Be sure to talk to a tax advisor about what your tax liability may be if you are doing Instacart as a side hustle. Because taxes are not withheld from their pay most independent contractors are responsible for making quarterly tax payments based on their estimated annual income.

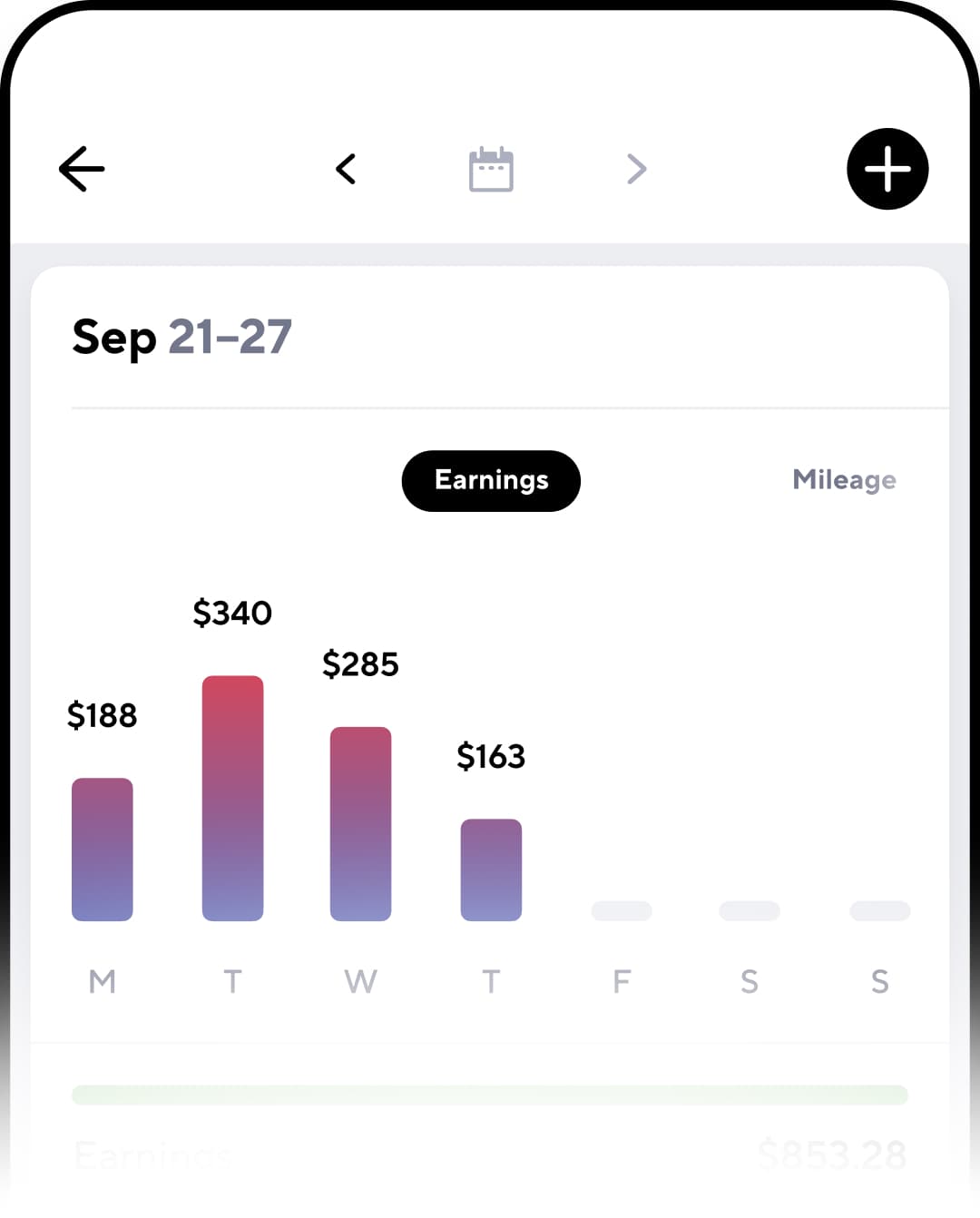

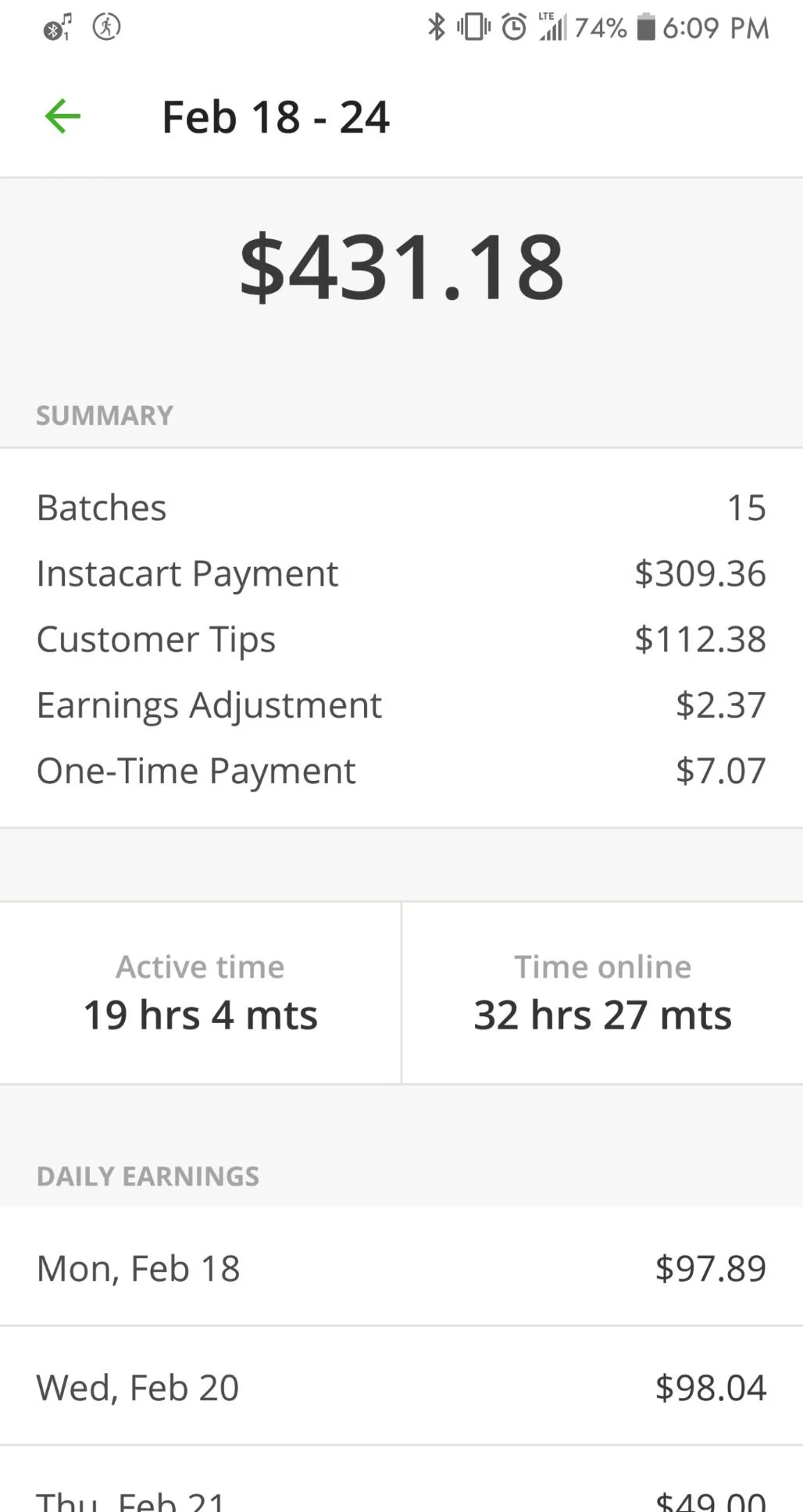

Instacart Shopper Review 10k As A Part Time Instacart Driver

Instacart Shopper Review 10k As A Part Time Instacart Driver

By January 31st Instacart sends all their contractors 1099- forms and files a copy to the IRS too complying with the US tax law.

Instacart shopper taxes. Instacart doesnt withhold tax from full-service shoppers gross pay. Terms and conditions may vary and are subject to change without notice. The Standard IRS Mileage Deduction.

But file and see because in your situation it may be different. That means youd only pay income tax on 80 of your profits. As an Instacart customer you are an independent temporary worker.

Everybody who makes income in the US. This implies you need to cover all your own costs and pay your own taxes. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits.

I joined instacart in February 2018 and this is my first full year with instacart which means its time to do my taxes. Its also where you claim any tax deductions like the Standard Mileage Rate health insurance premiums business supplies etc. Also although theyre reimbursed for miles driven full-service drivers must pay vehicle expenses such as fuel and maintenance out of pocket as they incur them.

