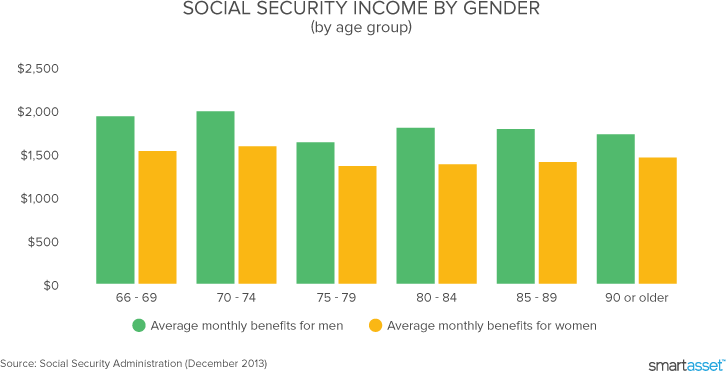

The chart shows Social Security earnings and Indexed Earnings for Jane. Thats about 1196 per month for women and about 1503 per month for men.

Taxes On Social Security Social Security Intelligence

Taxes On Social Security Social Security Intelligence

The earliest age you may begin drawing social security is 62 while the full retirement age is 66 or over for those born after 1943.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg)

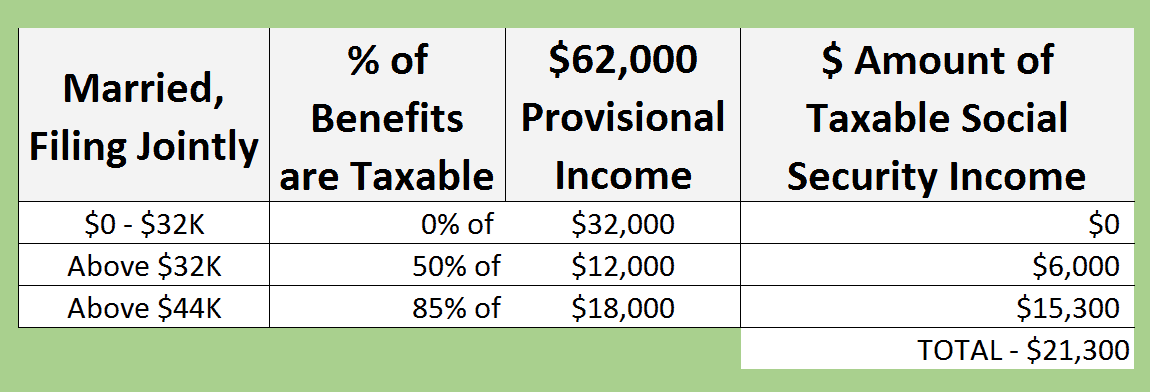

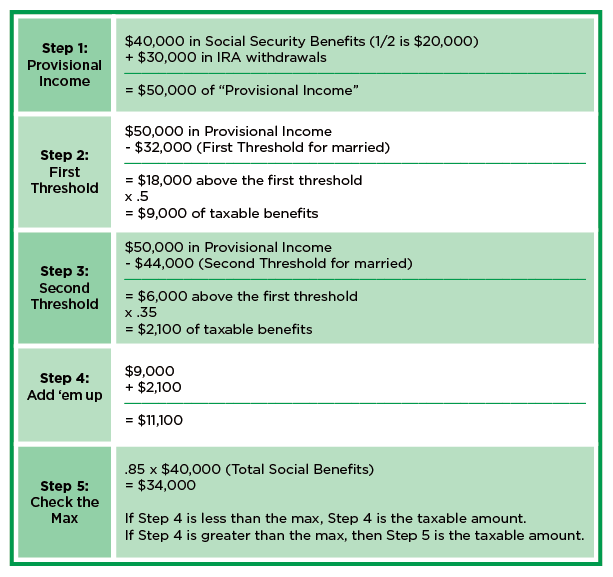

How much is social security income. Total monthly income 300 Social Security benefit 1 300 Social Security benefit -20 Not counted 280 Countable income 2 794 SSI Federal benefit rate -280 Countable income 514 SSI Federal benefit. Benefit estimates depend on your date of birth and on your earnings history. For married couples filing jointly you will pay taxes on up to 50 of your Social Security income if you have a combined income of 32000 to 44000.

Say you file individually have 50000 in income and get 1500 a month from Social Security. If the child is single the base amount for the childs filing status is 25000. The annual payment you receive from Social Security is based on your income birth year and the age at which you elect to begin receiving benefits.

You lose 1 for each 2 earned in excess of the limit so you lose 8680 of your annual benefits. If the total of 1 one half of the. Between 25000 and 34000 you may have to pay income tax on up to 50 percent of your benefits.

Your net income will be based on half of your Social Security income 8000 plus all of your other income 20000 minus the standard deduction or your itemized deductions. Up to 50 percent of your benefits if your income is 25000 to 34000 for an individual or 32000 to 44000 for a married couple filing jointly. The maximum possible Social Security benefit for someone who retires at.

The average Social Security benefit was 1543 per month in January 2021. This is far too little to live on. If the child is married see Publication 915 Social Security and Equivalent Railroad Retirement Benefits for the applicable base amount and the other rules that apply to married individuals receiving social security benefits.

If you receive the average Social Security benefit about 1431 per month relying on that for 90 of your income could leave you with around 19000 annually. Your annual income from Social Security will be reduced to. Social Security sets a cap on how much of your income it takes into account in figuring your benefit.

For non-disabled workers the SSA places a limit on how much earned income you can have per year while also drawing social security benefits. Up to 85 percent of your benefits if your income is more than 34000 individual or 44000 couple. In 2017 women age 65 and older received an average annual Social Security income of 14353 compared to 18041 for men.

