Sometimes a mistake from your payroll department could mean youve ended up paying the wrong amount of tax. The tool is designed for taxpayers that were US.

Effects Of Income Tax Changes On Economic Growth

Effects Of Income Tax Changes On Economic Growth

Any help would be appreciated.

Federal income tax sms. AL AR AZ CA CO CT DC DE FE federal GA HI IA ID IL IN KS KY LA MA MD ME MI MN MO MS MT NC ND NE NJ NM NY OH. House Bill 546. State and local tax or SALT deductions were capped at 10000 by the federal government in 2017.

Win Stoller R-Germantown Hills has Senate Bill 2531 at the statehouse that would change state tax code so businesses can take advantage of a change the IRS approved allowing them to file as an entity rather. Federal Income Tax SMS Benefit Advisors LLC. C She claimed exempt.

If married the spouse must also have been a US. The tax code allows an individual to gift up to 15000 per person in 2019 without triggering any gift or estate taxes. Couples can leave up to 22800000 without owing any federal tax.

Citizens or resident aliens for the entire tax year for which theyre inquiring. Federal Income Tax is a tax levied on every working adult in the USA. 2 The standard deduction increases to 18650 in 2020 if you qualify as head of household and it goes up to 18800 in 2021.

Use this calculator to estimate your income tax liability along with average and marginal tax rates. Calls for a single individual income tax rate of 4 on net income over 12500 while increasing the personal exemption and standard deduction and for eliminating the deduction for excess federal itemized personal deductions and the deduction for federal income taxes. The percentage of the costs that your household members paid toward keeping up a home.

A She does not make enough for this to be deducted. Federal income taxes are. I have SMS next to Fed Income Tax and I know it should be S 0 just how it is next to NY Income Tax I cant find anything regarding SMS and federal taxes on Google.

If youre exempt complete only lines 1 2 3 4 and 7 and sign the form to validate it. Your exemption for 2019 expires February 17 2020. The federal income taxes paid by average folks like you and your friends are Uncle Sams main source of funding.

What appears on my pay stub. The Federal Income Tax Brackets The US. You have no choice whether to pay this or not.

You might see it show up as FED for short Federal Tax in full or perhaps Fed Tax. Standard Tax Filing Status Codes Per State. If youre one of the lucky few to earn enough to fall into the 37 bracket that doesnt mean that the entirety of your taxable income will be subject to a 37 tax.

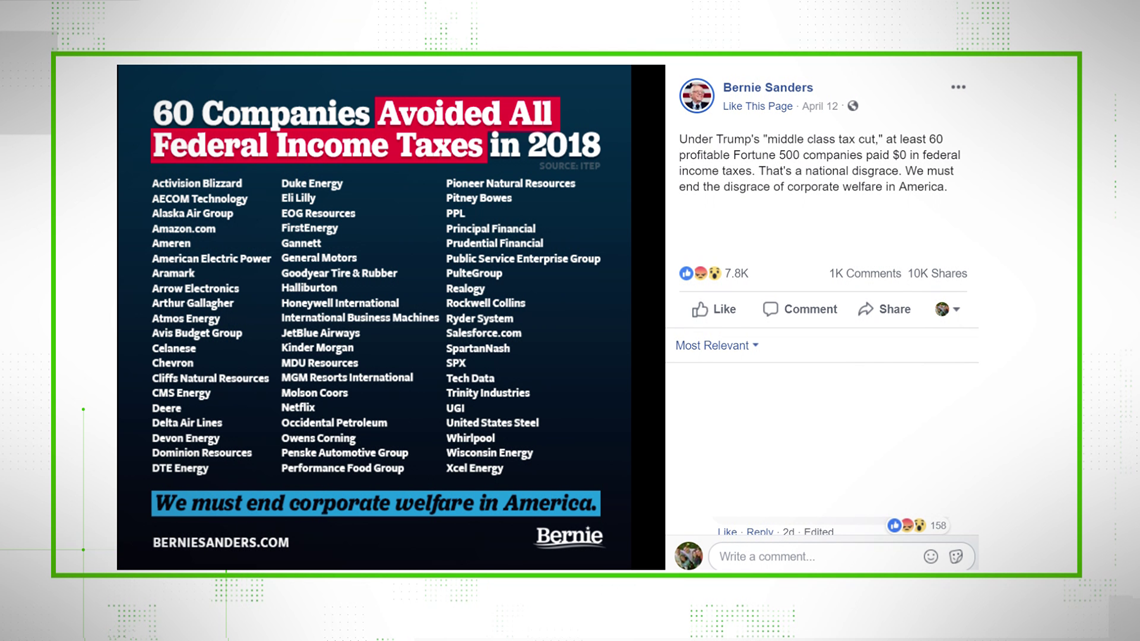

Citizen or resident alien for the entire tax year. You make more than her b She claimed one or more allowances or. Individual income taxes accounted for 17 trillion of the total 33 trillion the federal government collected in revenue during 2018 according to the Congressional Budget Office.

