You can retire as early as age 62 but if you retire before your full retirement age your benefits will be permanently reduced based on your age. And now youre hearing about this mysterious 16727 Social Security Bonus report.

When Should You Start Social Security Benefits Do The Math Cbs News

Social Securitys Divorced Spouse Benefits is federally funded and administered by the US.

Social security benfits. However if you are younger than full retirement age and make more than the yearly earnings limit we will reduce your benefit. An individual must pay into the. You would receive just 1750 per month if you chose to receive Social Security at age 62.

12 Your spouse. So lets say you filed for Social Security early at age 62 or maybe a little later. This section of our website helps you better understand the program the application process and the online tools and resources available to you.

The portion of benefits that are taxable depends on the taxpayers income and filing status. For starters a person is due no Social Security benefits for the month of their death. Lets say you receive the maximum Social Security benefit for a worker retiring at full retirement age in 2021.

Any benefit thats paid after the month of the persons death needs to be refunded Sherman said. Yes there is a limit to how much you can receive in Social Security benefits. The maximum Social Security benefit changes each year.

Social Security is part of the retirement plan for almost every American worker. If Married Filing Separately and taxpayer lived apart from his or her spouse for the entire tax year enter D to. Social Security benefits provide partial replacement income for qualified retirees and disabled individuals as well as for their spouses children and survivors.

You can get Social Security retirement benefits and work at the same time. These benefits are paid to divorced spouses of workers who are receiving or are eligible to receive Social Security. Social Security Taxable Benefits Worksheet 2020 Before filling out this worksheet.

Multiply that by 12 to get 46740 in maximum annual benefits. Workers who are at least age 62 and who have worked at least 10 combined years at jobs for which they paid Social Security taxes are eligible for Social Security retirement benefits. Your benefit would increase to 3020 or so if you waited until age 70 to claim your Social Security.

Determine any write-in adjustments to be entered on the dotted line next to line 22 Schedule 1 Form 1040. They dont include supplemental security income payments which arent taxable. Social Security Benefits for People with Disabilities Social Security and How It Works Social Security provides you with a source of income when you retire or if you cant work due to a disability.

Social Security Administration SSA. The Social Security administration explains how that works on this page. It provides replacement income for qualified retirees and their families.

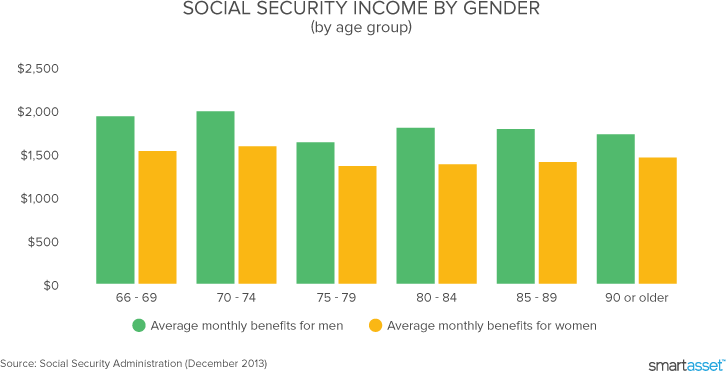

For 2021 its 3895month for those who retire at age 70 up from 3790month in 2020. You may know that your own Social Security benefits are reduced if you claim them before your full retirement age which currently is either 66 or 67 depending on your birth year. Social Security benefits include monthly retirement survivor and disability benefits.

It can also support your legal dependents spouse children or parents with benefits in the event of your death. You must also pay back all the benefits you received. In many cases spouses widows and divorcees are eligible for Social Security retirement benefits based on a spouses or ex-spouses earnings history.

Starting with the month you reach full retirement age we will not. You can do this once. Your Social Security retirement benefit payment is also affected by the age at which you decide to retire.