You will receive 40982 in annual social security payments starting at age 66. Any income above that is not counted in your benefit calculation and is also not subject to Social Security taxes. Average Indexed Earnings are.

In 2020 the annual Social Security earnings limit for those reaching full retirement age FRA in 2021 or later is 18240. In 2021 the cap is 142800 its adjusted annually to reflect historical wage trends. If you have a combined income of more than 44000 you can expect to pay taxes on up to 85 of your Social Security benefits.

Some of you have to pay federal income taxes on your Social Security benefits. Instead it will estimate your earnings based on information you provide. Is retirement pay considered income.

The two vertical lines bracket her 35 highest Indexed Earnings years 1980 to 2014. 28960 Total Wages the Social Security Income Limit of 18960 10000 Income in Excess Of Limit Because this is a full calendar year during which Rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages. So benefit estimates made by the Quick Calculator are rough.

If You Work More Than One Job Keep the wage base in mind if you work for more than one employer. My social security election age. Of course it can.

For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. More than 34000 up to 85 percent of your benefits may be taxable. EXAMPLE A SSI Federal Benefit with only UNEARNED INCOME.

For security the Quick Calculator does not access your earnings record. Social Security Quick Calculator.

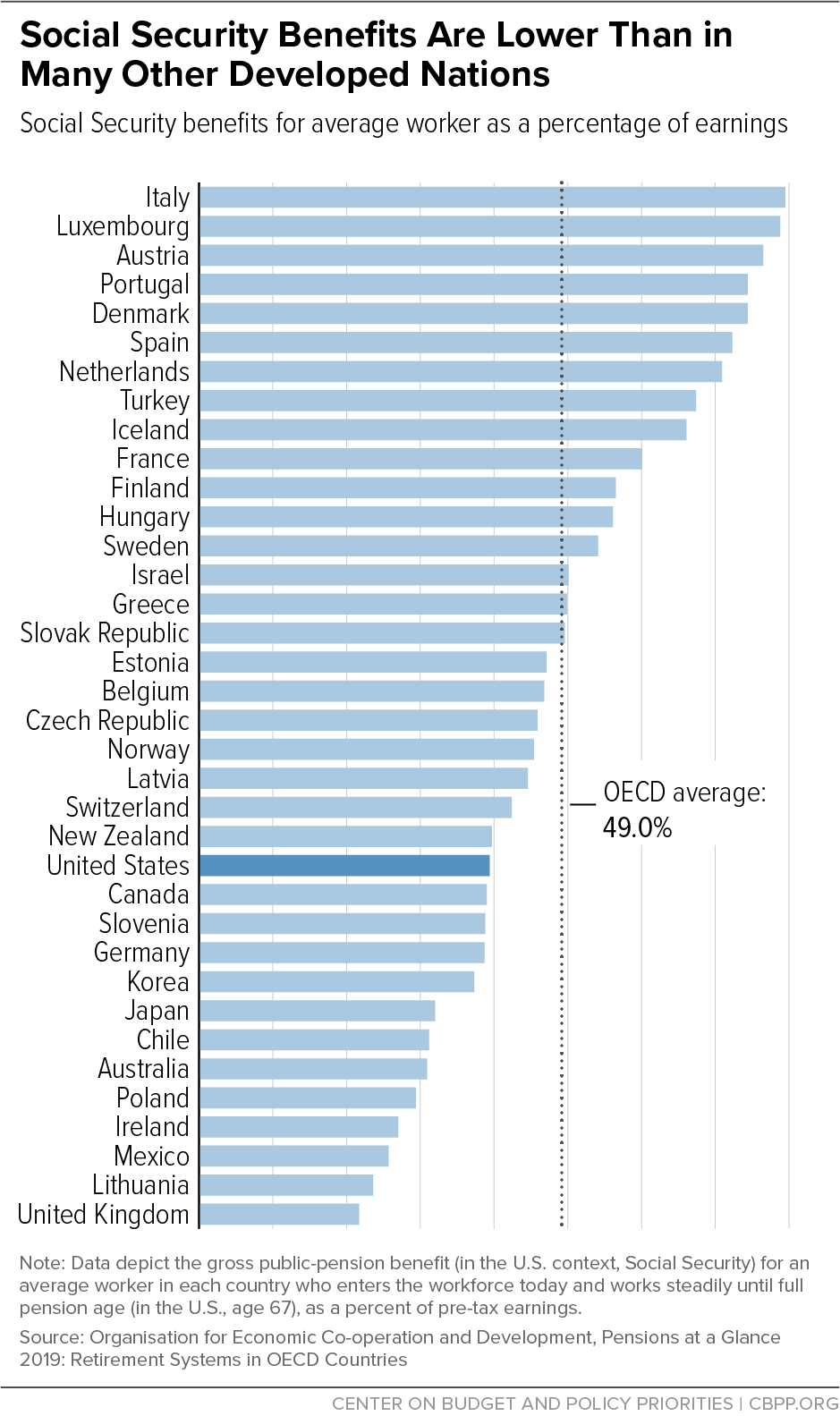

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Learn About Social Security Income Limits

Learn About Social Security Income Limits

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png) Social Security Retirement Benefits While Working

Social Security Retirement Benefits While Working

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

When Should You Start Social Security Benefits Do The Math Cbs News

Taxable Social Security Calculator

Taxable Social Security Calculator

Here S How Much Social Security Benefits Are By Age And Income Level

Here S How Much Social Security Benefits Are By Age And Income Level

Social Security United States Wikipedia

Social Security United States Wikipedia

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

How Are Social Security Benefits Taxed

How Are Social Security Benefits Taxed

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.