The responsibility for providing the Risk-Based Pricing Notice in auto lending depends on the lending. B A credit card issuer engages in risk-based pricing and the annual percentage rates it offers to consumers are based in whole or in part on a credit.

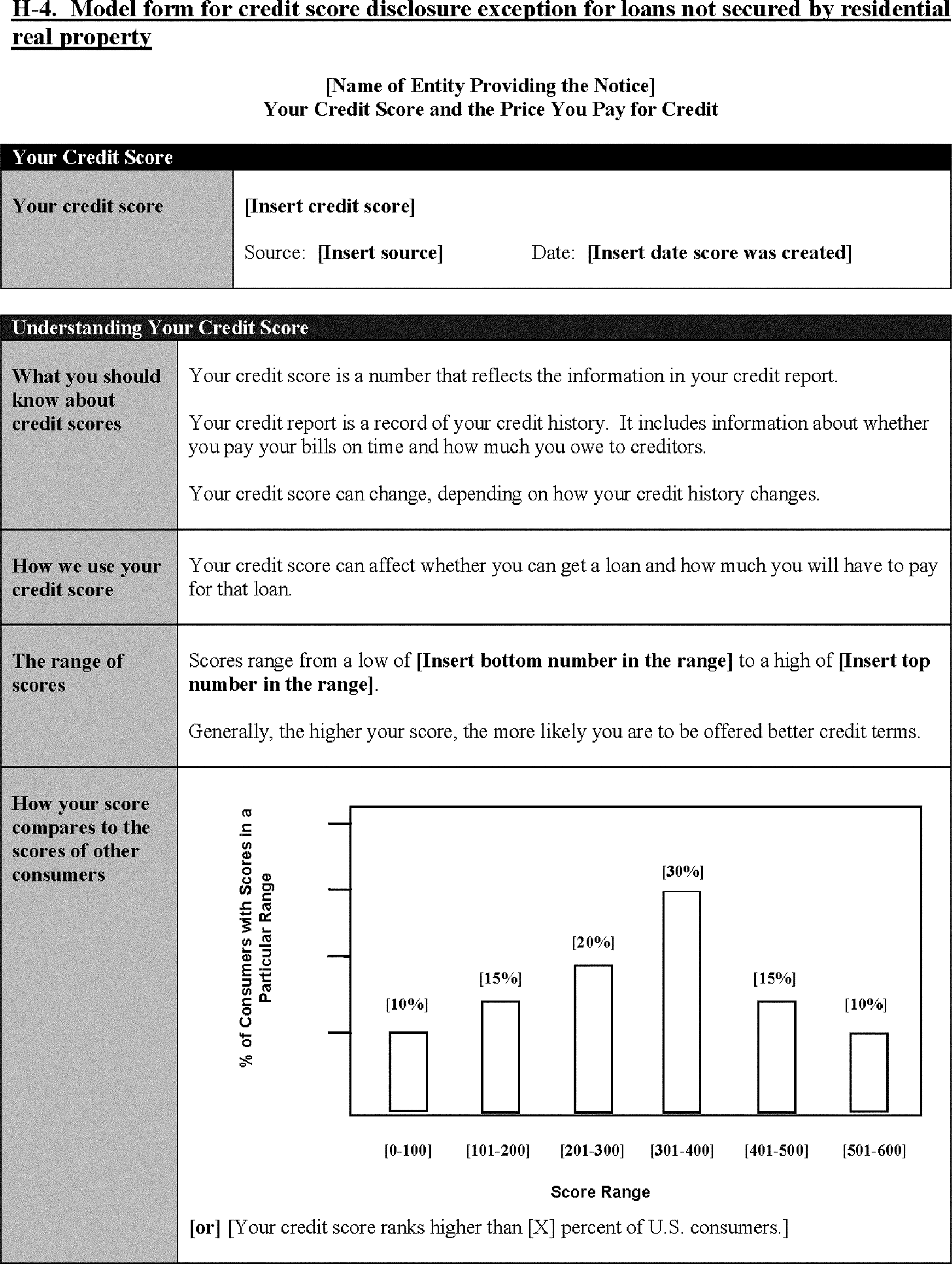

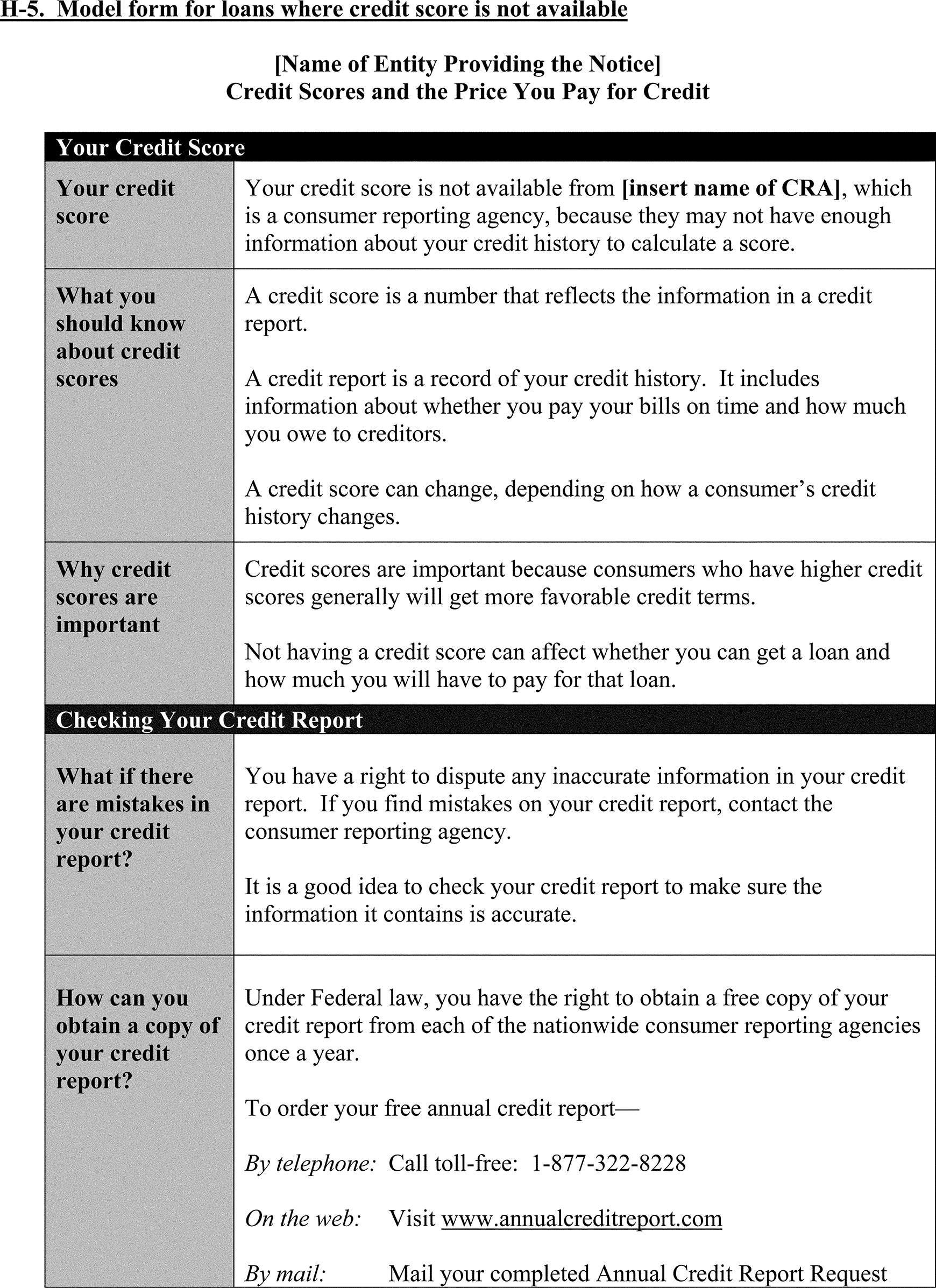

