E-ZPass TollsNY App Video. Discount applies to E-ZPassNY accounts only.

Cashless Tolling On New York State Thruway Still A While Off Waer

Cashless Tolling On New York State Thruway Still A While Off Waer

NY E-ZPass customers outside of those who use the Gov.

Ny state thruway tolls. The Thruway Authority Board of Directors approved the proposal in December 2020 after a public process that began in 2019. Email If provided a confirmation will be sent Confirm Email Address. Also new E-ZPass customers will be charged the Tolls by Mail rate on the Thruway for improper tag mounting.

If you do not have E-ZPass an image of your license plate is captured and a Toll Bill is mailed to the registered owners address on file with DMV. New toll rates went into effect on Jan. Pay your Unpaid Toll online at httpswwwappsthruwaynygovupt Pay by telephone at 518 471-5051 Mon-Fri 900 am - 400 pm If you received a Thruway Toll Bill for Thruway travel during the COVID-19 Emergency Tolling Procedures between the dates of March 22 2020 and June 4 2020 please visit wwwthruwaynygovetp.

The state Thruway Authority employs roughly 1100 toll workers 900 part-time and 200 full-time employees. But if you dont then starting January 1 you will see a 30 increase for tolls. It is operated by the New York State Thruway Authority NYSTA a New York State public-benefit corporation.

Free New York tolls plus travel and tourist information. Approximately 175 million motorists travel through the Yonkers Toll Barrier north and south each year accounting for more than 65 percent of the Thruways overall toll traffic volume. Get E-ZPass learn more andor access your account.

Effective January 1 2017 the New York State Thruway Authority will no longer provide a 5 percent discounted toll rate for customers using E-ZPass accounts provided by. For more information please Click Here. New E-ZPass mid-tier toll rate for improper tag mounting also goes into effect.

The New York State Thruway is officially going cashless on Saturday. Get E-ZPass near you. New toll rates will be in effect at NYS Bridge Authority beginning May 1 2021.

The 49600-mile 79823 km mainline is a toll road that extends from the New York City line at Yonkers to the Pennsylvania state line at Ripley by way of Albany Syracuse and Buffalo. Sign Up Online. The State Thruway Authority passed its budget Tuesday morning along with a motion to increase tolls for drivers who dont have the pass.

For more information please Click Here. The Yonkers Toll Barrier is located on the Thruway I-87 near exit 6A Stew Leonard Drive. New York State Thruway toll calculator for cars trucks SUVs RVs busses and all vehicle classes.

E-ZPass Discounts E-ZPassNY accounts only. The 570-mile superhighway system will transition from traditional toll booths to. New toll rates will be in effect at MTA Bridges and Tunnels beginning April 11 2021.

New E-ZPass mid-tier toll rate for improper tag mounting also goes into effect. We cannot process payments for toll bills from Tolls by Mail or E-ZPass Violations at this location. For more information please Click Here.

Save 30 on Thruway tolls. For additional information see Thruway Tolls FAQs. E-ZPass is the easiest and quickest way to pay tolls on the Thruway.

The location converted to cashless tolling in November 2018. If you do have an E-ZPass your rates dont change. Tolls by Mail customers will pay 30 above the NY E-ZPass toll rate in addition to a 2 administrative surcharge per billing statement.

When New York changes Friday night into Saturday morning the Thruways 228 individual toll booths will go dark never to be used again. Violation Number s Please provide if applicable Toll Bill or E-ZPass Account Number s Please provide if applicable License Plate Number. If you received an E-ZPass violation and wish to pay it online please visit the E-ZPass.

Find an E-ZPass retailer near you cars only By Mail Download Application CommercialBusiness Vehicles. Cuomo Bridge are not impacted. Also new E-ZPass customers will be charged the Tolls by Mail rate on the Thruway.

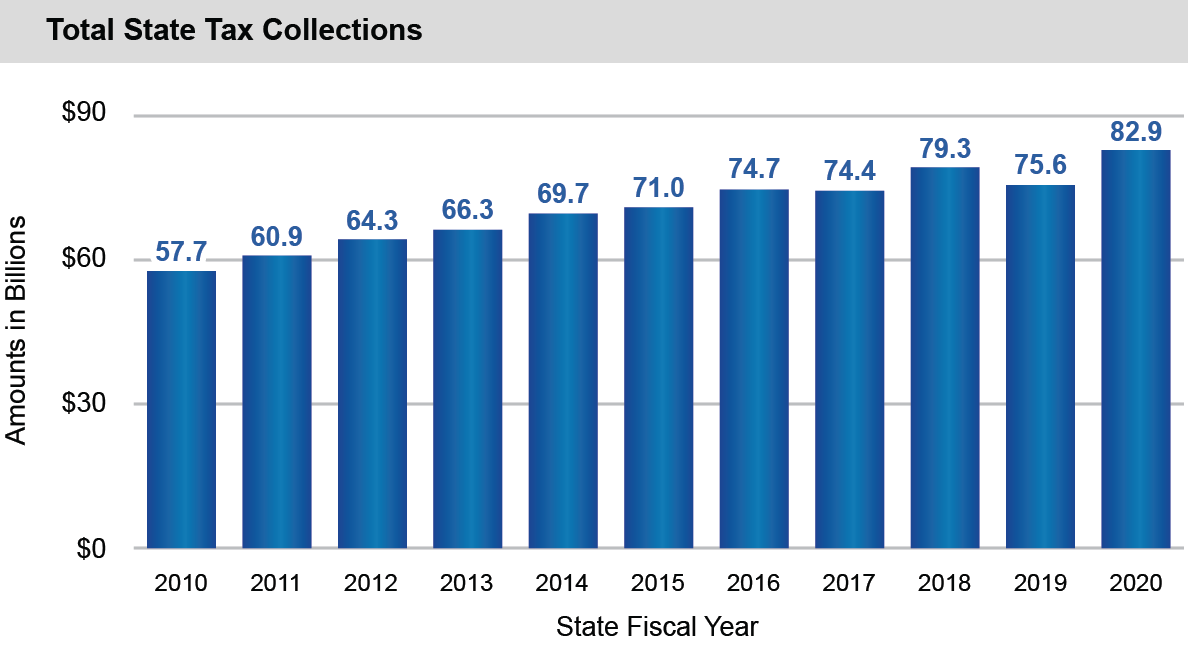

Thruway tolls have not been adjusted since 2010.