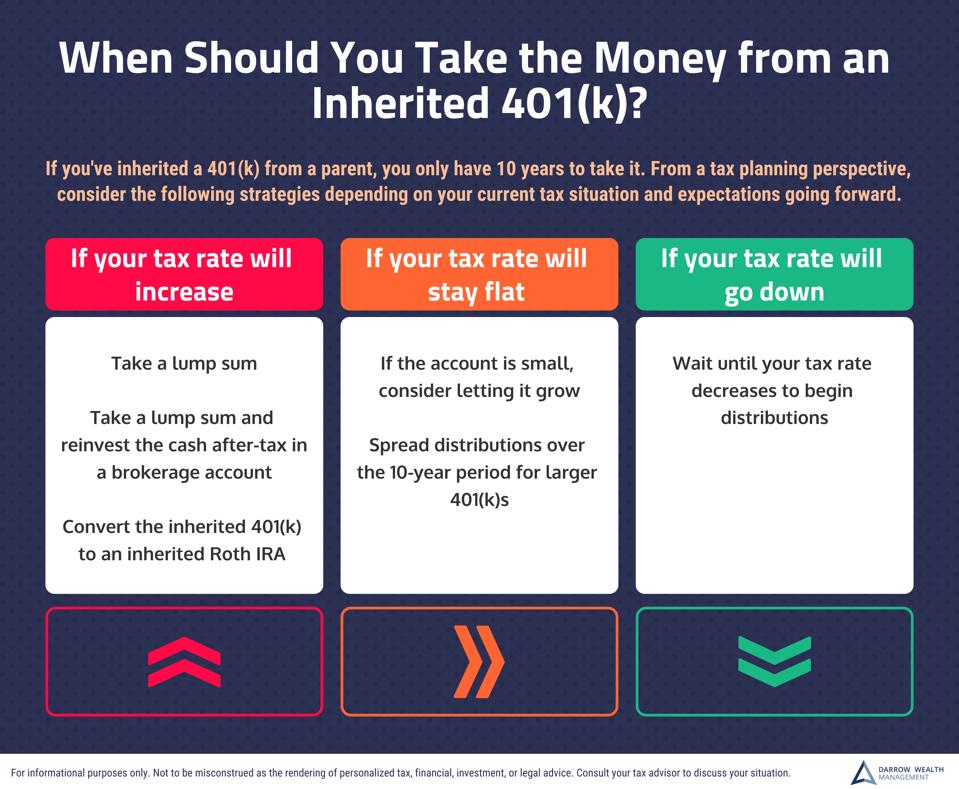

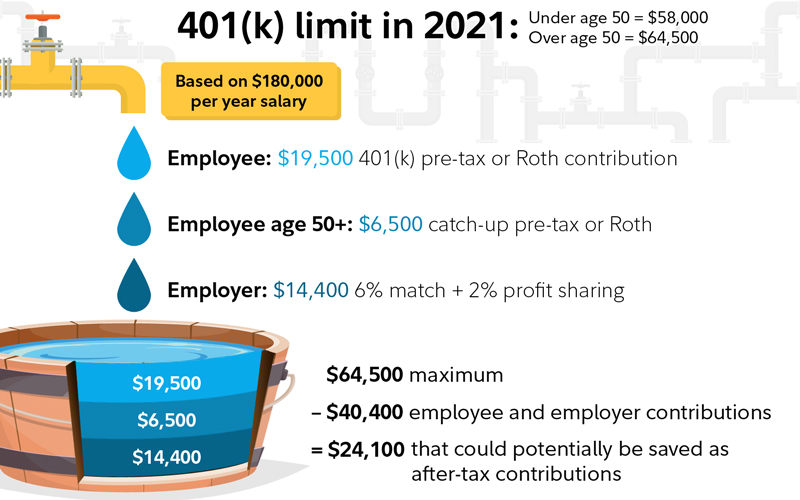

Most often distributions from an inherited 401 k are included in a beneficiarys regular taxable income. Employers can receive tax benefits for contributing to 401k plans too the tax code wants to encourage saving for retirement so employers are offered tax incentives to contribute in order to trigger a 401k tax deduction as well as to offset the cost of setting up retirement plans.

