Those who qualify can receive a weekly benefit payment for a maximum of 26 full weeks during a one-year period. Any certification made on a Sunday is for the week ending that day.

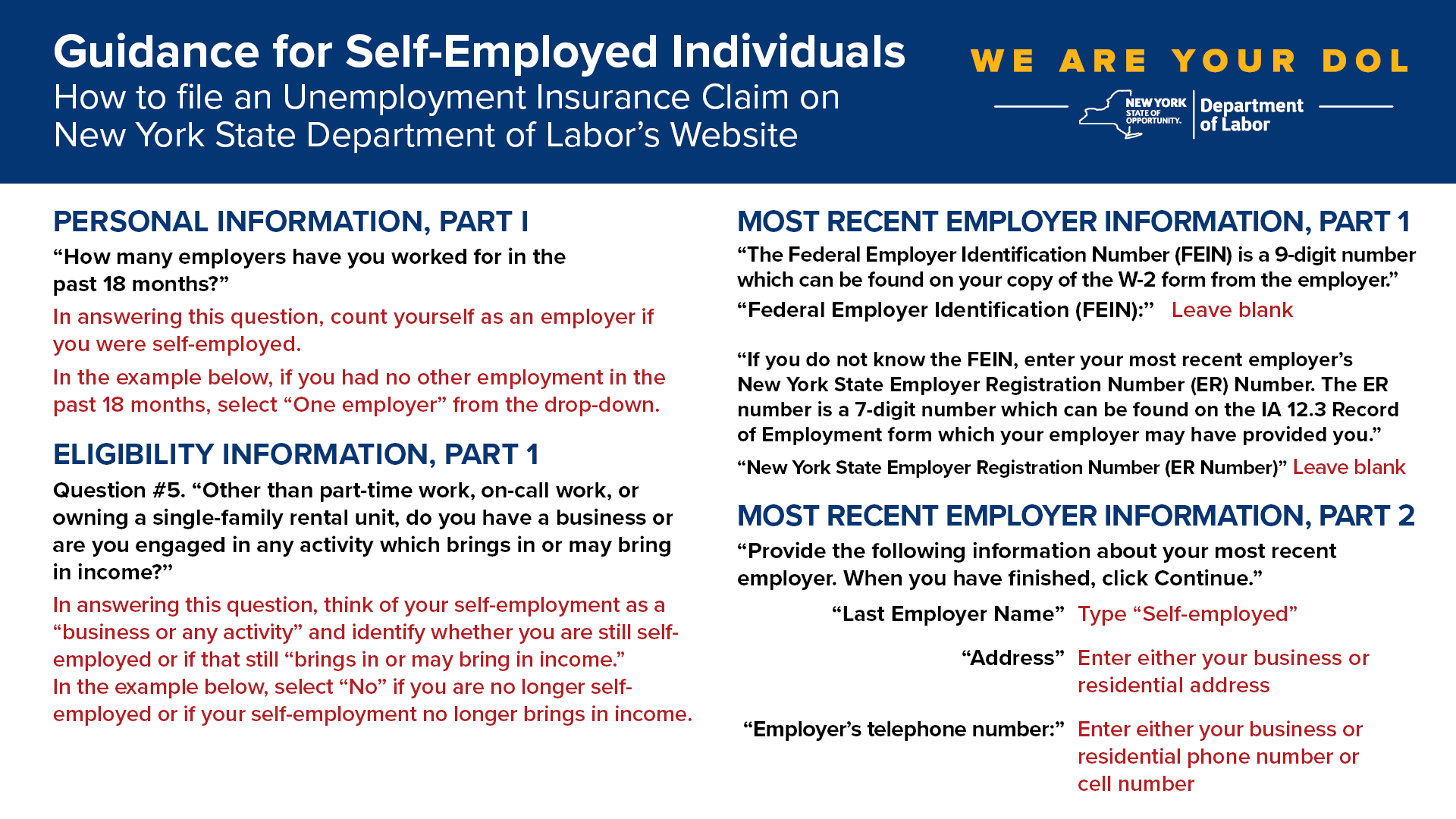

Nys Department Of Labor On Twitter If You Are Self Employed You Can Now Apply For Unemployment Insurance Benefits The Best Way To File Is Online At Https T Co T2tezsp2lf Please See Guidance Below On

Nys Department Of Labor On Twitter If You Are Self Employed You Can Now Apply For Unemployment Insurance Benefits The Best Way To File Is Online At Https T Co T2tezsp2lf Please See Guidance Below On

However we would like to contact you if we need more information.

