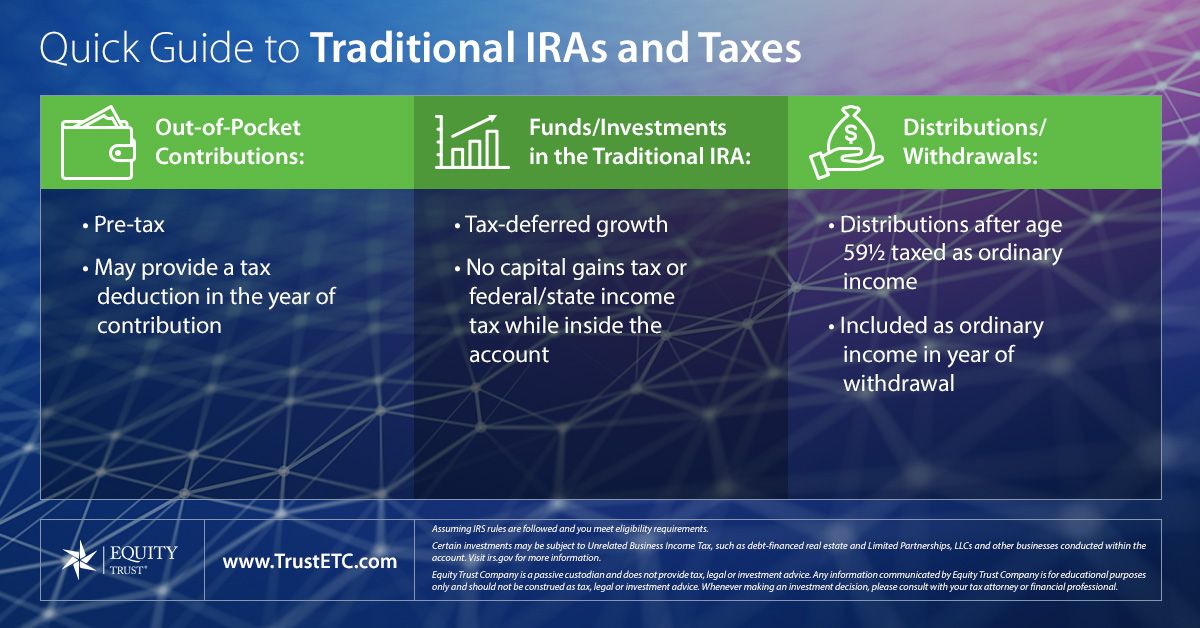

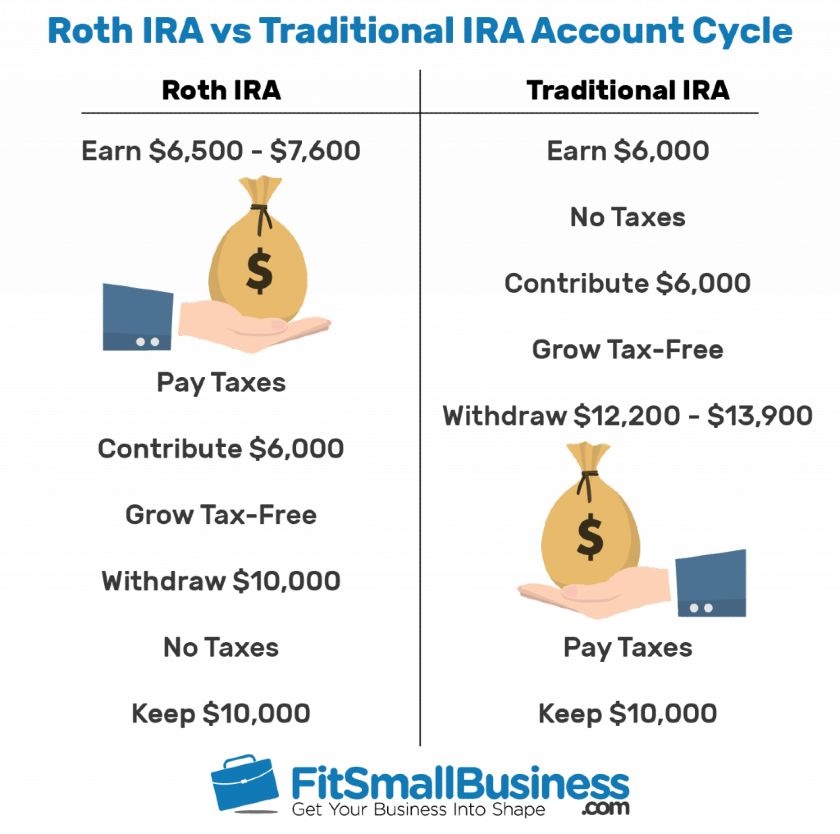

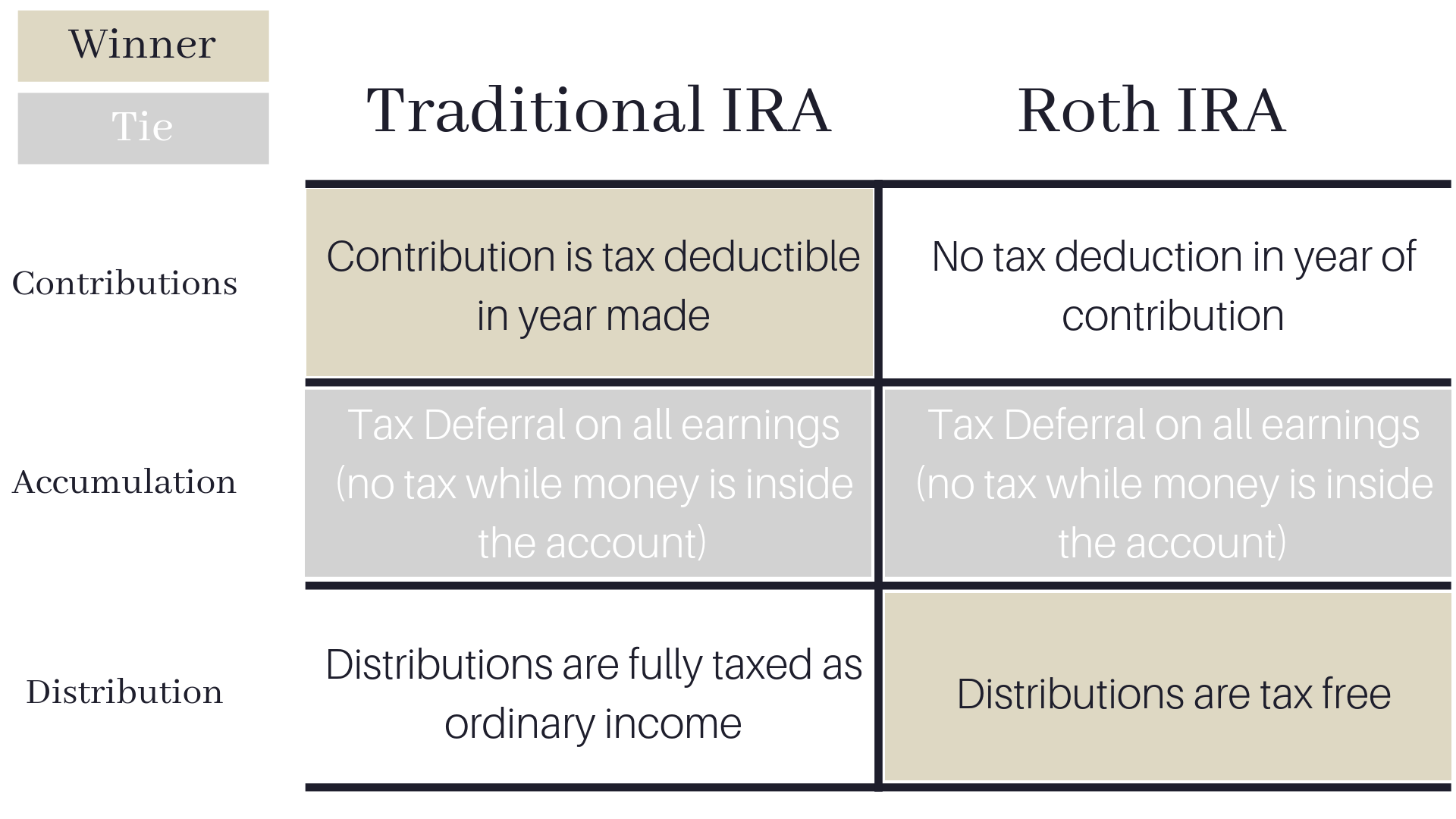

Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Youll pay tax on withdrawals from a traditional IRA but with a Roth IRA there is no tax due at. Distributions taken before retirement are considered taxable income in most cases and also assessed an.

