The highest-scoring state is Minnesota with an average score of 713 followed by South Dakota Vermont New Hampshire and Massachusetts respectively. The Schumer Box accompanying each credit card offer must disclose the APR or APR range for the card.

Best Starter Credit Cards For No Credit Of April 2021 Nerdwallet

Best Starter Credit Cards For No Credit Of April 2021 Nerdwallet

Your credit profile is the tool lenders use to judge your creditworthiness or how likely you are to repay any money you borrow.

Credit cards for below average credit. Best for Cash Back. Low limit credit cards. Choose between 200 and 1000.

Why this is the best credit card for fairaverage credit with building credit The Capital One Platinum Credit Card gives you the opportunity to get a credit limit increase after as little as 6 months something not often seen with credit-builder cards. Petal 2 Cash Back No Fees Visa Credit Card. Best for rebuilding credit.

The Ultimate Guide to Credit Cards. It typically means your credit scores. QuicksilverOne from Capital One.

Credit One Bank Platinum Visa for Rebuilding Credit. Low credit scores indicate a limited credit history or a bad credit. This reduces the risk to the lender and you may be more.

Best for cash back. Find the best Credit Cards for Bad Credit right now curated by our editors and financial experts. Best Secured Cards for People with a 500 Credit Score.

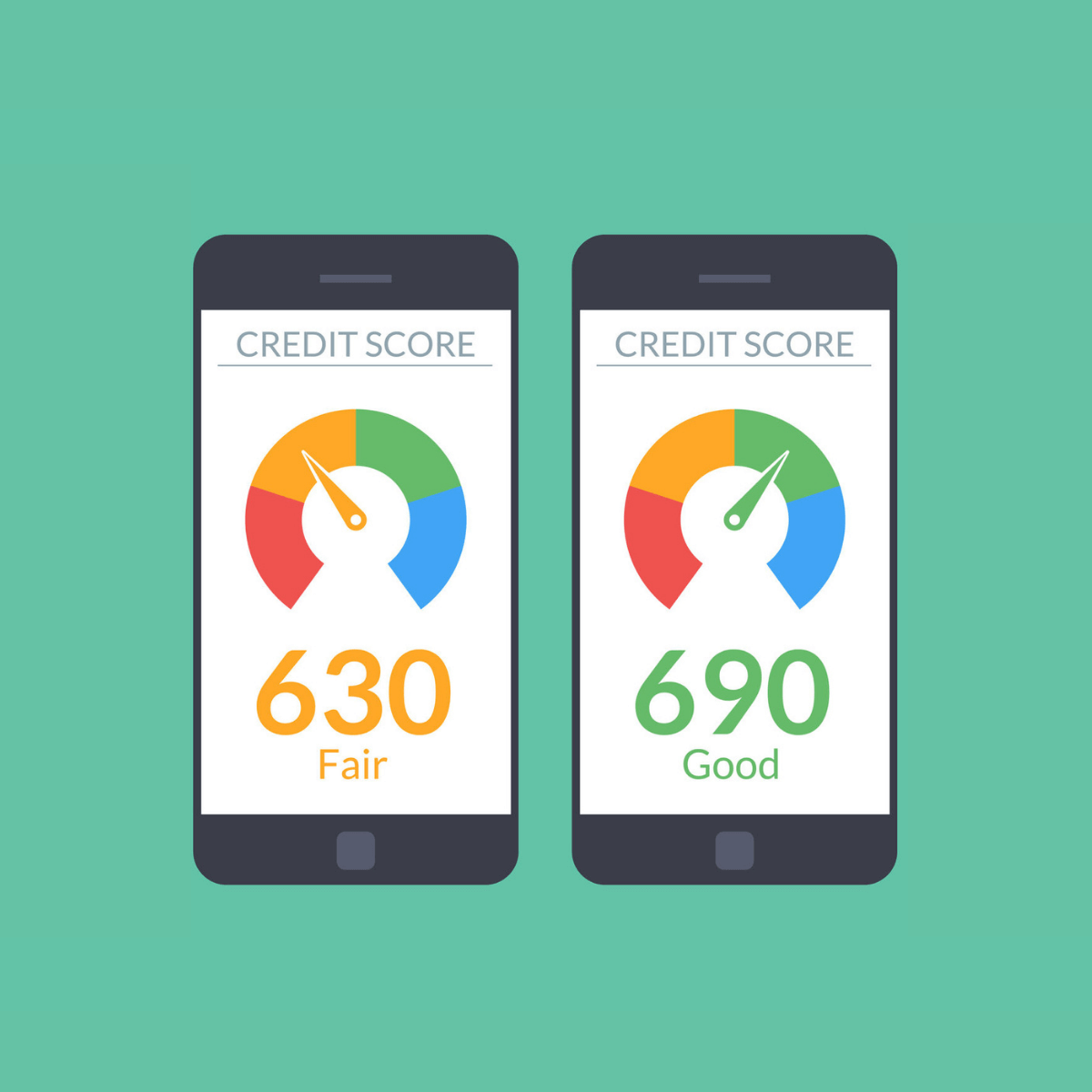

It provides a great opportunity to build your credit even as you earn cash back rewards at a decent rate all for no annual fee. Fair credit sometimes called average credit is a step up from bad credit but a notch below good credit. Your credit line will be equal to the amount you deposit.

Best for No Fees. Best for credit line increases. But if youre skirting that average or are several points below it with a fair credit score finding a good business credit card can be a little tougher.

The card was mainly designed for people who are looking to rebuild their credit so people with fair credit have a good chance to qualify for it. Here are our picks for the best credit cards for fair credit. And a great APR for a credit card is 0.

Here are CNBC Selects picks for the top credit cards for people with fair or average credit. Wed say any APR below that average is good. After the first year you can request to increase the credit limit up to a maximum of 5000 subject to credit approval and additional collateral deposits.

Upon credit approval the collateral deposit you provide becomes the credit limit on your Visa card. Louisiana Nevada Georgia and Texas round out. Compare and apply online.

A good APR for a credit card is 14 and below. Here are some of our favorites that. Thats roughly the average APR among credit card offers for people with excellent credit.

According to WalletHub the average APR on all new credit card offers in early 2021 was 1787. Discover it Student Cash Back. Feb 8 2021.

The lowest-scoring state is Mississippi with an average score of 652. If your credit score is between 600 and 700 here are six cards worthy of your attention as you make your way along the credit building journey. The Discover it Secured requires a security deposit of 200 to 2500.

The right 0 credit card could help you avoid interest entirely on. See the 2021s 20 Best Cards for Fair Credit - Get 0 APRs cash back and fast approval with fair or below average credit. When there is a range only the better credit scores will be given the lower APRs.

Its even better than some basic reward cards made for average or good credit scores. One of the best rewards credit cards for people with below-average credit especially those who want high approval odds and some protections against overspending is the Discover it Secured Credit Card. If your credit score is weak and youre working to improve it consider a card with a low minimum credit limit.

Weve broken down the best credit cards for people with average credit scores across a wide range of possible scenarios from students to cash back.