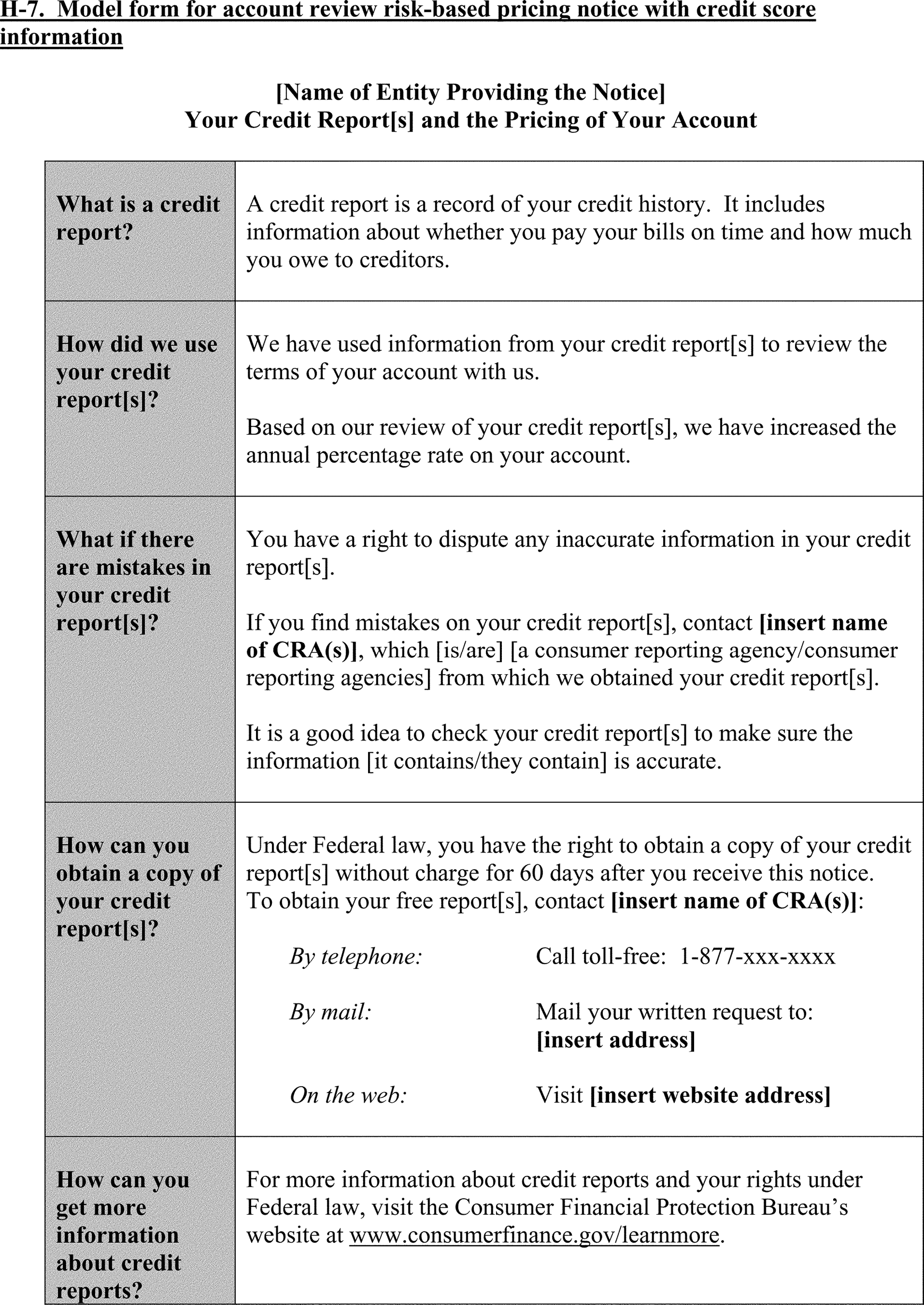

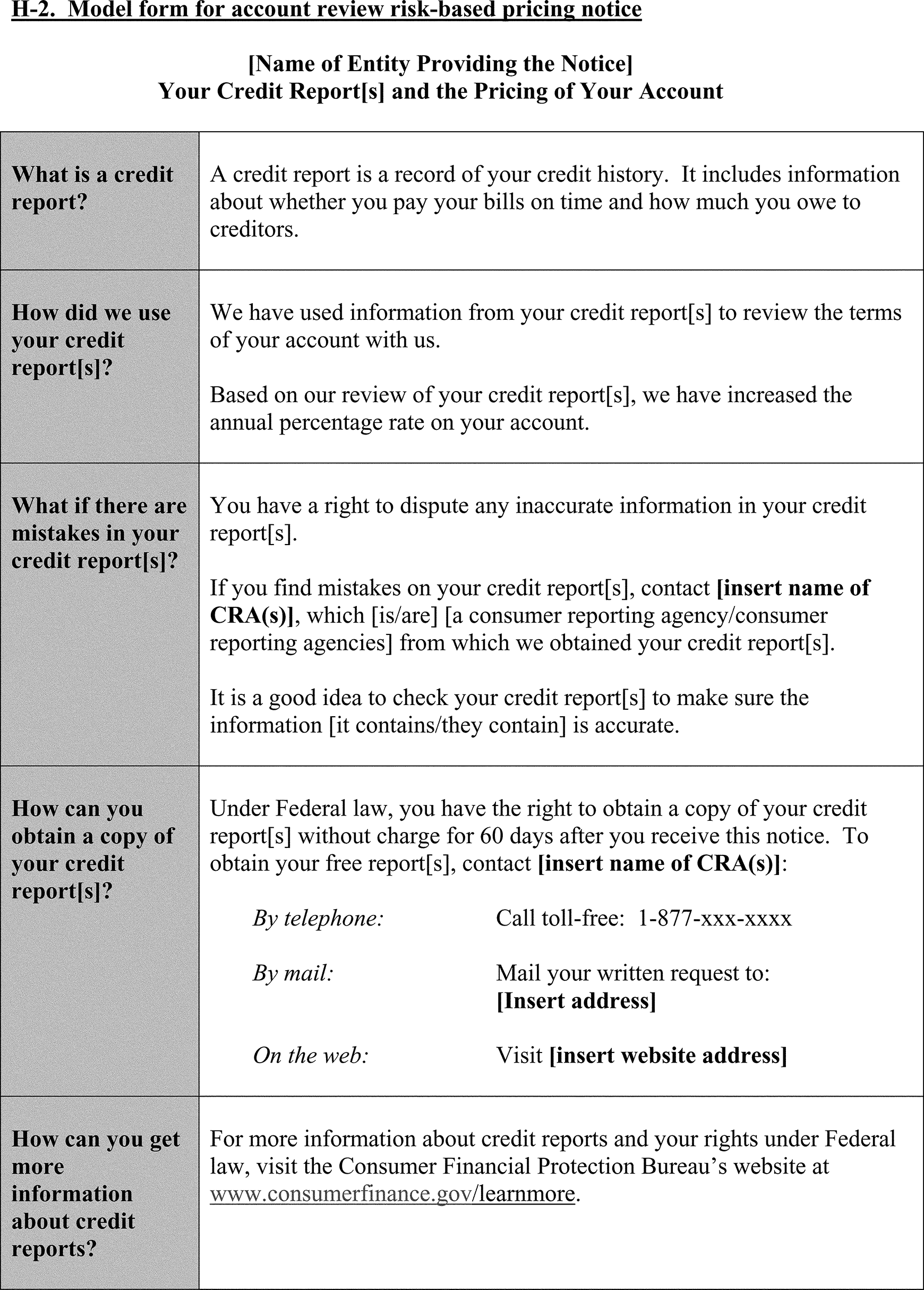

Appendix H To Part 1022 Appendix H Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices

Since the consumers 700 credit score falls below the 720 cutoff score the credit card issuer must provide a risk-based pricing notice to the consumer.