401 K Vs Roth 401 K How Do You Decide Ellevest

401 K Vs Roth 401 K How Do You Decide Ellevest

Credits for Setting Up Retirement Plans.

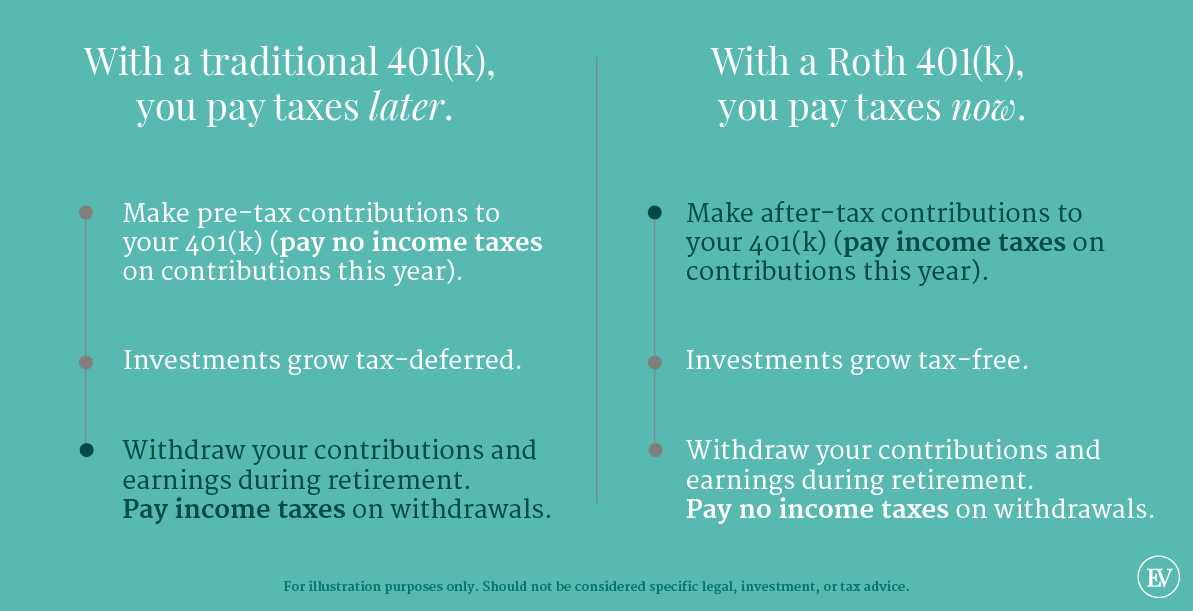

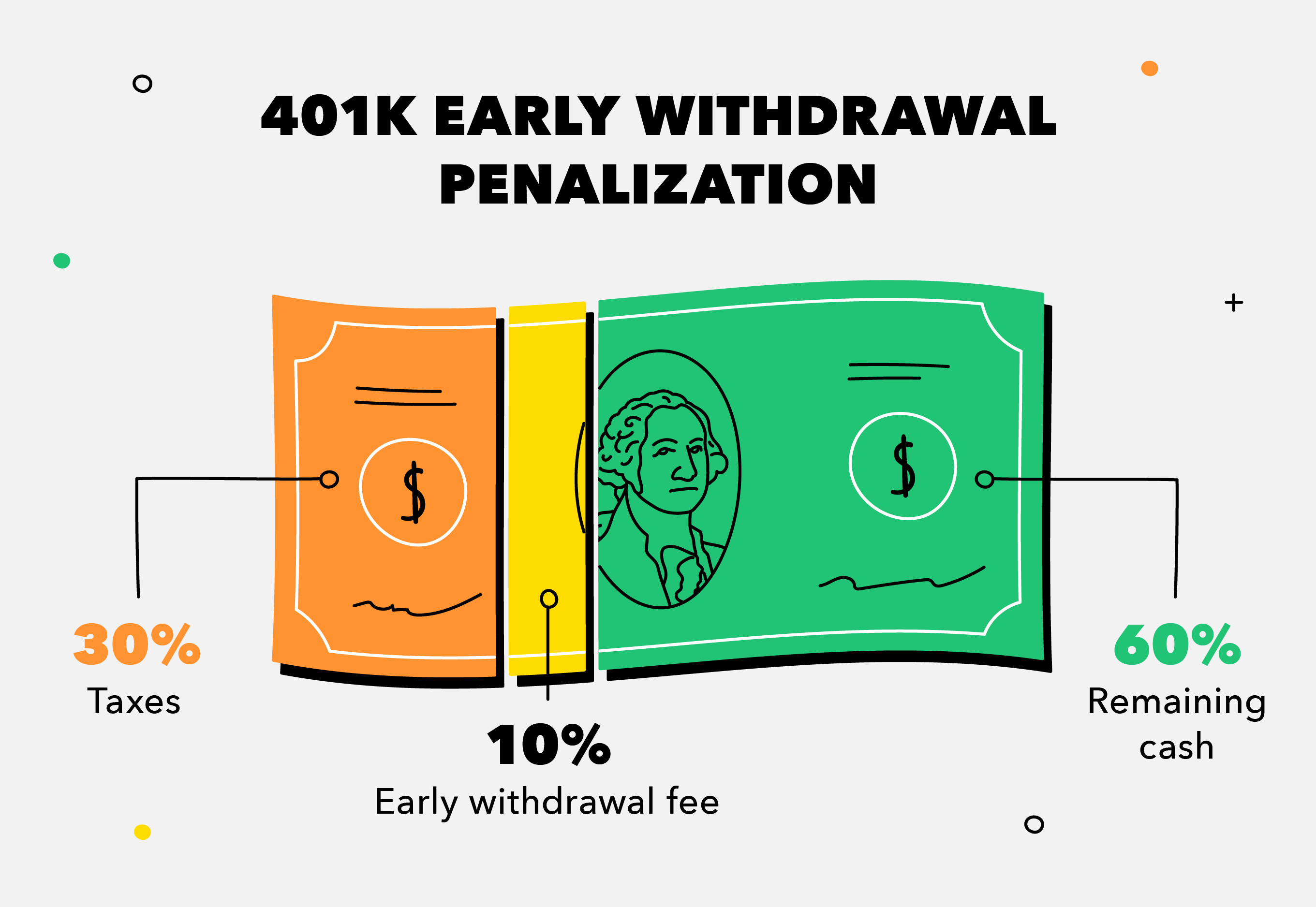

Do you pay taxes on 401k. Taxpayers need to separate contributions from earnings. In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years ago. Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

When you eventually make withdrawals from a traditional defined contribution plan youll have to pay regular income taxes on the money you withdraw - whether the. You still have to pay Medicare and Social Security taxes on your payroll contributions to a 401 k. When do I pay tax on a 401 k.

Get Results from 6 Engines. If you are wondering whether your 401k withdrawals are taxed the short answer is yes your 401k distributions are likely taxable. Ad Tax Appeal Tax Audit Garnishment Past due Taxes any tax problems.