You dont get the QBI deduction on the 153 in self-employment taxes. If I am employed by Instacart or Shipt or any other personal shoppingdelivery service what or who do I claim as the business owner. Tax Tips for Independent Contractors - YouTube.

Do Instacart shoppers pay taxes. Just be aware that Instacart does not take out money for your taxes and you may have to owe money as well. You can deduct a fixed rate of 56 cents per mile in 2020.

Thats because Instacart doesnt withhold taxes from earnings like. Your earnings exceed 600 in a year. For 2020 the rate was 575 cents per mile.

Like any other service or product taxes are included in the order total on your delivery receipt thats emailed to you upon the completion of your order. According to Instacart if you dont meet this requirement you wont receive a 1099-NEC. When filing as a personal shopper for a company like Instacart do I declare myself as the business owner.

You use the Schedule C to determine your profit or loss. Along these lines the time-based compensation you procure from Instacart wont be the final sum you clear after taxes. Instacart shoppers pay taxes like all self-employed independent contractors.

If they make over 600 Instacart is required to send their gross income to the IRS. This means that total earnings potential depends on the individual. Fortunately you can still file your taxes without it and regardless of whether or not you receive a 1099-NEC you must still file taxes with the IRS.

This form documents your taxable income from last year made through Instacart platform usually if you are a part-time driver. Filing your taxes as an Instacart shopper. Under business income and expenses its asking for a business profile.

Starting from 2021 the previously used 1099-misc forms are getting replaced with 1099-NEC for non-employee compensation. Instacart 1099 tax forms. Since full-service shoppers are considered independent contractors they may have to make estimated quarterly tax payments.

Has to pay taxes. In-store shoppers are scheduled for shifts based on personal availability up to 29 hours each week. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical.

I would suggest setting aside around 10 of what you make away for taxes if that is the case. In Canada we usually get a tax form called a t4 from the employer which can be used to file the taxes. First you will input the amount youve earned as reported in Box 7 on your Instacart 1099 on the Schedule C.

They will owe both income and self-employment taxes. Filing taxes in canada. As independent contractors full-service shoppers have the flexibility to work as little or as often as they want.

Most people know to file and pay their taxes by April 15th. If youre an Instacart shopper you are self-employed that means you likely owe quarterly taxes. For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year.

In-store shopperIn-store shoppers are Instacart employees who earn an hourly wage detailed in the initial offer letter. Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. This rate covers all the costs of operating your vehicle like gas depreciation oil changes and repairs.

Understanding Your Instacart 1099

Understanding Your Instacart 1099

Download Instacart Shopper Earn Money To Grocery Shop 4 231 2 P Apk Downloadapk Net

Download Instacart Shopper Earn Money To Grocery Shop 4 231 2 P Apk Downloadapk Net

