It aims to provide the investor with an attractive dividend yield over the long-term whilst striking a balance between capital growth and return. The Key Facts of the ExxonMobil Investment Analysis.

How To Build A Dividend Portfolio Intelligent Income By Simply Safe Dividends

How To Build A Dividend Portfolio Intelligent Income By Simply Safe Dividends

Ad Analysts recommendations help to create strategies to drive financial opportunities.

High dividend portfolio. The 2020 market crash gives a rare opportunity for dividend investors to build a high-dividend portfolio. This is an income focused portfolio investing in local high value shares paying higher and sustainable dividends. By remaining focused on simple high quality businesses trading at reasonable prices we can construct a sound dividend portfolio that can deliver safe growing dividend income for years to come.

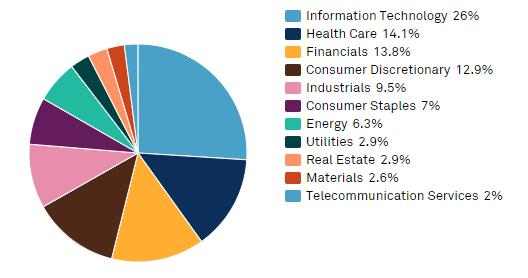

Utilities and financial stocks are generally good bets for investors looking for high dividend yields he says. Understanding the key risk factors influencing a portfolios returns and volatility can help us avoid taking unnecessary risk. If the latter happens the 50000-income stream would grow to.

For example you could assemble a portfolio of high dividend stocks but then also hold 10 of your portfolio in the PowerShares QQQ ETF to provide much-needed tech exposure to your overall. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio. That 6040 portfolio would have a weighted dividendinterest yield of about 21 today.

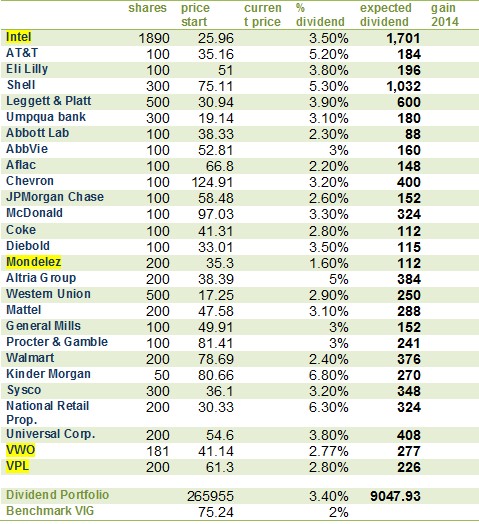

Building a dividend portfolio is part art part science. 178 rows The dividend portfolio spreadsheet auto calculates the stock price dividend. 3M NYSEMMM one of the most stable dividend payers in the country and a great addition to any portfolio that is focused on dividend growth.

If you invest in an ETF Portfolio with low cost fees and very little maintenance needed you can actually build your financial freedom path. Ad Transparent independent and extensively researched investment analyses. The Key Facts of the ExxonMobil Investment Analysis.

If you need a regural income from your investments you should look for stocksbonds that give you periodic dividendsdistributions. A second option is to balance a portfolio with some ETFs. COVID-19 has put pressure on certain dividend stocks.

Explore the latest Invest money jobs on Receptix for freshers and experienced candidates. If you were to plan a 4 withdrawal rate youd be forced to generate an additional 19 percentage points roughly half. Choose your Lazy Portfolio and implement it.

Opinions expressed by Forbes Contributors are their own. This 5-Fund Portfolio Pays A Monthly 89 Dividend. Equity portfolios come with risks involving non-guaranteed dividends and economic risks.

This portfolio is generally return from their discretionary investment. Yahoo Finance ERNs calculations as of 272019. I write on high yield assets that deliver a.

Our goal is to get a safe high-dividend. Investors should not ignore consumer staples companies such as Coca-Cola ticker. 79 rows High Dividend ETF Portfolios.

A higher payout ratio indicates that the company has moved past the initial growth phase. Ad Transparent independent and extensively researched investment analyses. In normal markets itd be dangerous to seek an average yield of 6.

Consequently investors can build a high-dividend portfolio with much lower risk. Investing 10000 in these funds a decade ago would result in a portfolio worth 44000 today. But thats not the.

Constructing an optimal portfolio largely depends on an individuals goals risk tolerance and available capital. Add another 10000 per year and youve got over 228000 over a decade.