Income Taxes. City of Buffalo Assessors Office Services.

Buffalo Property Taxes To Increase In Proposed City Budget

Buffalo Property Taxes To Increase In Proposed City Budget

To begin please enter your bill number.

City of buffalo taxes. The fee will be added automatically to each transaction. Buffalo Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Buffalo New York. Find Tax Records including.

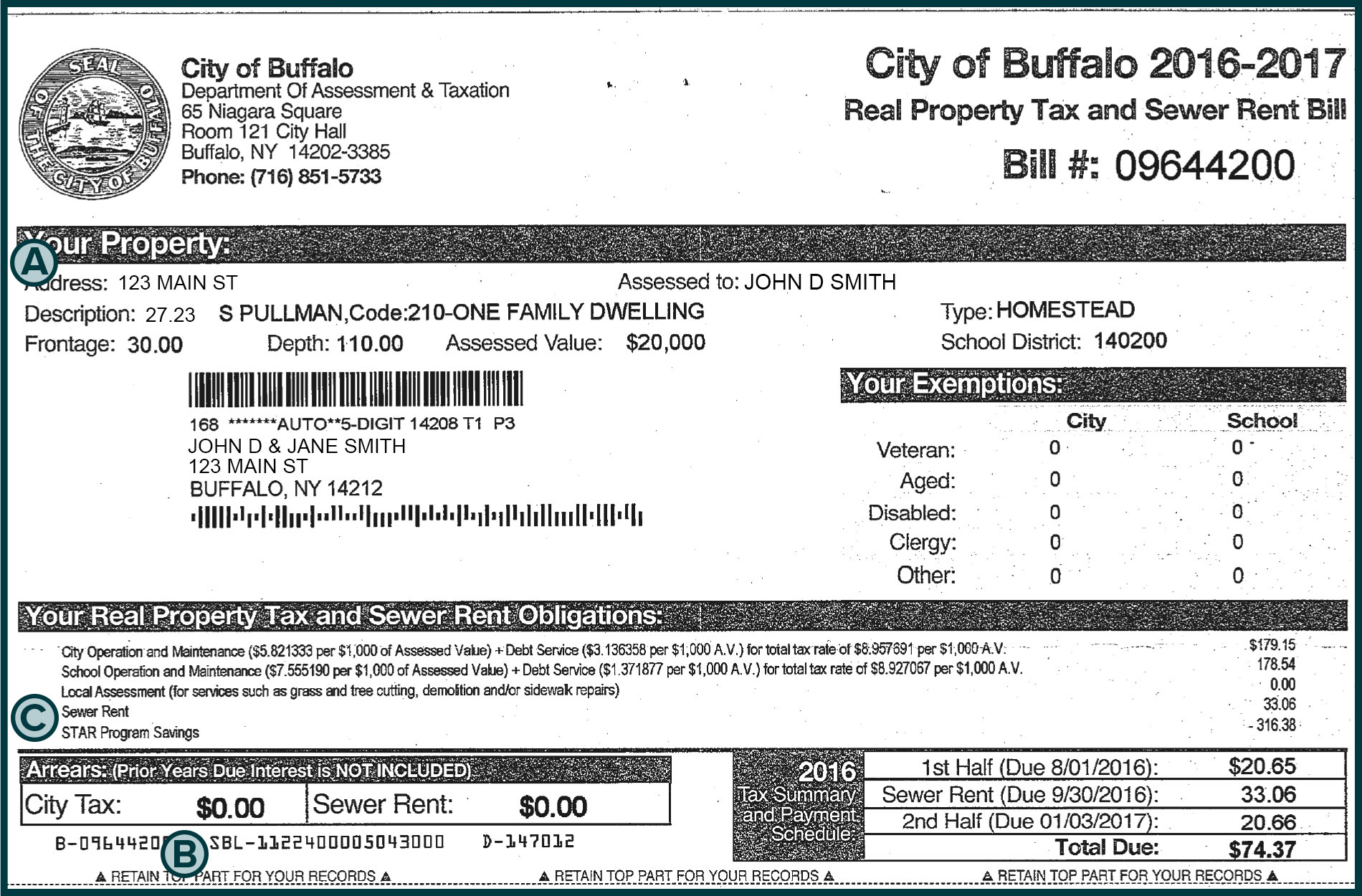

City of Buffalo NY Payments. The total of all income taxes for an area including state county and local taxes. Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo.

Federal income taxes are not included. The reassessment project on all real property in the City of Buffalo is complete. Tax Records include property tax assessments property appraisals and income tax records.

Residents and business owners will soon be receiving the disclosure notices in the mail. New online resource to assist small businesses and consumers as the City of Buffalo reopens responsibly during the COVID-19 pandemic Read on. Pay your City of Buffalo - Tax NY bill online with doxo Pay with a credit card debit card or direct from your bank account.

Point Pay - 800 AM to 800 PM EST. A 2 percent increase in the tax levy would raise the citys tax levy by 28 million. Tax Rates for Buffalo NY.

The city expects to collect 1395 million in property taxes this budget year. Not enough to plug recent recurring budget deficits but at least itd be a start. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of Information Act FOIA request.

Manage all your bills get payment due date reminders and schedule automatic payments from a single app. Mayor Brown launched BUFFALERT a new civic alert notification system that sends notifications to enrolled residents via email text or recorded phone message alerting them to emergencies PSAs or events. The City of Buffalo assessors office can help you with.

The City of Buffalo will charge a 200 convenience fee if paying by checkACH from your bank account. Doxo is the simple protected way to pay your bills with a single account and accomplish your financial goals. Assessment Taxation Department.

You can pay your city taxes through this web site. The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo. The City of Buffalo Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in City of Buffalo.

The fee is pursuant to the provisions of Section 3-19 of the city charter. Property Tax Sewer Payments. The 2020 Assessment Preliminary Disclosure Notices include assessments based on current market values to ensure that every property owner is paying only their fair share of property taxes.

The Department issues the appropriate annual tax bill predicated on the final assessed value. The total of all sales taxes for an area including state county and local taxes. The City of Buffalo Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within City of Buffalo and may establish the amount of tax due on that property based on the fair market value appraisal.

Email Tax for Questions. City of Buffalo NY. The Department issues the appropriate annual tax.

Ad Book your Hotel in Buffalo NY online. Street Address Please Do Not Include Street Suffixes rd st ave. The City of Buffalo Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

2021 Final Assessment Roll. Ad Book your Hotel in Buffalo NY online. Point Pay Support.