Use the NYS tax computation. Most of the things that go into federal income taxes apply to New York State income taxes.

For the 2021 tax season the tax rates are between 4 to 882.

New york state income tax brackets. NYS adjusted gross income is 107650 or LESS. New Yorks income tax rates were last changed one year ago for tax year 2019 and the tax brackets were previously changed in 2016. State Individual Income Tax Rates and Brackets 2021 Single Filer Married Filing Jointly Standard Deduction Personal Exemption.

2021 State Income Tax Rates and Brackets. New York state income tax rates are 4 45 525 59 609 641 685 and 882. For your 2020 taxes which youll file in early 2021 only individuals making more than 1077550 pay the top rate and earners in the.

New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. 400 1000. The state applies taxes progressively as does the federal government with higher earners paying higher rates.

AND NYS taxable income is LESS than 65000. NYS tax rate schedule. AND NYS taxable income is 65000 or MORE.

For single filers up to 8500 is subject to. Ad Its Easy To File US. Are Federal Taxes Deductible.

New York Income Taxes. New York state income tax brackets and income tax rates depend on taxable income and filing status. 2019 New York Tax Deduction Amounts.

New York State Tax. Ad Hadromi Partners is one of the prominent law firms in Indonesia. New York City or Yonkers Tax.

Ad Its Easy To File US. Get A 100 Accuracy Guarantee With HR Block for your US. New York state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525 59 609 641 685 and 882 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

The states tax rates consistently rank among the nations highest and it also imposes an estate tax. New York has 8 tax brackets each with its own tax rate. State Rates Brackets Rates Brackets Single Couple Single Couple Dependent.

Alabama a b c 200 0. Married filing jointly or qualified widower 4. New York City has four separate income tax brackets that range from 3078 to 3876.

Where you fall within these brackets depends on your filing status and how much you earn annually. Ad Hadromi Partners is one of the prominent law firms in Indonesia. Taxes Online Or With An Expat Advisor From Anywhere In The World.

New York state income tax rates. New York States top marginal income tax rate of 882 is one of the highest in the country but very few taxpayers pay that amount. New Yorks income tax rates were last changed one year prior to 2019 for tax year 2018 and the tax brackets were previously changed in 2016.

Single or married filing separately. The latest available tax rates are for 2020 and the New York income tax brackets have not been changed since 2019. New York State Income Tax New York State income tax rates range from 4 to 882 for the 2019 tax year depending on a taxpayers income.

NYS adjusted gross income is MORE than 107650. New York State Single Filer Personal Income Tax Rates and Thresholds in 2021. Get A 100 Accuracy Guarantee With HR Block for your US.

Each marginal rate only applies to earnings within the applicable marginal tax. Taxes Online Or With An Expat Advisor From Anywhere In The World. Part-year NYC resident tax.

2019 State Individual Income Tax Rates And Brackets Tax Foundation

2019 State Individual Income Tax Rates And Brackets Tax Foundation

The Provocative Millionaires Tax Its Potential And Past In Nj Nj Spotlight News

The Provocative Millionaires Tax Its Potential And Past In Nj Nj Spotlight News

Http Nysac Membershipsoftware Org Files Nysactaxwhitepaper 1 Pdf

Tax Advantages Of Home Ownership

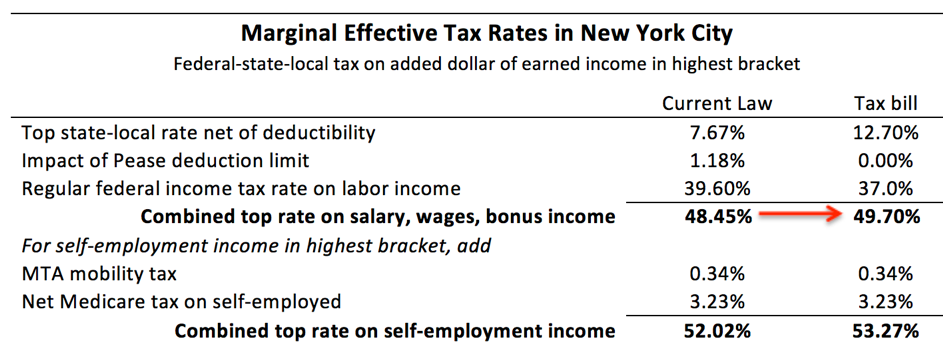

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

New York Income Tax Calculator Smartasset

New York Income Tax Calculator Smartasset

Albany Boosts Taxes On Wealthiest Wsj

Albany Boosts Taxes On Wealthiest Wsj

Annual State Local Tax Burden Ranking 2010 New York Citizens Pay The Most Alaska The Least Tax Foundation

Annual State Local Tax Burden Ranking 2010 New York Citizens Pay The Most Alaska The Least Tax Foundation

Do States Like New York And California Really Have High Taxes Quora

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

Https Www Empirecenter Org Wp Content Uploads 2018 04 Rdb Pit Ejm April 2018 Update Pdf

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.