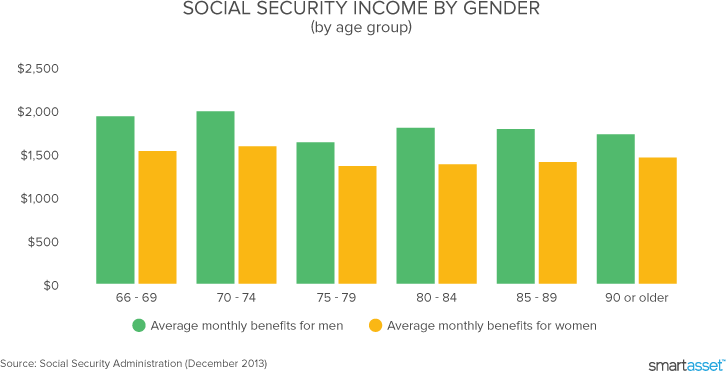

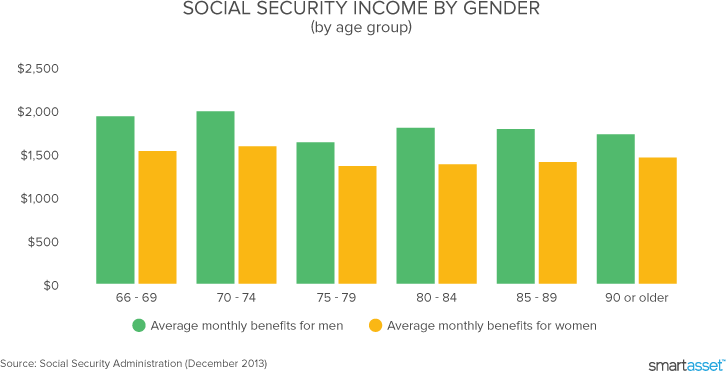

The maximum Social Security benefit changes each year. When determining your monthly benefit at full retirement age the Social Security Administration SSA will take into account your 35 highest-earning inflation-adjusted years.

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

How the Retirement Estimator Works.

How much social security will i get when i retire. There is no minimum benefit but there is a maximum. For someone at full retirement age the maximum amount is 3113 and for someone aged 62 the maximum amount is 2324. The average retired worker receives nearly 1500 a month.

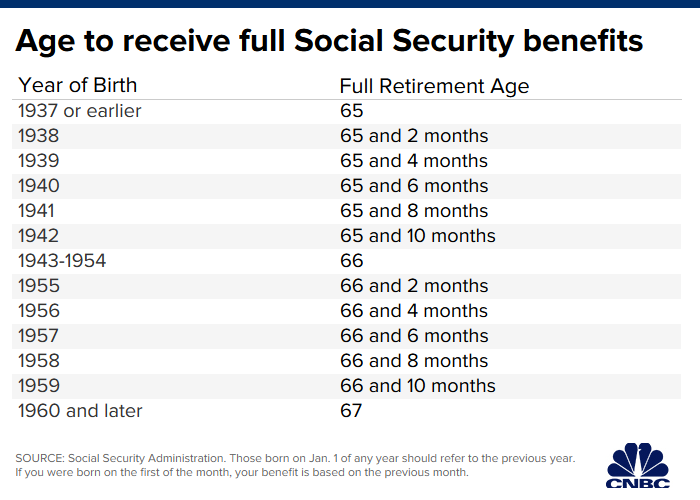

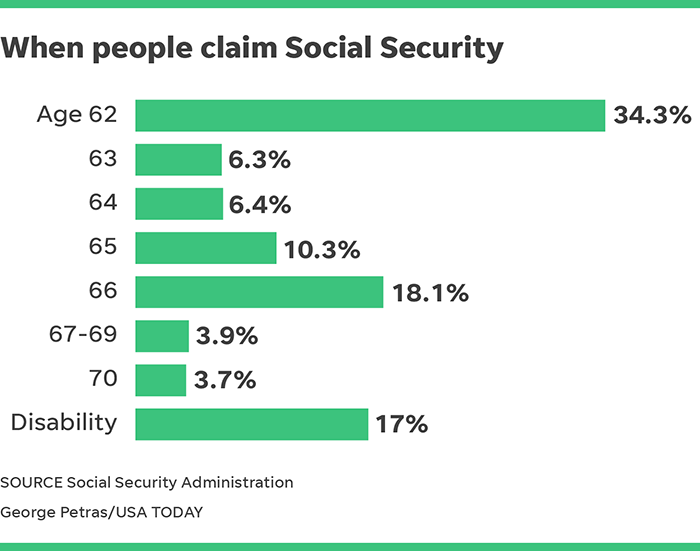

If you wait until you are 70 to take your Social Security benefit you will receive monthly payments that are 32 higher than the benefits you would. Yes there is a limit to how much you can receive in Social Security benefits. To receive the maximum benefit with delayed retirement credits the age is 70.

For security the Quick Calculator does not access your earnings record. For example if you made 20000 twenty years ago the SSA would consider it to be somewhere close to 35000 today when calculating benefits. What is the maximum amount you can get from Social Security when you retire.

Please keep in mind that these are just estimates. Estimate Your Retirement Benefits. That check was for a grand total of 2254.

Benefit estimates depend on your date of birth and on your earnings history. The maximum monthly Social Security benefit that an individual can receive per month in 2021 is 3895 for someone who files at age 70. So benefit estimates made by the Quick Calculator are rough.

