Estimated tax forms. 2020 personal income tax returns originally due on April 15 2021 and related payments of tax will not be subject to penalties or interest if filed and paid by May 17 2021.

Taxes Office Of The New York State Comptroller

Taxes Office Of The New York State Comptroller

New York state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525 59 609 641 685 and 882 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

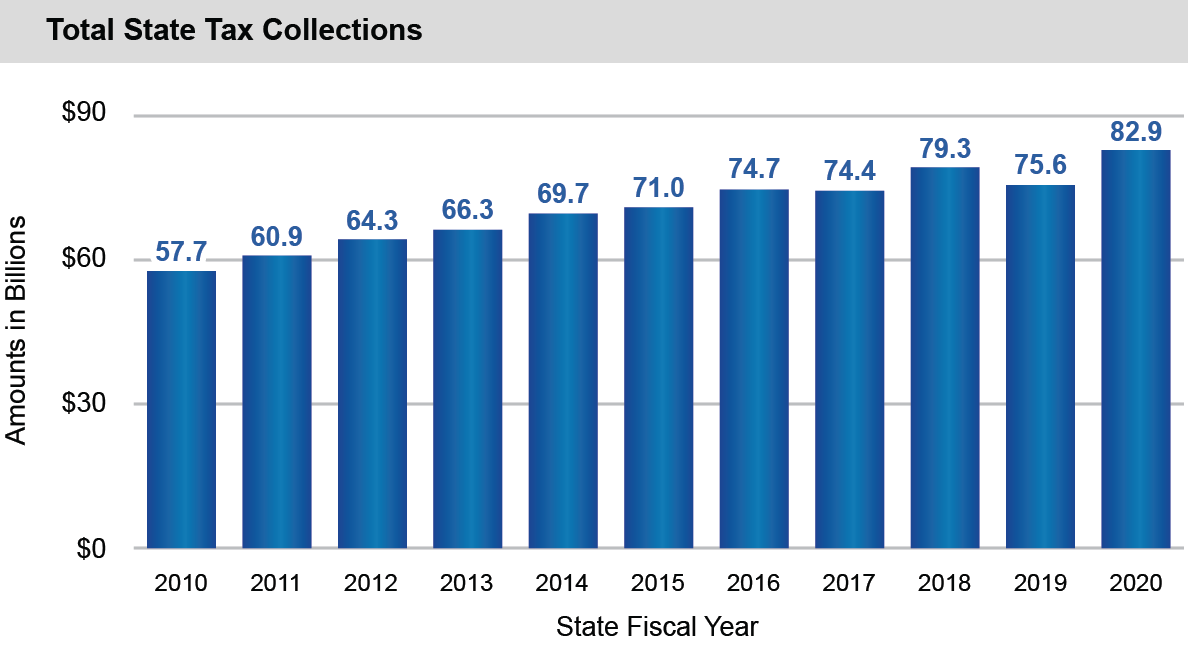

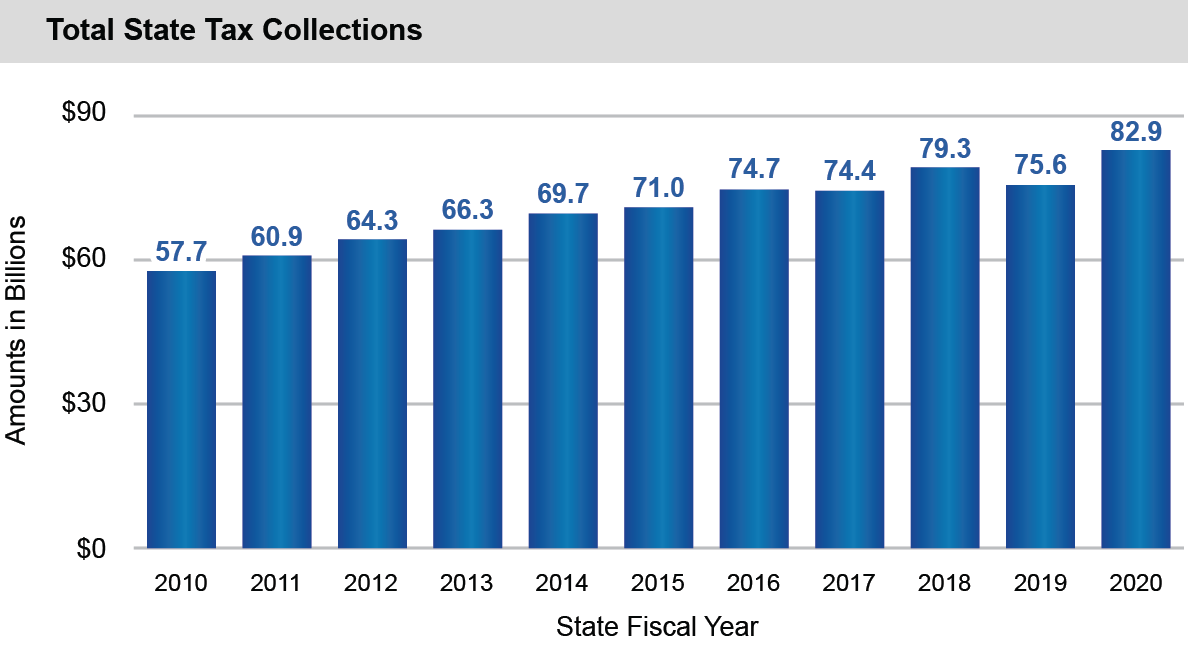

New york state taxes 2020. New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. The state applies taxes progressively as does the federal government with higher earners paying higher rates. Collections for consumption and use taxes New York States second largest tax revenue source increased by 145 percent from 2016 to 2020.

You are able to use our New York State Tax Calculator in to calculate your total tax costs in the tax year 202021. Partnership and LLCLLP forms. Our calculator has recently been updated in order to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Ad See the Empire State Statue of Liberty 911 Memomerial Top of the Rock More. Full Refund Available up to 24 Hours Before Your Tour Date. See our numerical list of forms.

For more information see N-21-1 Announcement Regarding Extension of the Deadline to File Personal Income Tax Returns for Tax Year 2020. Metropolitan commuter transportation mobility tax MCTMT Sales tax. Property tax Full list of tax types.

2020 tax tables Select the return you file below IT-201 for New York State residents or IT-203 for New York State nonresidents or part-year residents for more information on where to find the tax rates and tables for New York State New York City Yonkers and metropolitan commuter transportation mobility tax MCTMT. The second amount the 29 Medicare payment is applied to all your combined net earnings. Changes in the States top tax rate can have significant impacts in the overall level of State tax revenue.