New york state unemployment insurance. You must file your claim for the previous week on the last day of that week Sunday through the following Saturday. To receive unemployment insurance an individual must submit an application to the New York State Department of Labor. What steps must an individual take to receive unemployment insurance.

In New York State employers pay contributions that fund Unemployment Insurance. Effective January 1 2020 agricultural employers and farm crew leaders under certain conditions are required to provide unemployment insurance coverage for. There are two ways to apply.

Certify for Weekly Unemployment Insurance Benefits. Changes affecting agricultural employers In 2019 Governor Cuomo signed the Farm Laborers Fair Labor Practices Act. This is called the claim window.

What is the maximum benefit I can receive through Unemployment Insurance. Hop on to New York State Department of Labor website wwwdolnygov and click on Unemployment Insurance. Apply online at nygovservicesget-unemployment-assistance during the following hours.

Generally unemployment insurance is paid into an account held by the New York State Department of Labor at a specified percentage of each covered employees wages up to a cap. What is Unemployment Insurance. For the purposes of Unemployment Insurance a week runs from Monday to Sunday.

Those claims have hurt the timeline people truly in. In New York State employers pay for benefits not workers. NEW YORK - The New York State.

Amount of tax withheld for New York State New York City and Yonkers. Certify for benefits for each week you remain unemployed as soon as you receive notification to do so. The account is only a bookkeeping.

You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit amount. Less than 0 The Unemployment Insurance contribution rate is the normal rate PLUS the subsidiary rate. To collect benefits you must be ready willing and able to work and actively looking for work during each week in which you are claiming benefits.

If you are reporting an individual or business for fraud you may remain anonymous. If you have worked in New York State within the last 18 months and lost your job through no fault of your own you may be eligible forUI. Unemployment Insurance is temporary income for eligible workers who become unemployed through no fault of their own.

Following are the step to file for New York State Unemployment Insurance. You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit amount. To collect benefits you must be ready willing and able to work and actively looking for work during each week in which you are claiming benefits.

For nearly a full year New York state has been trying to respond to unemployment insurance claims as quickly as possible. However the state is also dealing with hundreds of thousands of false fraudulent claims. This form is to report unemployment insurance UI fraud against the Department of Labor andor identity theft related to UI.

All employers in New York are responsible for contributing to the Unemployment Insurance Fund which finances benefits to claimants. Unemployment Insurance Benefits - Government of New York. For 2021 the new employer normal contribution rate is 34.

Unemploymentinsurance alsoknownas UI provides temporary cashbenefits to employees whohave lost their jobs. Wage Reporting and Unemployment Insurance Report NYS 45. New York state officials are warning New Yorkers about scammers filing fraudulent claims for unemployment benefits using stolen identities.

The percentage rate is based on unemployment claim experience of the individual employer and the losses of the entire state fund. This new tool allows New Yorkers to safely and efficiently submit their identity documentation if required due to federal guidelines andor suspected fraud. The information you provide in this form will remain confidential.

When a former employee resigns or is terminated from his or her position the employer may receive notice that the former employee has applied for unemployment insurance benefits. In New York State employers pay contributions that fund Unemployment Insurance. Use this rate to calculate line 4 on the Quarterly Combined Withholding.

No deductions are taken from workers paychecks. NYS DOL is using IDmes secure online technology to verify the identity of some unemployment insurance UI and Pandemic Unemployment Assistance PUA applicants.