Sell the house and pay off the mortgage balance. If you have a reverse mortgage when you die the loan has to be paid back.

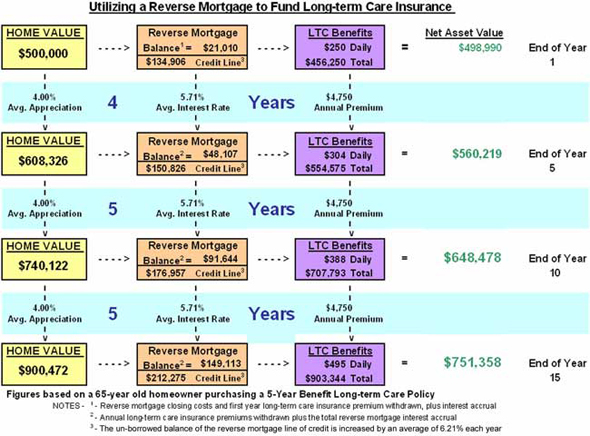

Reverse mortgages are credit advances that allow the elderly to borrow against their home equity during their retirement years.

How does a reverse mortgage work when you die. The lender does not automatically take over ownership of the home when the borrower dies although the person who inherits the home must pay off the reverse mortgage loan. However what happens to the reverse mortgage will depend on a number of factors including whether. The lender pays you money based on how much equity you have in the home.

Interest accumulates on the. How does a reverse mortgage work when you die. You have a co-borrower on the reverse mortgage loan When the reverse mortgage loan was taken out and.

