A lot of people apply for small business loans in New York which means that a lot of people get rejected and the process is very thorough and strict. Small businesses like yours are constantly vying for growth opportunities and maneuvering to stay ahead of the latest developments in your industry.

Computer Issues At Sba Said To Hold Up Small Business Loans

Computer Issues At Sba Said To Hold Up Small Business Loans

But in the case of MCA it is more personal.

Small business loans new york. They need extensive documents and the contracts are very complicated. New York City Small Business Owner Named SBAs New York State Small Business Person of the Year Lending Activity New York District Office Loan Production through 3rd Quarter 2019. New York companies use alternative loans to purchase business inventory help pay for expansion of their businesses help their small business make payroll purchase equipment and machinery and just about any other short-term business financing use for operational needs.

SBA guarantees up to 15 million dollars of any loan. The list is not exhaustive but it may be useful as a helpful starting guide to find grant or loan programs. The loans are for starting new businesses mergers or.

Commercial lenders make loans of up to 2 million dollars. Learn More and Find a Distribution Partner. Kiva exclusively offers microloansin this case loans under 15000.

NYS SBA District Office. See below for details about the New York Forward Loan Fund US. With easy to follow steps and no obligation or risk to your current credit visit their website here to apply for.

Micro-Grants Micro-Loans for New York Small Businesses This document lists pandemic-relief micro-grant and micro-loan programs available to small businesses in New York State organized by region. The New York District Office is responsible for the delivery of SBAs programs and services in New York City and Long Island and in Dutchess Orange Putnam Rockland Sullivan Ulster and Westchester counties. But if youre in the market for a little loan then its hard to go wrong with Kivait offers an unbeatable 0 interest rate.

New York City holds promise for entrepreneurs working in just about every industry. The need for effective funding solutions and business loans in New York is common but for small businesses especially this need can mean the difference between failure and thriving. Business Loans for Small Business in All States.

A lot of small businesses will want a larger loan which is why Kiva isnt in our top five. And its not just us. Minimum 10K of monthly sales.

The approval rate for MCA is much higher. Is standing by to provide you with all the help you need to get the financing your small business needs. New York Forward Loan Fund NYFLF is a new economic recovery loan program aimed at supporting New York State small businesses nonprofits and small landlords as they reopen after the COVID-19 outbreak and NYS on PAUSE.

As long as you have great ideas solid business plans a lot of energy and the right small business loan in NYC to get your dreams off the ground you can achieve business ownership and growth. We are here to help our small businesses and that is. Whatever your situation may be SBA-backed loans are extremely useful for any small business in New York and SBAExpressLoans Inc.

Access more than 15 small business loan programs custom-fit to your needs including SBA 504 SBA 7a and SBA Microloan Receive Custom Support Youll work one-on-one with a lender dedicated to understanding your business and your borrowing needs. If you are a small business with fewer then 100 employees looking to secure free face coverings for your employees find a distribution partner located near you. Small Business Administration SBA loans and Shuttered Venue Operators Grants and the New York Forward.

We offer capital loans to business owners with no pre-payment penalty. Small Business Administration SBA provides 7a loans for small businesses through commercial lenders. Many of the major SBA.

Business Loans for Small Business in All States. These loans are being used to help people just like you expand into new avenues of doing business and keep their businesses ready to open when quarantine lifts. Free Face Coverings for Small Businesses Their Employees.

Small businesses can now borrow up to 500000 through a government disaster loan program. Financial analysis shows that New York is one of the best places for small business owners to grow their businesses. New York State is working to support small businesses throughout the COVID-19 crisis by providing up-to-date resources and information about COVID-19-related loans funding and business counseling.