Risk based pricing notice. The consumers credit score is 700. The Risk-Based Pricing Notice to consumers. The risk-based pricing notice required by 6403a c or d must be.

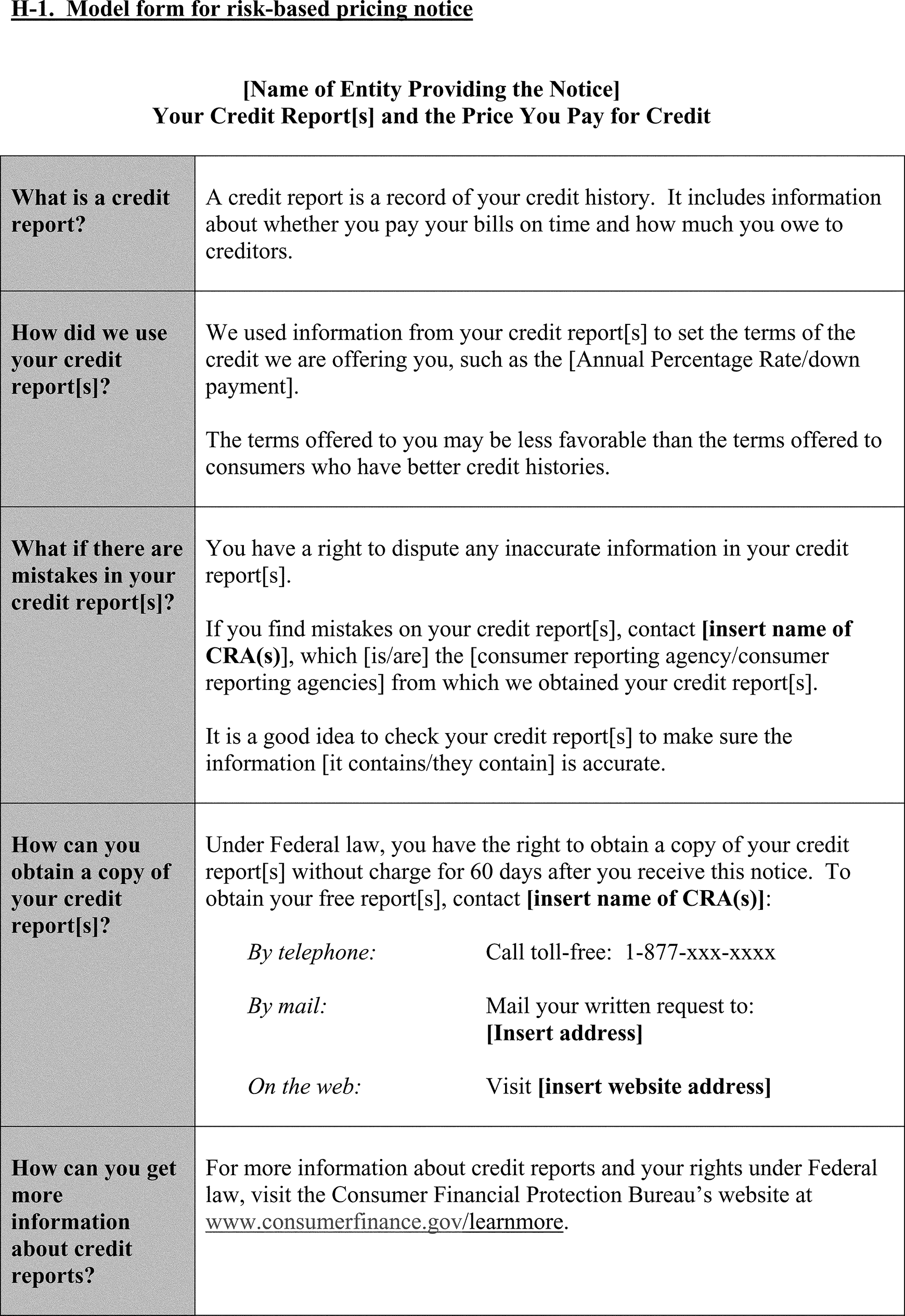

And ii Provided to the consumer in oral written or electronic form. Risk-based pricing is generally based on credit history. Model form for risk-based pricing notice Name of Entity Providing the Notice Your Credit Reports and the Price You Pay for Credit What is a credit report.