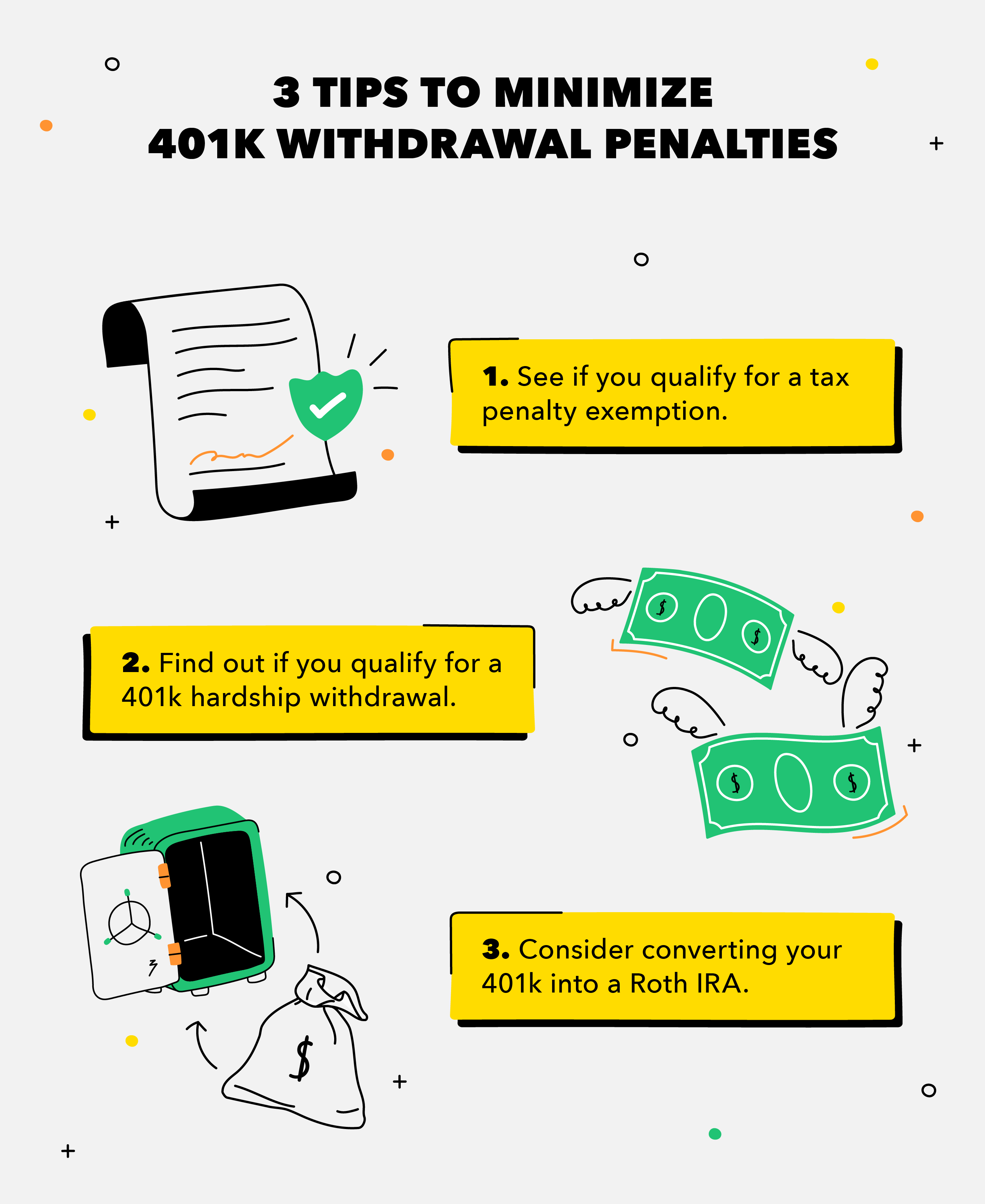

A 401 k loan will not affect the borrowers credit and does not require a credit check. Ad Search For Relevant Info Results. 401k contributions are made pre-tax.

This may come as a surprise because there is some confusion around how retirement accounts work. Do you Pay Tax on 401k Contributions. The Roth 401 k.