Where The Small Business Relief Loans Have Gone The New York Times

Where The Small Business Relief Loans Have Gone The New York Times

Business Owners Say Ppp Money Isn T Enough To Pay Rent

Business Owners Say Ppp Money Isn T Enough To Pay Rent

Small Business Program Scrutinized For Loans To Big Firms

Small Business Program Scrutinized For Loans To Big Firms

Some Small Businesses That Got Aid Fear The Rules Too Much To Spend It The New York Times

Some Small Businesses That Got Aid Fear The Rules Too Much To Spend It The New York Times

Trade Groups Ask Why Restaurant Chains Are Getting Small Business Relief Loans

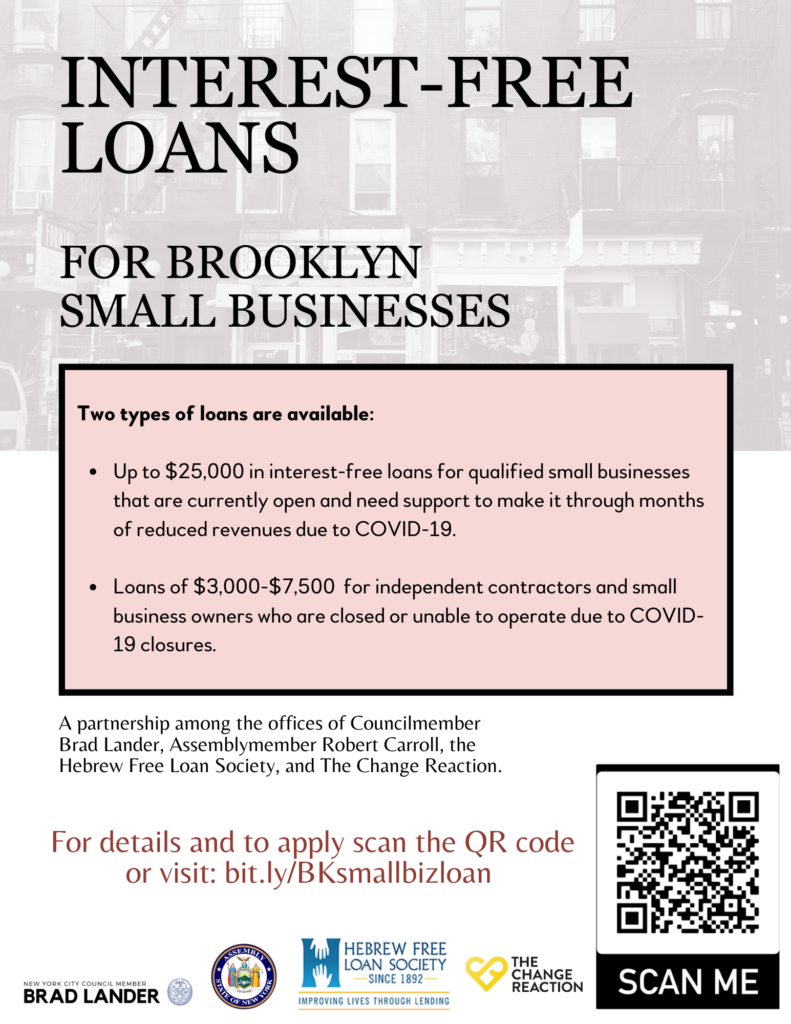

Small Business Loan Fund Brad Lander

Small Business Loan Fund Brad Lander

New York City Small Business Assistance During Covid 19 Start Small Think Big

New York City Small Business Assistance During Covid 19 Start Small Think Big

Small Business Loans Potentially Overwhelm Banks With Demand The New York Times

Small Business Loans Potentially Overwhelm Banks With Demand The New York Times

Treasury Clarifies Small Business Loans As Fed Vows Transparency The New York Times

Treasury Clarifies Small Business Loans As Fed Vows Transparency The New York Times

Thousands Of Small Business Loans May Have Been Fraudulent House Panel Finds Amnewyork

Thousands Of Small Business Loans May Have Been Fraudulent House Panel Finds Amnewyork

Senator Anna Kaplan Encourages Long Island Small Businesses To Consider Assistance From Ny Forward Loan Fund Program Ny State Senate

Senator Anna Kaplan Encourages Long Island Small Businesses To Consider Assistance From Ny Forward Loan Fund Program Ny State Senate

Nonbanks Face New Disclosure Rules On Small Business Loans In N Y American Banker

Nonbanks Face New Disclosure Rules On Small Business Loans In N Y American Banker

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.