Risk-Based Pricing Notices. TransUnion does not deliver the completed model form. The threshold that determines when a consumer should receive a Risk-Based Pricing Notice is when theyre offered credit on less favorable terms than what a.

Since the consumers 700 credit score falls below the 720 cutoff score the credit card issuer must provide a risk-based pricing notice to the consumer. Model forms of the risk-based pricing notice required by 6403a and c are contained in appendices A-1. I Clear and conspicuous.

How did we use your credit. The consumers credit score is 700. A risk-based pricing notice is then provided to all consumers having a credit score lower than the cutoff score the 60 category.

This post is not going to discuss the Regulation Z issues involved ie change-in-terms process and APR. The Risk-Based Pricing Notice can be given in oral written or electronic form2 Automotive clients Is the auto dealer or auto lender responsible for complying with the Risk-Based Pricing Rule. Debt-to-income credit scores and other metrics are factors in risk-based pricing.

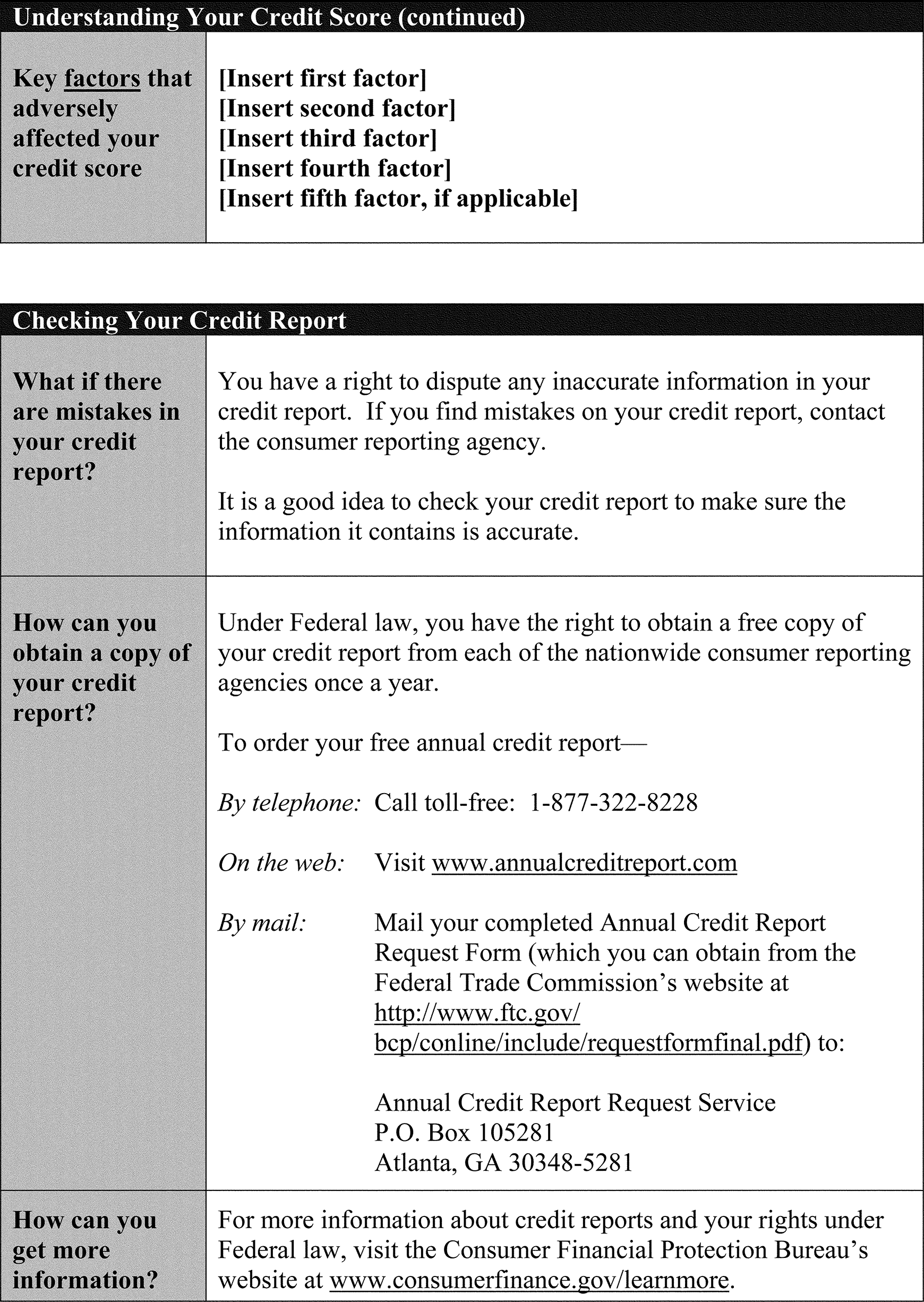

Score Distribution Graphs Score Interval Tables and the. There is a final exception or alternative to providing the risk-based pricing notice as. Lets begin by discussing the risk-based-pricing notice.