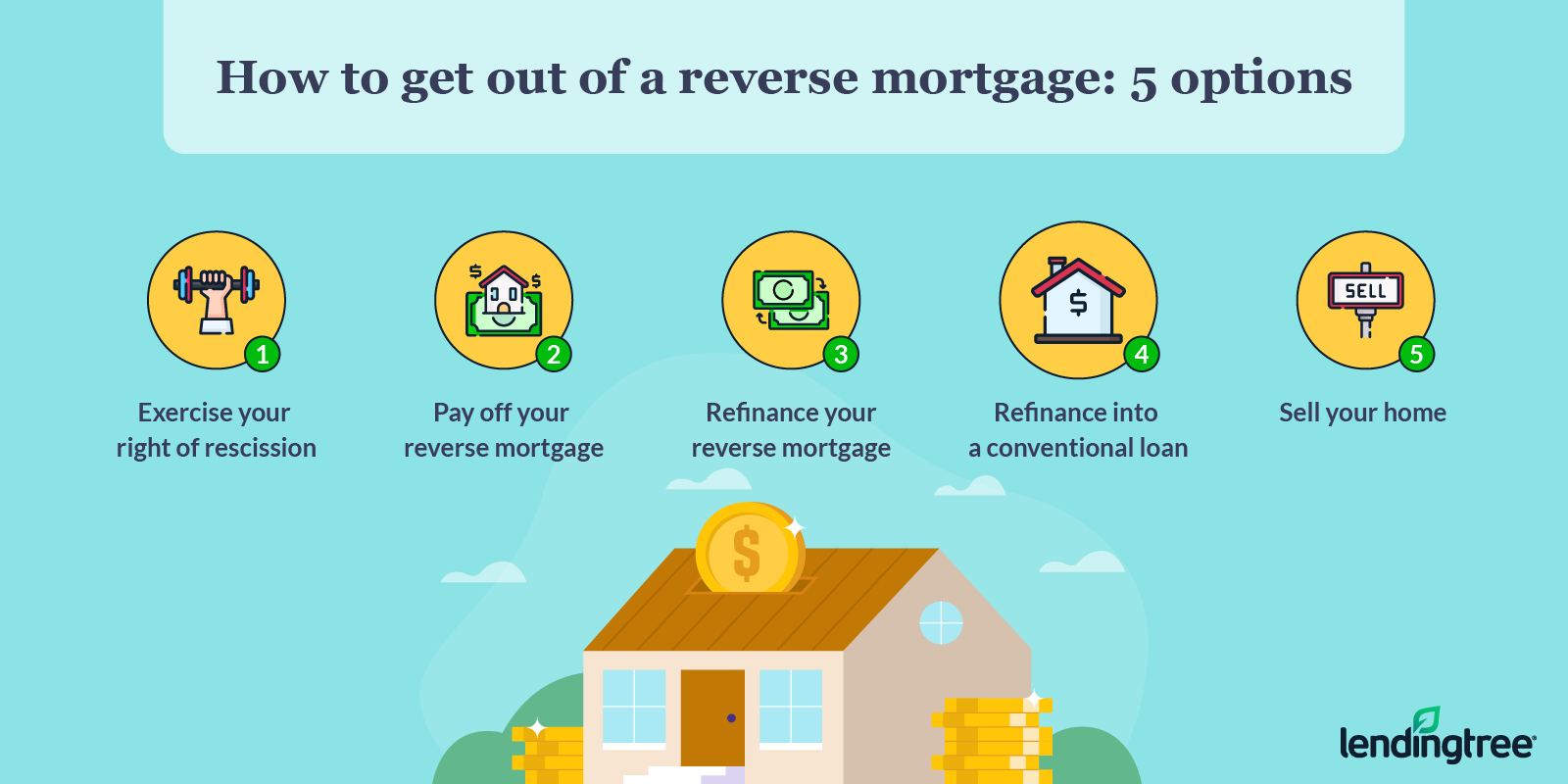

These are the options for paying off a reverse mortgage before or after the borrowers death. In a situation where a reverse mortgage has been taken out the mortgagee has to service the loan according to the set agreement. There is no prepayment penalty and you are welcome to repay any portion of your loan balance back voluntarily.

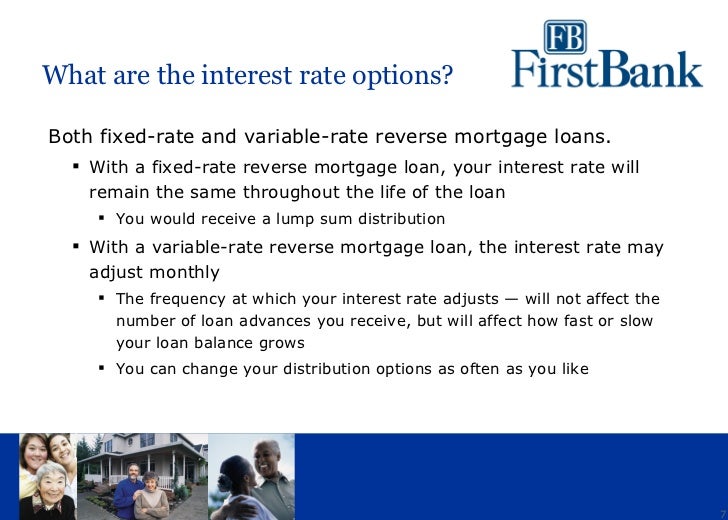

Reverse mortgages allow homeowners aged 62 and older to convert a portion of their home equity into tax-free loan proceeds which they can elect to receive either in a single lump-sum payment in monthly installments or through a line of credit that allows funds to be withdrawn as needed. A reverse mortgage has to be paid off when the borrowers move out or die. However a reverse mortgage is sometimes repaid upon.

Usually borrowers or their heirs pay off the loan by selling the house securing the reverse mortgage. At that time the borrowers or. Remember under the reverse mortgage heirs can choose to repay the loan at the amount owed or 95 of the current value whichever is less.

This doesnt give you the heir much time to refinance or sell the home so its important to stay in close contact with the loan servicer as times vary. Even when you die and your heirs inherit the home with the reverse mortgage on it it is still possible for them to retain the ownership of the home. However generally speaking reverse mortgages must be repaid when the borrower dies moves or sells their home.

You can receive reverse. Estate assets can repay a reverse mortgage. For example anytime a homeowner dies with a reverse mortgage in place the lender must formally notify the heirs that the loan is due.

Reverse mortgage loans typically must be repaid when you die. Beneficiaries are given 30 days to figure out their next steps. When youve established a reverse mortgage you receive funds tax-free either as a lump sum or as regular monthly deposits.

When heirs sell the property to pay off the loan any remaining equity in the home is theirs once the loan is satisfied. When a homeowner passes away the responsibility of the house will pass to whoever is indicated in a will. Unlike traditional mortgages borrowers dont have to make a monthly payment on their reverse mortgage.

