You can access the following unemployment taxes guidance as a Google doc here. When you signed up for unemployment benefits if you chose to have 10 of each payment withheld you cant withhold more or less to help cover federal income taxes you might not have to do anything else.

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

You will pay taxes on your unemployment compensation.

Do i need to pay taxes on unemployment. Add up all of your income from 2020 such as wages unemployment benefits and retirement income. People shouldnt have to pay taxes on their unemployment checks. If you dont want to get hit with a bill when you pay your taxes next year check with your local.

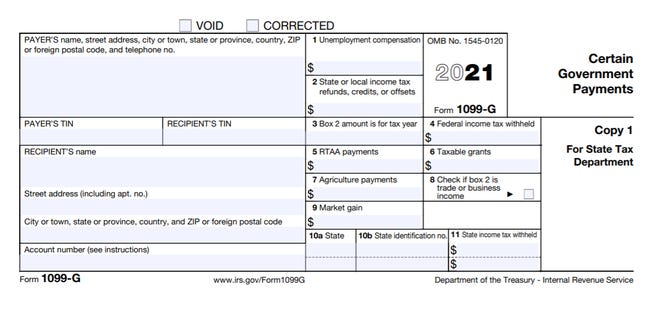

Your 1099-G will have the information youll need to transfer to your tax return. Do you have to pay taxes on unemployment. That means taxpayers will need to pay state tax on benefits they received last year absent any forthcoming.

Unemployment compensation has its own line Line 7 on Schedule 1. More than a dozen states arent offering a new tax break on unemployment benefits. The federal government usually taxes unemployment benefits as ordinary income like wages although you dont have to pay Social Security and Medicare taxes on this income.

Yes you need to pay taxes on unemployment benefits. While you dont have to pay Social Security or Medicare taxes typically about a combined 765 rate while receiving unemployment benefits you. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

However thanks to a new rule passed by Congress you dont have to pay tax on the first 10200 of the unemployment benefits you received in 2020 if your income is under 150000. But know that if you owe taxes on your benefits next year that doesnt spell doomsday for your finances. The benefits have been fully taxable since 1986.

Youll have to pay taxes on the remaining amount if you received more than 10200 in unemployment compensation. If your modified AGI is 150000 or more you cant exclude any unemployment compensation. For the 2020 tax year the standard deduction amounts are.

On the plus side you dont have to pay Social Security or Medicare taxes on unemployment income as you would for regular freelance income. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200. The IRS considers unemployment benefits taxable income.

Robin Hartill is a certified financial planner and a senior writer at The Penny Hoarder. By Christine Tran 2021 Get It Back Campaign Intern. The IRS and most states consider unemployment payments as taxable income which means that you have to pay tax on these payments and report them on your return.

Pay them upfront either automatically or quarterly if you can. JACKSONVILLE Fla Some unemployed Floridians who didnt have taxes deducted from their unemployment benefits may have a hefty payment. Normally any unemployment compensation someone receives is taxable.

With this new law if your household income is less than 150000 the first 10200 of unemployment per taxpayer will be tax free on your federal tax return but any amount you receive above that will be taxed. Until 1979 unemployment benefits werent taxed by the federal government. But the American Rescue.

If its less than the standard deduction for your filing status you might not need to file a tax returnand youre not on the hook for paying taxes on unemployment income. Amounts over 10200 for each individual are still taxable. Ultimately your unemployment income will be taxed right along with any other income you might have earned during the year except for the first 10200 in 2020 if youre eligible for relief under the terms of the ARPA.

The bottom line. Withhold your taxes from your unemployment benefits. You must include all unemployment compensation as income when you file your federal taxes.

There are a few states that exempt unemployment benefits.

Do You Pay Taxes On Unemployment Benefits Mi Tax Cpa

Do You Pay Taxes On Unemployment Benefits Mi Tax Cpa

Paying Taxes On Income From Unemployment Insurance Fu

Paying Taxes On Income From Unemployment Insurance Fu

Do You Have To Pay Taxes On Unemployment Benefits Tax Hack Tip 600 Week Unemployment Benefits Youtube

Do You Have To Pay Taxes On Unemployment Benefits Tax Hack Tip 600 Week Unemployment Benefits Youtube

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Paying Taxes On Unemployment Benefits Tax Queen

Paying Taxes On Unemployment Benefits Tax Queen

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

/GettyImages-182396779-56a0a54a3df78cafdaa38ff0.jpg) Important Unemployment Tax Questions For Employers

Important Unemployment Tax Questions For Employers

Are Unemployment Benefits Income Taxable Compensation Mint

Are Unemployment Benefits Income Taxable Compensation Mint

Unemployment Benefits Do You Have To Pay Taxes On Them Cbs News

Unemployment Benefits Do You Have To Pay Taxes On Them Cbs News

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Irs Will Start Sending Refunds In May To Many Who Paid Tax On 2020 Unemployment Mlive Com

Irs Will Start Sending Refunds In May To Many Who Paid Tax On 2020 Unemployment Mlive Com

Taxes On Unemployment Checks May Surprise Some

Taxes On Unemployment Checks May Surprise Some

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.