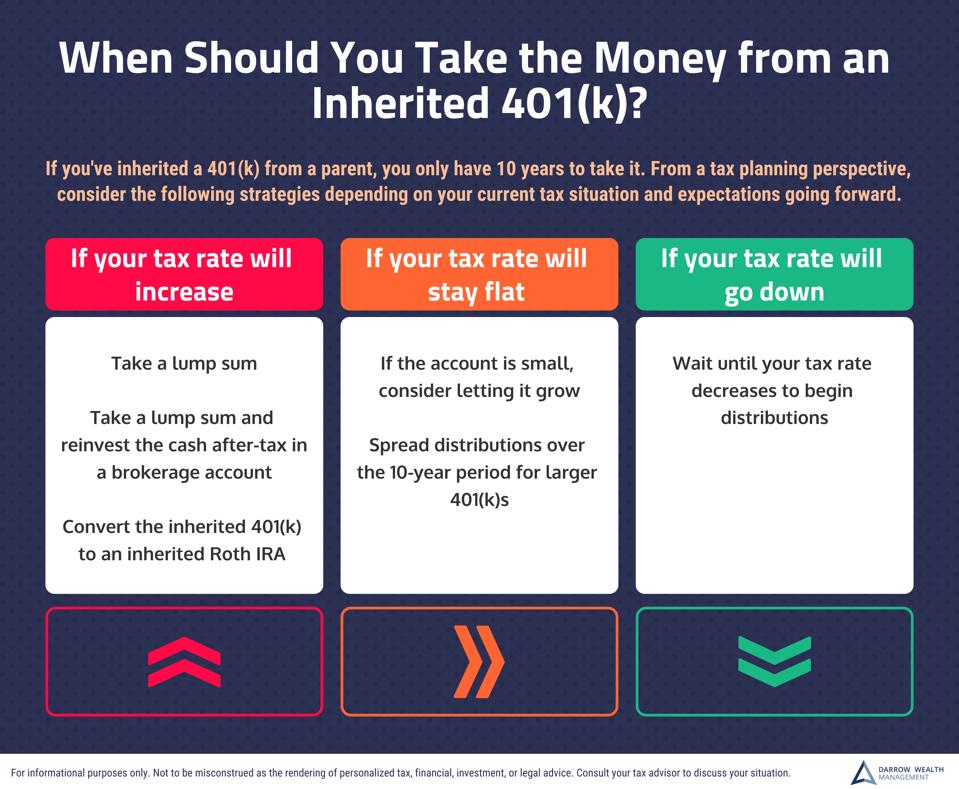

Although beneficiaries typically pay income taxes on 401k proceeds the funds are not actually taxed until the money is withdrawn from the plan. The standard 401 k provides a current tax break which means the actual savings cost less. However if a person takes distributions from their 401k then by law that income has to be reported on their tax return in order to ensure that the correct amount of taxes will be paid.

If you default on the loan you will pay income taxes on the money withdrawn and may also be subject to an. Get Results from 6 Engines. This would be the case if your parent made pre-tax contributions to a 401 k as most do.

As such they are not included in your taxable income. The whole point of putting your money into the 401 k was for your retirement years and that is why the IRS has the additional 10 tax on early distributions. Ad Search For Relevant Info Results.

Ad Tax Appeal Tax Audit Garnishment Past due Taxes any tax problems. The annual contribution limit is per person and it applies to all of your 401 k account. Instead your employer withholds your contribution from your paycheck before the money can be subjected to income tax.

Thanks for the great question and. That means you do not pay income taxes when you contribute money. A 401k is a tax-deferred account.

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png) Estimating Taxes In Retirement

Estimating Taxes In Retirement

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png) How Do 401 K Tax Deductions Work

How Do 401 K Tax Deductions Work

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

After Tax 401 K Contributions Retirement Benefits Fidelity

After Tax 401 K Contributions Retirement Benefits Fidelity

/Facts-about-401k-loans-9b8c3bd3d0314c338c0a50bc3c75728c.gif) What You Need To Know About 401 K Loans Before You Take One

What You Need To Know About 401 K Loans Before You Take One

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) How To Take Money Out Of A 401 K Plan

How To Take Money Out Of A 401 K Plan

If You Inherited A 401 K From A Parent Here S When You Need To Take The Money And When You Should

If You Inherited A 401 K From A Parent Here S When You Need To Take The Money And When You Should

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg) 4 Reasons To Borrow From Your 401 K

4 Reasons To Borrow From Your 401 K

/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg) 4 Reasons To Borrow From Your 401 K

4 Reasons To Borrow From Your 401 K

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.