For many people Social Security is the only form of retirement income they have that is directly linked to inflation. To qualify for social security you must have paid into the system for at least 40 quarters of a year. Is There a Maximum Benefit.

We cant give you your actual benefit amount until you apply for benefits. The maximum benefit the most an individual retiree can get is 3148 a month for someone who files for Social Security in 2021 at full retirement age or FRA the age at which you qualify for 100 percent of the benefit calculated from your earnings history. For example if you are have 20 years of service a high three of 100000 and retire at age 63 your calculation would look like this.

Your multiplier will be 1 unless you retire at age 62 or older with at least 20 years of service at which point your multiplier would be 11 a 10 raise. If you make more than 18960 in 2021 for every 2 over the limit 1 of your Social Security benefit will be withheld. You receive benefits later on when its your turn to retire.

The estimated and actual amounts may differ due to. If you have more than 20 years of substantial covered earnings where you paid Social Security tax the impact of the WEP begins to diminish. Its a big perk that doesnt get a lot of attention.

The maximum possible Social Security benefit for someone who retires at. The average Social Security benefit for a retired worker in 2017 was 1404 with a disabled worker drawing 1197 on average. The maximum possible benefit sits at 2639 right now for people retiring at 62 but you would have to earn the highest taxable earnings for.

The average Social Security benefit was 1543 per month in January 2021. Instead it will estimate your earnings based on information you provide. In the case of early retirement at any age benefits are reduced by five-ninths of one percent per month for the first 36 months and five-twelfths of one percent per month for every additional month beyond the original 36 months explains the SSA.

Social Security is based on contributions that workers make into the system. Today Social Security represents about 33 of all income for older Americans. 100000 x 20 x 11 22000.

The year you reach full retirement age this limit changes to 1 in benefits. The Retirement Estimator gives you a benefit amount based on your actual Social Security earnings record. The maximum Social Security reduction will never be greater than one half of your pension amount.

You will receive a statement. Once Social Security calculates your average full retirement benefit based on your 35 year work history it then reduces the amount it will pay you by applying multipliers at specific income. This is capped at a monthly reduction of 498 maximum WEP reduction for 2021.

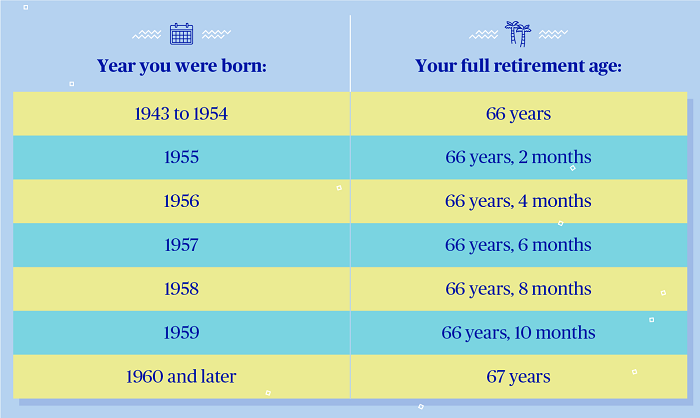

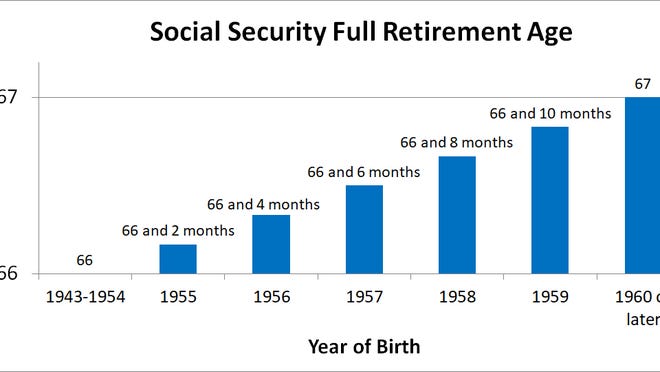

While youre employed you pay into Social Security. Full retirement age or FRA is the point at which you qualify for 100 percent of the benefit Social Security calculates from your lifetime earnings At full retirement age currently 66 and 2 months and gradually rising to 67 over the next several years your SSDI payment converts to a retirement benefit. Social Security Quick Calculator.

Your average earned income over those years is used to calculate the amount you qualify for as a retirement stipend.

When Should You Start Social Security Benefits Do The Math Cbs News

How Does Social Security Work Top Questions Answered Ramseysolutions Com

How Does Social Security Work Top Questions Answered Ramseysolutions Com

:strip_icc()/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png) Social Security Retirement Benefits While Working

Social Security Retirement Benefits While Working

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

Here S Why Raising The Social Security Age Is A Terrible Idea

Here S Why Raising The Social Security Age Is A Terrible Idea

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

How Early Retirement Reduces Projected Social Security Benefits

How Early Retirement Reduces Projected Social Security Benefits

What S The Most Popular Age To Take Social Security

What S The Most Popular Age To Take Social Security

Full Retirement Age For Getting Social Security The Motley Fool

Full Retirement Age For Getting Social Security The Motley Fool

8 Things Everyone Wants To Know About Social Security Becu

8 Things Everyone Wants To Know About Social Security Becu

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

Breaking Down Social Security Retirement Benefits By Age Simplywise

Breaking Down Social Security Retirement Benefits By Age Simplywise

A Quick Guide To Social Security Benefits Equitable

A Quick Guide To Social Security Benefits Equitable

Retirement Social Security Full Benefits Can Be Claimed At This Age

Retirement Social Security Full Benefits Can Be Claimed At This Age

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.