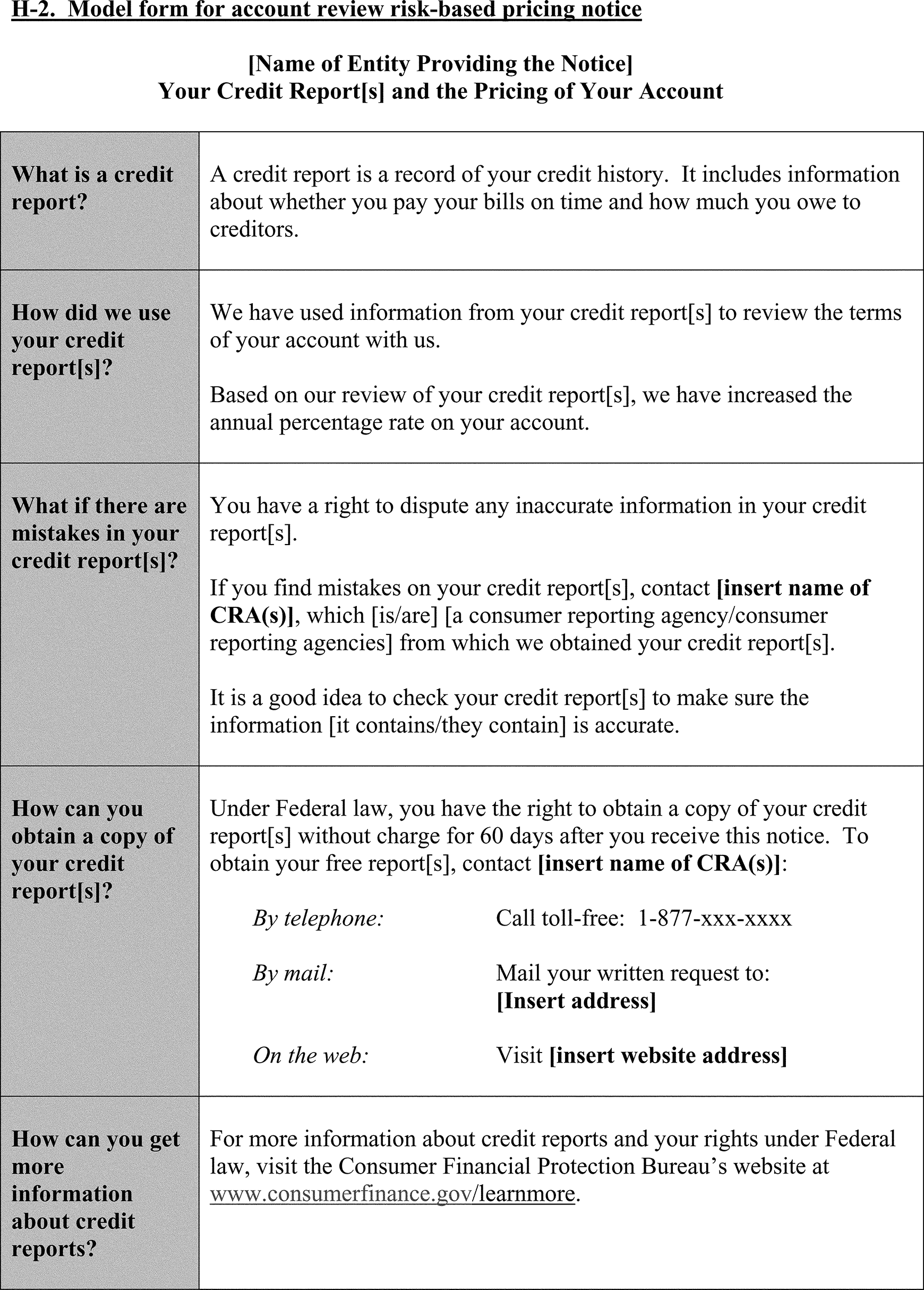

B A credit card issuer engages in risk-based pricing and the annual percentage rates it offers to consumers are based in whole or in part on a credit score. The recent risk-based pricing rule in Regulation V contains a requirement for institutions to send a risk-based pricing notice when the credit union has conducted an account review and increased the APR on an existing loan. Risk-Based Pricing Notice This notice is supplied to a specific segment of consumers who apply for credit only those who did not receive the lenders most favorable rate To determine which consumers receive a Risk-Based Pricing notice lenders can use one of.

The creditors cutoff score must be re-calculated at least every 2 years. The consumers credit score is 700. On December 22 2009 the Federal Reserve and the Federal Trade Commission the Agencies released new and finalized rules for risk-based pricing notices which will become effective on January 1 2011.

By Timothy Raty DocuTech Compliance Specialist. B A credit card issuer engages in risk-based pricing and the annual percentage rates it offers to consumers are based in whole or in part on a credit. Since the consumers 700 credit score falls below the 720 cutoff score the credit card issuer must provide a risk-based pricing notice to the consumer.

It includes information about whether you pay your bills on time and how much you owe to creditors. Furthermore in the event the member is declined credit altogether credit unions need not send those members risk-based pricing notices if they provide said members with adverse action notices. Lenders must provide notices of specific terms.

In 2003 the FACT Act started the ball rolling on the 2011 rules found in section 102273 of Regulation V which affect financial institutions who offer risk-based pricing. If the creditor uses two or more different scores to set material credit terms such as from a tri-merge. Comply with the Risk-Based Pricing Rule please contact your sales representative today or For illustration only.