New York States top marginal income tax rate of 882 is one of the highest in the country but very few taxpayers pay that amount. The New York tax rate is mostly unchanged from last year. For 2020 that amount is the first 137700 of your net earnings.

The New York self employment tax is calculated in two sections. 31 2020 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a NY state return. Ad Book your Hotel in New York NY online.

New York State Income Taxes for Tax Year 2020 January 1 - Dec. The States top personal income tax rate of 882 percent is in effect until December 31 2024. Quick Easy Purchase Process.

Ad Book your Hotel in New York NY online. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Be sure to use the correct mailing address for your personal income tax return and avoid common filing errors.

First a set amount is established each year against which the 124 of Social Security is applied. For your 2020 taxes which youll file in early 2021 only individuals making more than 1077550 pay the top rate and earners in the. We comply with the state law that requires agencies to post all application forms for general public use on their Web sites.

Quick Easy Purchase Process. Full Refund Available up to 24 Hours Before Your Tour Date. In New York different tax brackets are applicable to different filing types.

The latest deadline for e-filing New York State Tax Returns is. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Ad See the Empire State Statue of Liberty 911 Memomerial Top of the Rock More.

New York Salary Tax Calculator for the Tax Year 202021. 2020 New York Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. New York Income Taxes.

Nonresident group and team returns.

