That means that if you put money into your Roth IRA in 2020 but contributed it toward the 2019 tax year then the five years will run on Jan. Once you reach age 59 ½ and have had the account open for at least five years you can withdraw any amount from your Roth IRA at any time without incurring a tax liability.

Roth Vs Traditional Ira What You Need To Know Ellevest

Roth Vs Traditional Ira What You Need To Know Ellevest

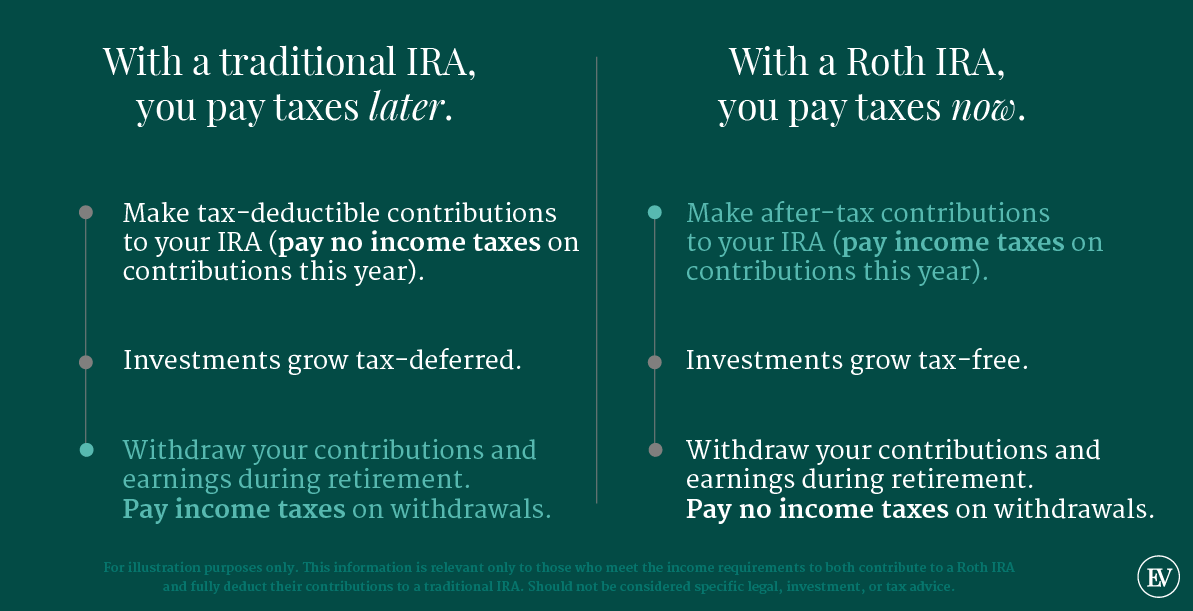

In other words youre paying your taxes up front so the gains can remain tax free.