Though the lending institution will not take ownership of the home most are the times when repayment has to be done by selling the property and then transferring the total proceeds or just a part to the bank. How does a reverse mortgage work if you die. If someone passes away without a will the property will be bequeathed to direct descendants or close family members.

While no payments are made by a homeowner with a reverse mortgage the mortgage is due upon death. Guttman team of mortgage professional are here to help you every step of. So heres the question.

If the heirs want to. Its important to understand that a reverse mortgage is simply a loan against the home. They can continue to own the home simply by.

A reverse mortgage becomes repayable once the last borrower or owner passes away. With a reverse mortgage you remain the owner of the home. Once youve decided to sell or pay off the loan youll have an.

Partially or in full. Since its already your home there is no buying it back. How Reverse Mortgages Work.

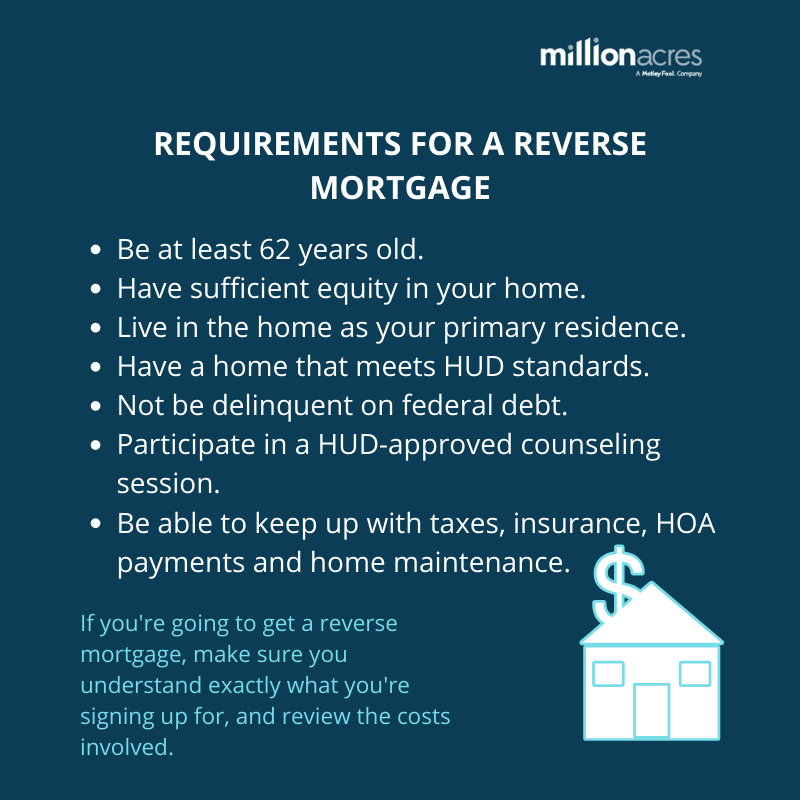

A reverse mortgage is for homeowners age 62 or older who want to tap into their home equity.