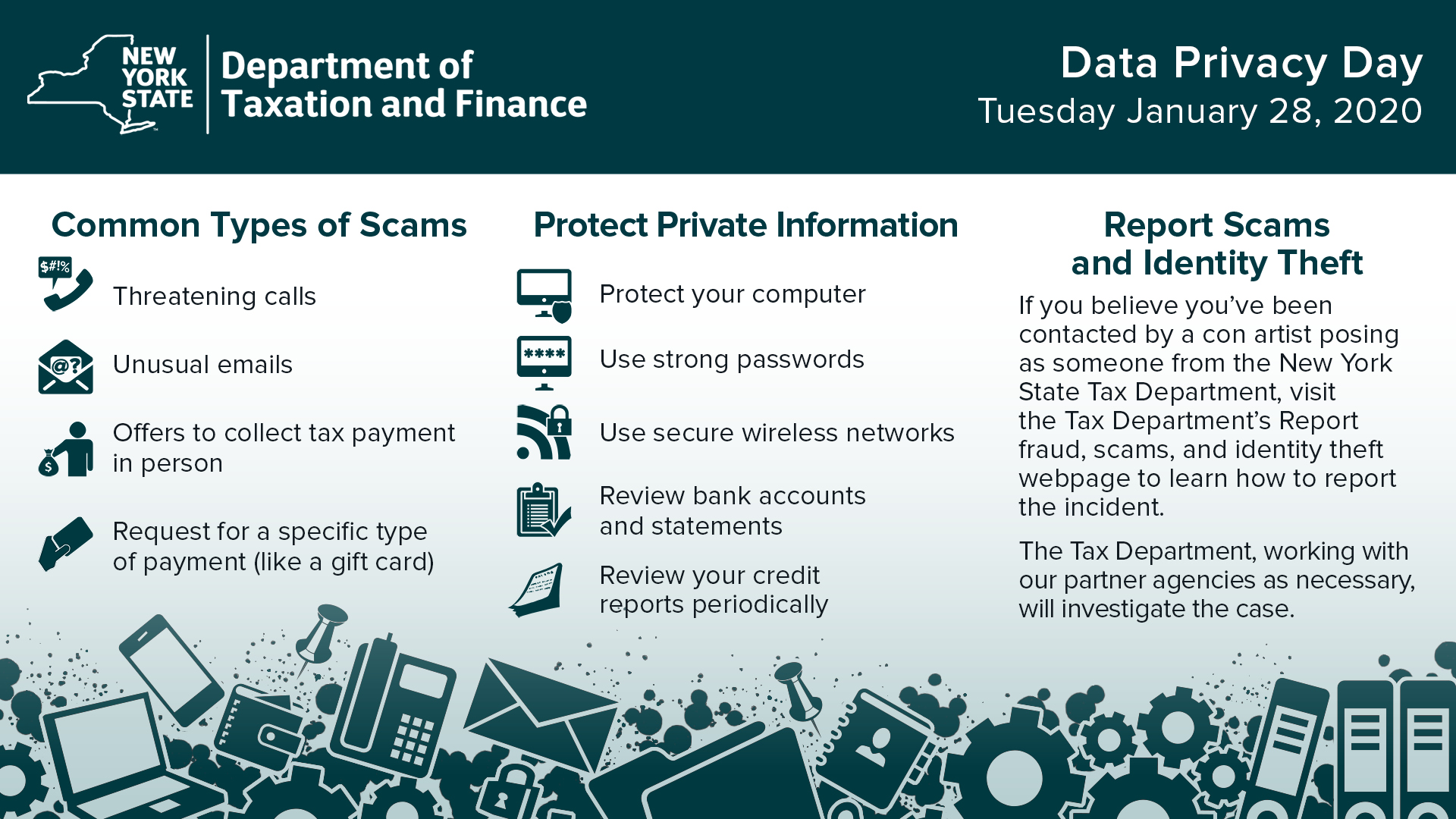

Secure Your Sensitive Information

Secure Your Sensitive Information

Http Nysac Membershipsoftware Org Files Nysactaxwhitepaper 1 Pdf

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

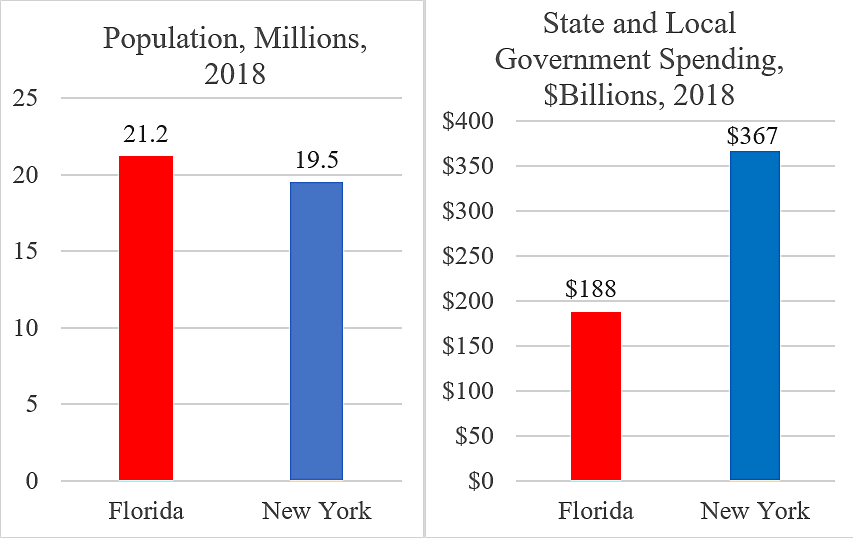

New York Vs Florida Cato At Liberty Blog

New York Vs Florida Cato At Liberty Blog

Dinapoli April Sales Tax Collections Decline More Than 24 After Covid 19 Shutdown Real Estate In Depth

Dinapoli Local Sales Tax Collections Drop Over 32 Percent In May Office Of The New York State Comptroller

Dinapoli Local Sales Tax Collections Drop Over 32 Percent In May Office Of The New York State Comptroller

New York State Fined Noncompliant Tax Preparers Nearly 4 Million In 2020

New York State Fined Noncompliant Tax Preparers Nearly 4 Million In 2020

Charting Ny S Fiscal Collapse Empire Center For Public Policy

Charting Ny S Fiscal Collapse Empire Center For Public Policy

New York Tax Forms 2020 Printable State Ny Form It 201 And Ny Form It 201 Instructions

New York Tax Forms 2020 Printable State Ny Form It 201 And Ny Form It 201 Instructions

Taxes Office Of The New York State Comptroller

Taxes Office Of The New York State Comptroller

Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More

Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.