Generally amounts in your traditional IRA including earnings and gains are not taxed until you take a distribution withdrawal from your IRA. You dont report any of the gains on your IRA investments on your income taxes as long as the money remains in the account because IRAs are tax-sheltered for either a traditional IRA or a Roth IRA. It can pose a problem for the beneficiary of the IRA or 401k if the deceased owners estate is taxable and there arent enough assets outside the IRA or 401k to pay the estate tax bill.

See IRA Resources for links to videos and other information on IRAs. You can withdraw your entire US 401k IRA Tax Free using Tax Treaty. 1 In 2020 and.

Call us learn more. The way individual retirement account IRA withdrawals are taxed depends on the type of IRA. Ad US retirement funds withdrawal can be tax-free in the US for Non Resident Alien 401k IRA.

Roth IRAs offer tax-free growth on both the contributions and the earnings that accrue over the years. Ad Térítse vissza ír adóját. Qualified withdrawals from a traditional IRA are always taxed as ordinary income while qualified withdrawals from your Roth IRA are free from federal income taxes.

You can take back your principal contributions even before age 59½ as long as you dont touch any investment gains. Any activity that occurs inside the account including a stock trade does not result in a currently taxable event. Your contributions can be deducted from your taxable income so you would only pay taxes on the remaining balance.

IRAs and inherited IRAs are tax-deferred accounts. You can withdraw your entire US 401k IRA Tax Free using Tax Treaty. Contributions you make to a traditional IRA may be fully or partially deductible depending on your filing status and income and.

Ad US retirement funds withdrawal can be tax-free in the US for Non Resident Alien 401k IRA. The Internal Revenue Service IRS wont tax you twice on the money you contribute to a Roth IRA although you do have to maintain the account for at least five years and as with traditional IRAs you must be at least age 59½ before you take distributions to avoid a penalty. Funds inside both types of IRAs work the same.

Call us learn more. Dividends received in the IRA are tax-free in most cases. How much you will pay in taxes when you withdraw money from an individual retirement account IRA depends on the type of IRA your age and even the purpose of the withdrawal.

When the Account Must Pay Estate Taxes. You can contribute up to 6000 into a traditional IRA investment account annually as of tax year 2021. If youre eligible you can choose a traditional IRA for an up-front tax deduction and defer paying taxes until you take withdrawals in the future.

Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy.

Ultimate Guide To Self Directed Accounts Taxes Equity Trust

Ultimate Guide To Self Directed Accounts Taxes Equity Trust

Roth Ira Or Traditional Ira Or 401 K Fidelity

Roth Ira Or Traditional Ira Or 401 K Fidelity

When It S A Bad Deal To Inherit A Roth Ira

When It S A Bad Deal To Inherit A Roth Ira

Ira Basics Planmember Retirement Solutions

Ira Basics Planmember Retirement Solutions

Taxes Contributions And Your Ira Your Questions Answered Accuplan

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Roth Ira Rules Contribution Limits Deadlines

Roth Ira Rules Contribution Limits Deadlines

Individual Retirement Account Ira Basics Planmember

Individual Retirement Account Ira Basics Planmember

Traditional Ira Definition Rules And Options Nerdwallet

Traditional Ira Definition Rules And Options Nerdwallet

What Is An Ira Guide To Individual Retirement Accounts Mint

What Is An Ira Guide To Individual Retirement Accounts Mint

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

Tax Deferred Ira Account A Unwritten Ira Lets You Hold Over Taxes

Tax Deferred Ira Account A Unwritten Ira Lets You Hold Over Taxes

Who Uses Individual Retirement Accounts Tax Policy Center

Who Uses Individual Retirement Accounts Tax Policy Center

/Takingmoneyoutofanira-98057a4d86a843f99b9141cd5c111009.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.