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

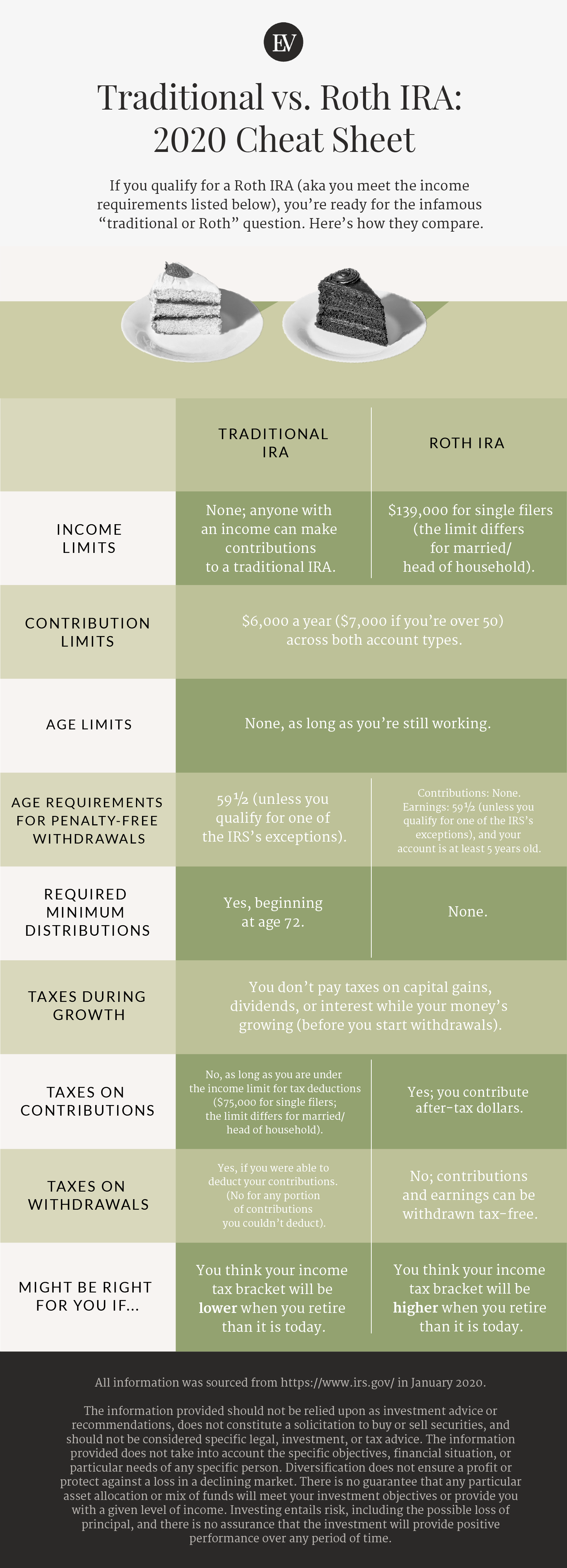

Do you pay taxes on gains in a roth ira. 1 In 2020 and. The Basics of Roth IRAs Roth IRAs offer a tax-advantaged way to save for retirement. Because you pay taxes upfront on the money you put into a Roth IRA all the returns your investment earns over the years are tax free.

Youll pay income taxes and a 10 penalty tax on earnings you withdraw as of 2021. For example you can buy 100 shares of stock in your Roth IRA and later sell it for a profit and the capital gain. With a Roth you pay no income taxes on withdrawals nor capital gains taxes.

Roth IRAs add tax-free treatment to the mix. Although you pay taxes on the money you put into a Roth IRA the investment earnings in the account are tax-free. Like with a traditional IRA you put aside money today but cannot deduct the contribution against current-year taxes.

Also when you reach age 59½ and have had the account open for at. Unlike a traditional IRA Roth IRA contributions are made with after-tax dollars and are not deductible. Roth IRAs offer tax-free growth on both the contributions and the earnings that accrue over the years.

When you contribute to a Roth 401 k the contribution wont lower your taxable income today. With a Roth IRA. With a Roth IRA you pay taxes on your contributions so you dont have to pay later when you take qualified withdrawals.

Likewise you must pay income taxes on early withdrawals of earnings from a Roth IRA and you might owe a 10 IRS penalty as well. Is there capital gains taxes on a Roth IRA. If you play by the rules you wont pay taxes when you take the money out.

The funds going into a Roth are post tax dollars. The only time you can pay tax on gains earnings in a Roth is if you have. It will compound over years in the same way but the Roth money does so tax-free.

You can avoid the. You dont get an up-front deduction for Roth IRA contributions but the payback is that theres no tax on distributions in the future either. The 10 penalty can be waived however if you meet one of eight exceptions to the early withdrawal penalty tax.

With a traditional IRA the tax is merely deferred and you will have to pay taxes on your contributions and any gains at your ordinary income tax rates. If you deducted your traditional IRA contributions which you did if you met income limits you have. No you have to meet certain income.

The gains on assets you hold in your Roth IRA are not subject to current taxation. If you withdraw funds before that date you. As you do so you pay taxes on the.

However not all Roth IRA withdrawals are tax-free. With traditional IRAs you have to begin taking required minimum distributions RMDs at age 72. Your Roth IRA withdrawals might be taxable if.

Pay taxes on your IRA contributions and earnings. If you take out the earnings before they are qualified youll owe income taxes and a penalty. Also not if you have qualified distributions.

You havent met the five-year rule for opening the Roth and youre under age 59½. A Roth IRA is tax free in distribution if used as the plan design calls for. Not if the money is sitting in the account.

Can anyone contribute to a Roth IRA. Roth IRAs are particularly valuable as estate-planning tools. But when you eventually take the money out similar to a Roth IRA its completely and utterly.

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning

/what-to-do-if-you-contributed-too-much-to-your-roth-ira-49102ec9ed7948d2863c9ea0e7581dce.png) Your Options For Excess Roth Ira Contributions

Your Options For Excess Roth Ira Contributions

When It S A Bad Deal To Inherit A Roth Ira

When It S A Bad Deal To Inherit A Roth Ira

Isolating Ira Basis For More Tax Efficient Roth Ira Conversions Financial Planning

Isolating Ira Basis For More Tax Efficient Roth Ira Conversions Financial Planning

Roth Vs Traditional Ira What You Need To Know Ellevest

Roth Vs Traditional Ira What You Need To Know Ellevest

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Why Roth Iras Are One Of The Best Wealth Building Vehicles Around Grey House Weiss

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Roth Ira Conversion What To Know Before Converting Fidelity

Roth Ira Conversion What To Know Before Converting Fidelity

Roth Ira Withdrawal Rules Oblivious Investor

Roth Ira Withdrawal Rules Oblivious Investor

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.