A credit report is a record of your credit history. Model form H-7 is for risk-based pricing notices given in connection with account review if. 102272 if a credit score is used in setting the material terms of credit.

Model form H-6 is for use in complying with the general risk-based pricing notice requirements in Sec. Under the Risk-Based Pricing Rule a customer must be informed if theyre being offered worse credit terms than other consumers because of information in their credit report. Risk-based pricing is when a creditor sets a rate or other credit terms based on a consumer.

This is one of the model form notice examples from the risk-based pricing regulations.

Fillable Online 151 H 1 Model Form For Risk Based Pricing Notice Fax Email Print Pdffiller

Fillable Online 151 H 1 Model Form For Risk Based Pricing Notice Fax Email Print Pdffiller

Electronic Code Of Federal Regulations Ecfr

Electronic Code Of Federal Regulations Ecfr

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Electronic Code Of Federal Regulations Ecfr

Electronic Code Of Federal Regulations Ecfr

Https Consumercomplianceoutlook Org Outlook Live 2011 Risk Based Pricing Notices Assets D185d582431c40fb96409e112b44136b Ashx

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

12 Cfr Appendix H To Part 222 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Cfr Us Law Lii Legal Information Institute

12 Cfr Appendix H To Part 222 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Cfr Us Law Lii Legal Information Institute

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Appendix H To Part 1022 Model Forms For Risk Based Pricing And Credit Score Disclosure Exception Notices Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.