Reverse Mortgage After Death What Heirs Need To Know Lendingtree

Reverse Mortgage After Death What Heirs Need To Know Lendingtree

Reverse Mortgage After Death What Heirs Family Must Know

Reverse Mortgage After Death What Heirs Family Must Know

What Is A Reverse Mortgage Explaining What A Hecm Is

What Is A Reverse Mortgage Explaining What A Hecm Is

What Is A Reverse Mortgage How Do They Work Millionacres

What Is A Reverse Mortgage How Do They Work Millionacres

What Heirs Need To Know About Reverse Mortgages Kiplinger

What Heirs Need To Know About Reverse Mortgages Kiplinger

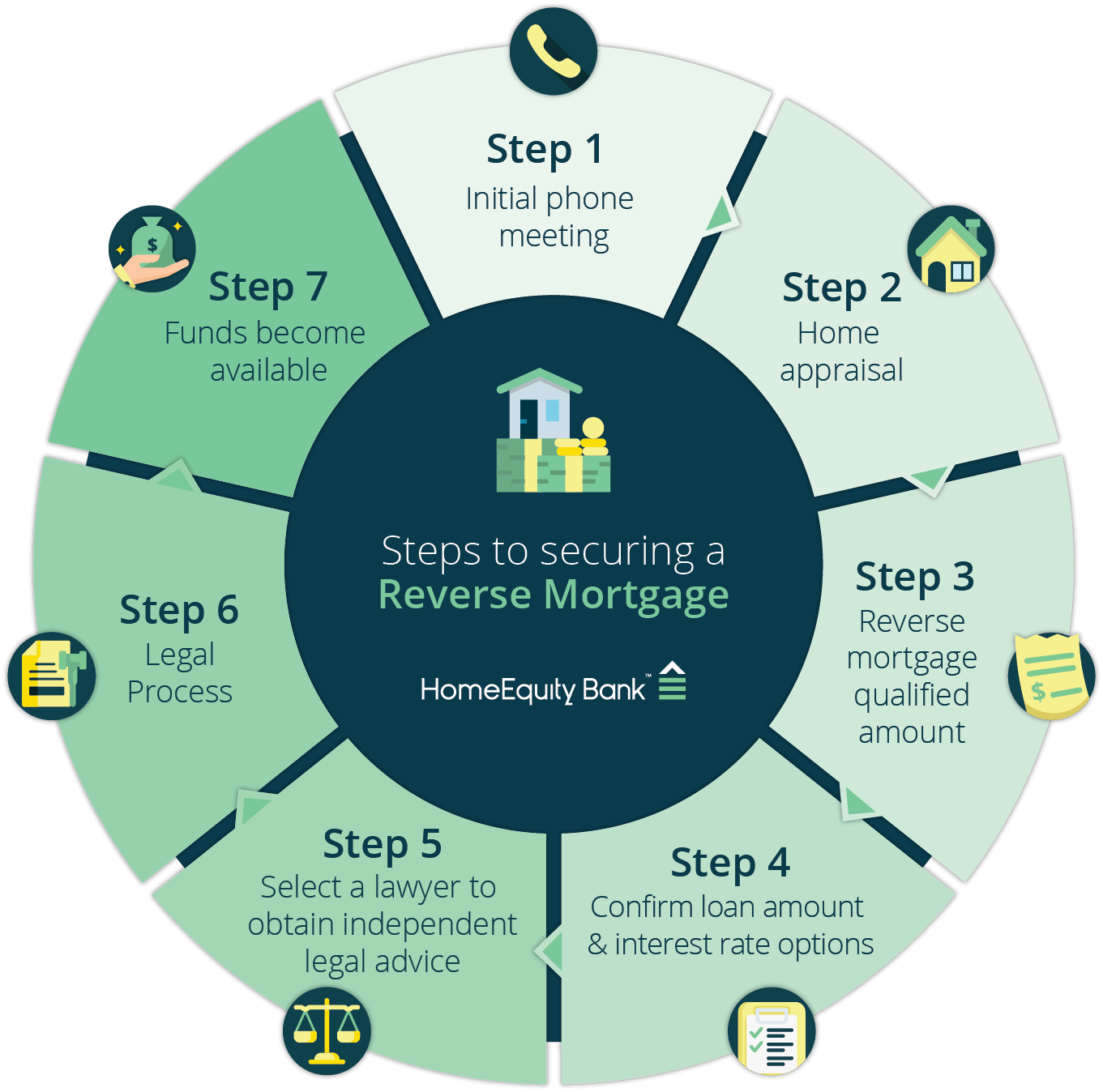

Reverse Mortgage Problems Myths And Truths Homeequity Bank

Reverse Mortgage Problems Myths And Truths Homeequity Bank

What To Do With A Reverse Mortgage When The Owner Dies

What To Do With A Reverse Mortgage When The Owner Dies

How A Reverse Mortgage Really Works Know The Facts Arlo

How A Reverse Mortgage Really Works Know The Facts Arlo

How Does A Reverse Mortgage Work When You Die Insurance Noon

How Does A Reverse Mortgage Work When You Die Insurance Noon

How Does A Reverse Mortgage Work When You Die

How Does A Reverse Mortgage Work When You Die

What To Do With A Reverse Mortgage When The Owner Dies

What To Do With A Reverse Mortgage When The Owner Dies

How Does A Reverse Mortgage Work When You Die Kevin A Guttman

How Does A Reverse Mortgage Work When You Die Kevin A Guttman

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.