This deduction increases to 12550 for the 2021 tax year. Also keep in mind that some states may have their own estate tax regulations. Your standard deduction for tax year 2020 is 12400 if youre single and you dont qualify for the advantageous head-of-household status.

These payments are managed by the IRS. The federal government is entitled to a portion of your income from every paycheck. Fed Income Tax SMS.

An individual can give away up to 11400000 without owing any federal tax. NY Income Tax S 0. Federal income tax single unmarried person not claiming any allowances.

Federal income tax withheld because you had no tax liability and For 2019 you expect a refund of all federal income tax withheld because you expect to have no tax liability. Federal Income Tax. This is known as your withholding tax a partial payment of your annual income taxes that gets sent directly to the government.

That impacts taxpayers paying high taxes in states like Illinois. So where is all that money going. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37.

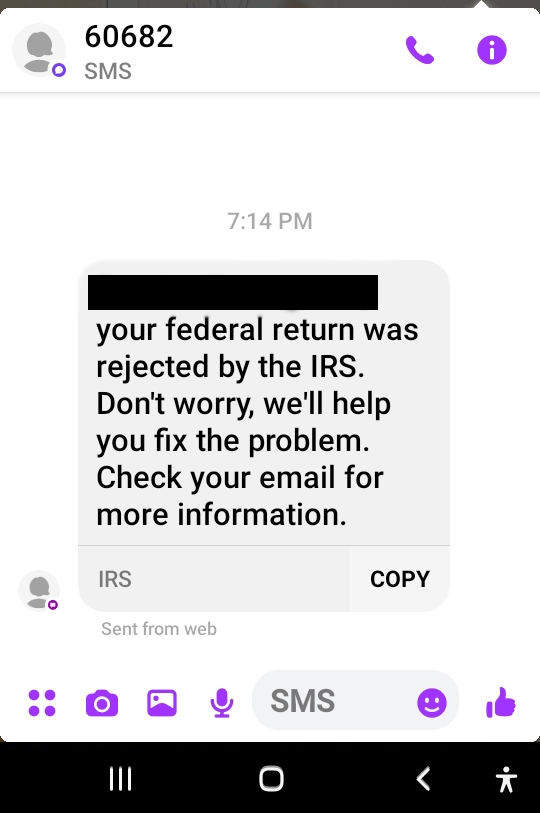

Several taxpayers might consider this to be an authentic SMS sent by the income tax department to claim tax refund. The federal income tax is the tax levied by the Internal Revenue Service IRS on the annual earnings of individuals corporations trusts and other legal entities.

Tax Cartoons Tax Day Income Tax Humor Taxes Humor

Tax Cartoons Tax Day Income Tax Humor Taxes Humor

Latest Irs Text Scam Claims Your Return Has Been Rejected Identity Theft Resource Center

Latest Irs Text Scam Claims Your Return Has Been Rejected Identity Theft Resource Center

How Do I Read My Pay Stub Gusto

How Do I Read My Pay Stub Gusto

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Publication 505 2021 Tax Withholding And Estimated Tax Internal Revenue Service

Publication 505 2021 Tax Withholding And Estimated Tax Internal Revenue Service

Verify Yes These U S Companies Avoided Paying Federal Income Tax Abc10 Com

Verify Yes These U S Companies Avoided Paying Federal Income Tax Abc10 Com

How To Understand Your Paycheck And Meet Your Tax Goals

How To Understand Your Paycheck And Meet Your Tax Goals

When Are Taxes Due 11alive Com

When Are Taxes Due 11alive Com

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

What Does 90 Day Tax Delay Mean For Filers 10tv Com

What Does 90 Day Tax Delay Mean For Filers 10tv Com

Paycheck Taxes Federal State Local Withholding H R Block

Paycheck Taxes Federal State Local Withholding H R Block

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.