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

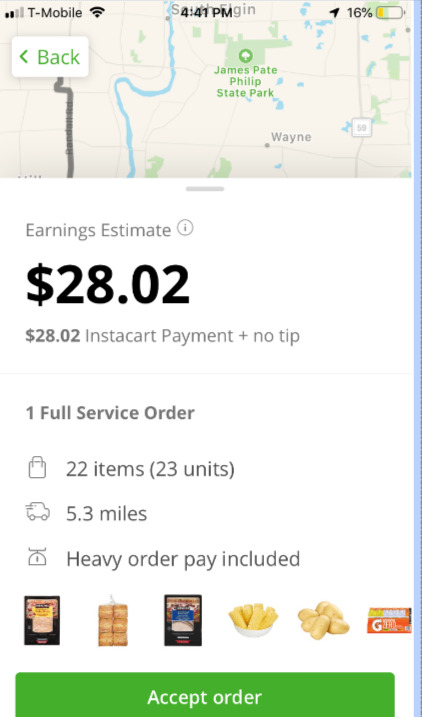

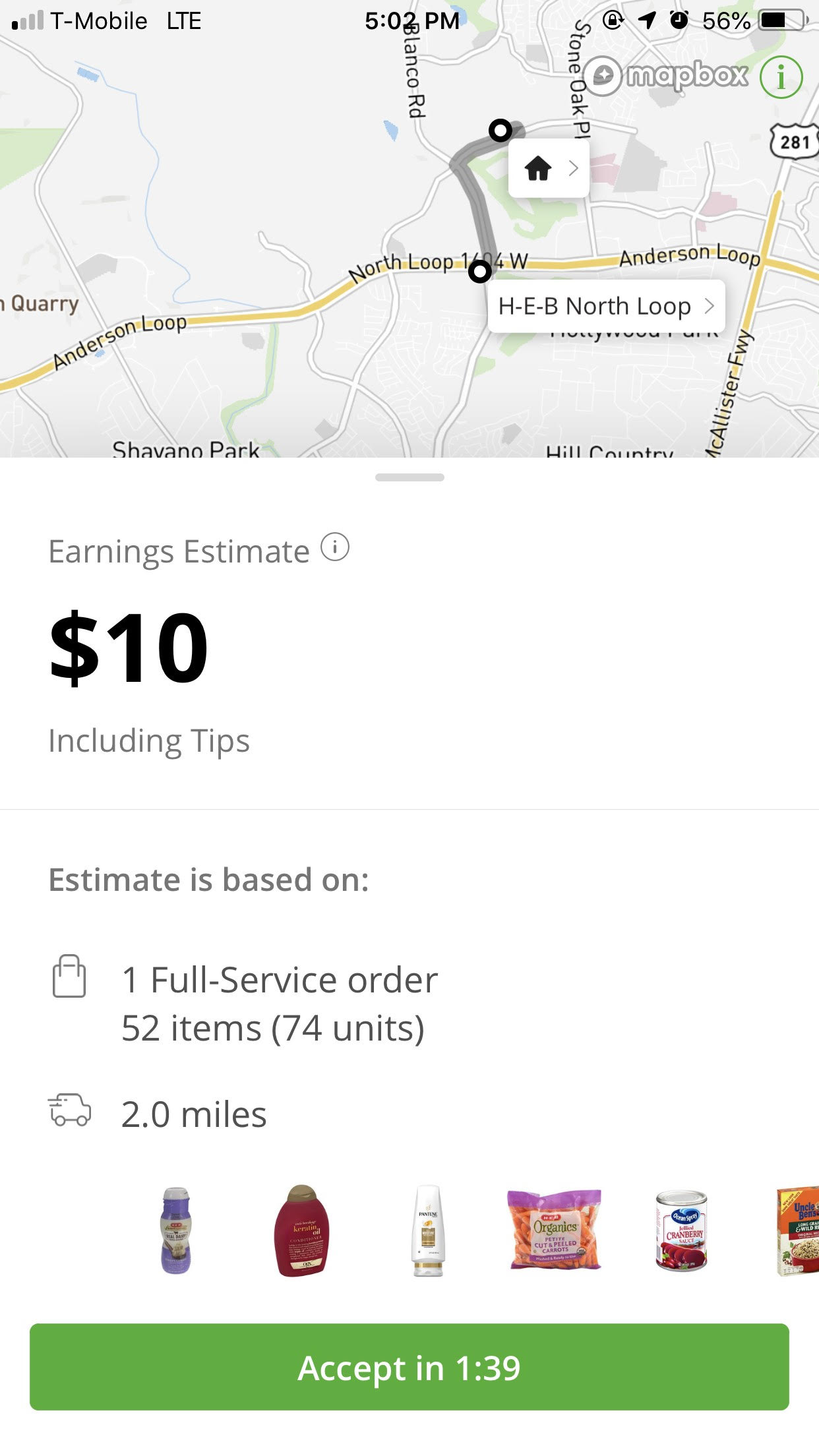

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms

Instacart Pay How Much Does Instacart Pay Shoppers In 2021 Revealed

Instacart Pay How Much Does Instacart Pay Shoppers In 2021 Revealed

Get Help On Taxes With Turbotax We Are Announcing A New Partnership By Instacart The Instacart Checkout Mar 2021 Medium

Get Help On Taxes With Turbotax We Are Announcing A New Partnership By Instacart The Instacart Checkout Mar 2021 Medium

Gridwise Instacart Mileage Tracking For Instacart Shoppers

Gridwise Instacart Mileage Tracking For Instacart Shoppers

Instacart Shopper Review 10k As A Part Time Instacart Driver

Instacart Shopper Review 10k As A Part Time Instacart Driver

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Pay How Much Does Instacart Pay Shoppers In 2021 Revealed

Instacart Pay How Much Does Instacart Pay Shoppers In 2021 Revealed

Instacart Changes How It Pays Shoppers But Many Say They Re Now Making Less Ars Technica

Instacart Changes How It Pays Shoppers But Many Say They Re Now Making Less Ars Technica

What You Need To Know About Instacart 1099 Taxes

What You Need To Know About Instacart 1099 Taxes

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.