A good CPA may cost you more upfront but will pay off in the long run because he or she is thorough. How much does CPA charge.

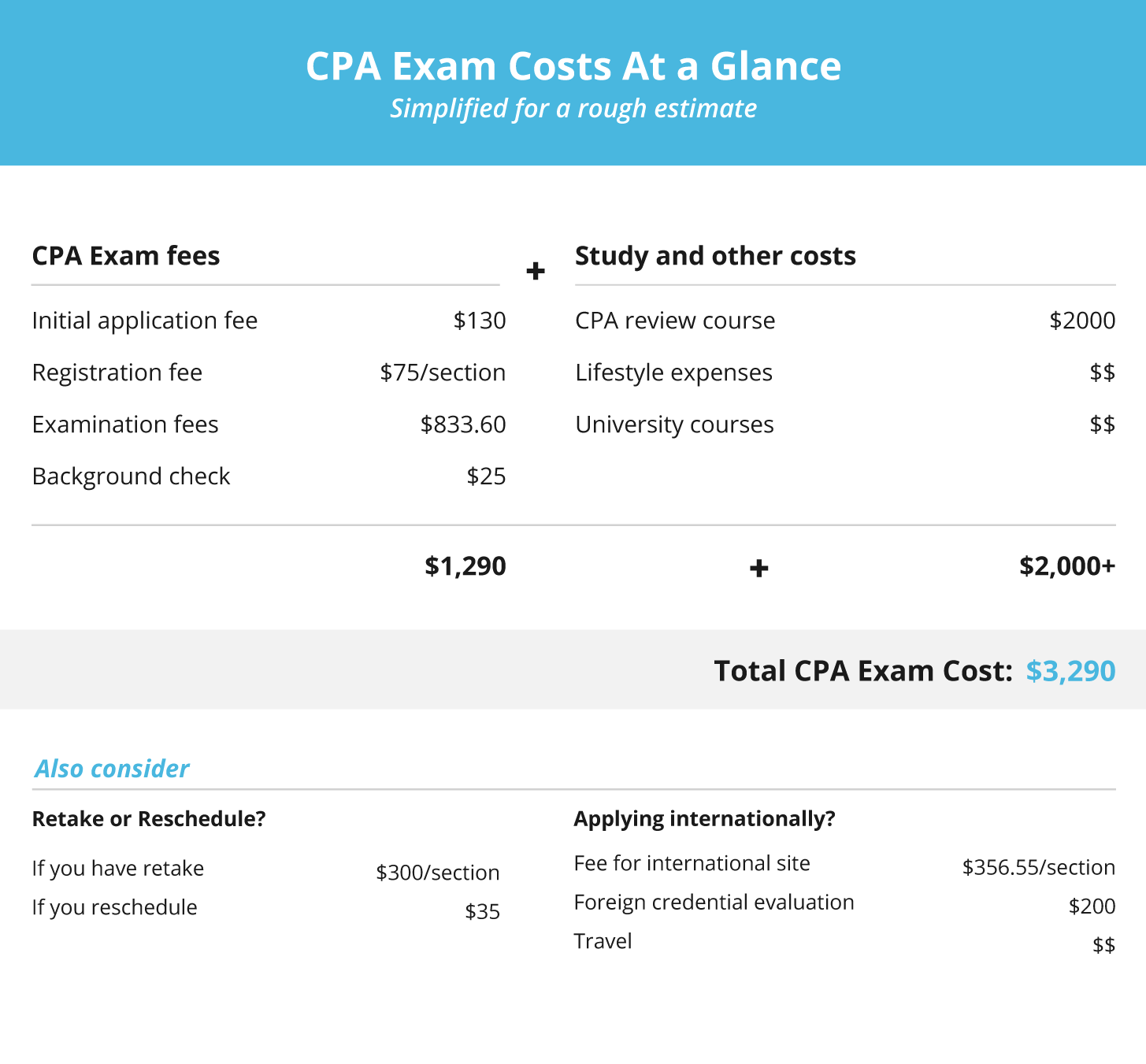

Cpa Exam Costs 2019 Save On Fees

Cpa Exam Costs 2019 Save On Fees

However costs can reach as high as 450.

How much do cpas charge. To give you an idea of the comparison of other professional accounting fees to that of a certified public accountant take a look at the averages below. Some CPAs charge less than 100 per hour. Accountant non-CPA hourly rate.

How Much Should a CPA Cost. Senior Accountant hourly rate. On the other hand I had a client whose return took over a week to prepare when I worked in a large firm which cost the client around 100000.

How much do accountants charge. How much can a CPA charge. Anyone can drop numbers in software.

Typically accountants nationwide cost between 30 and 300 per hourAccounting costs are determined by the size of your business and your accounting needs. The difference is knowledge skill education the value of whats at stake procedural expertise reputation likeability location and circumstance. Ad Search For Relevant Info Results.

How much do accountants charge. You may be charged based on your turnover as well as what type of legal structure your business is. Some have a fixed annual fee to complete accounts business tax calculations and file documents while others charge by the hour although this is becoming less common.

Theres a broad hourly range as to what theyll charge but you should expect to pay between 100 250 per hour. So it follows that deducing which services can be done yourself can help you budget your accounting needs. Charge by the Hour.

An hourly rate for a CPA also varies depending on experience. How much you can expect to pay for accounting services largely depends on what sort of help you need and their particular pricing structure. Study the CPA Program with the level of support you need to succeed.

Ad Study the CPA Program with the level of support you need to succeed. If you are self-employed and need to hire a CPA to prepare an itemized Form 1040 with a Schedule C and a state tax return form the average fee increases to 457. Study the CPA Program with the level of support you need to succeed.

How much you pay will depend on how complex your tax return is. In general accountants can make between 175 to 450 dollars per hour as part of their small business accountant fees. It depends entirely on ones value to the client.

Ad Search For Relevant Info Results. Staff Accountant hourly rate. CPAs will also charge clients an hourly rate to prepare tax returns.

A CPA or Certified Public Accountant is at a much higher level than an accountant. Get Results from multiple Engines. Some accountants charge by-the-hour for consultation services short-term assistance sorting out bookkeeping issues or one-time help to get new accounting software up and running.

The actual rate will depend on the experience of the Certified Public Accountant and the actual services that heshe provides. The 2017 average salary of a Certified Public Accountant according to the Journal of Accountancy was 119000. How much do accountants charge.

And as they provide such complex support different services will have a different price tag attached. On the low end individual tax preparation fees start at 100. Get Results from multiple Engines.

In simple terms accountants charge by the service not the hour. Ad Study the CPA Program with the level of support you need to succeed. Ask for a.

Stephen Harrison 09012020 H ow much do you charge is the question we get asked the most and a lot of the time this is the deciding factor in people choosing an accountant to work with. Tax Accountant hourly rate. So it sounds like 1800year is a reasonable charge for an experienced real estate cpa to file returns and give ongoing advice.

Especially since I am planning on growing my portfolio. The 2021 average cost of tax preparation is 175 with prices typically ranging from 150-200. It is essential that you know your accountants charges what the fees are based on and what services they include.

Others more than 1000 per hour.